Looking for ways to make a market-beating dividend income? Here are two high-yield FTSE 100 and FTSE 250 shares — along with a big-paying exchange-traded fund (ETF) — I feel are worth serious consideration right now.

The ETF

The Invesco US High Yield Fallen Angels ETF (LSE:FAHY) doesn’t, unlike most London-listed funds, invest in local or global equities. Instead, its portfolio’s loaded with below-investment-grade bonds.

Today, more than 97% of the fund’s tied up in debt instruments with ratings of BB or B. Some of the corporate bonds it holds are from medical specialist CVS Health, clothing manufacturer VF Corp and media giant Paramount Global.

Should you invest £1,000 in BAE Systems right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if BAE Systems made the list?

Why’s this important? A focus on riskier bonds obviously comes with a higher level of risk. But the higher yields these bonds subsequently offer also mean the fund’s dividend yields are substantially above the ETF average.

For 2025, this stands at a very healthy 7%. And with 87 different holdings, the fund’s structured to cushion the impact of potential defaults on overall investor returns.

The FTSE 100 share

Now, BAE Systems (LSE:BA.) doesn’t offer up the same sort of eye-popping dividend yields as this. For 2025, its yield is a healthy-if-unspectacular 2.8%.

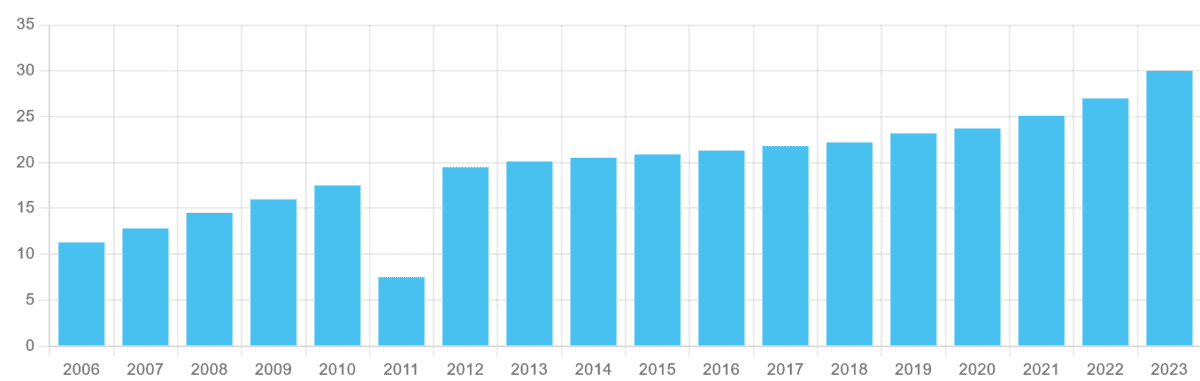

Yet I believe the defence giant remains a top-tier dividend stock to consider. As the chart shows, the dividend on BAE Systems shares has risen every year for more than a decade. This has allowed investors to offset the impact of rising inflation on their wealth.

BAE Systems’ progressive dividend policy is thanks to its impressive cash flows and the dependable nature of defence spending. Even during economic downturns, the Footsie firm can expect new orders for its equipment to keep rolling in (its order book was a record £74.1bn as of last summer).

Past performance isn’t always a reliable guide of future returns however. In the case of BAE Systems, a range of problems, from supply chain issues and rising costs to disappointing project execution, could impact future earnings and dividends.

But, on balance, I’m optimistic the blue-chip weapons builder will remain an impressive passive income share.

The FTSE 250 stock

As a real estate investment trust (REIT), Urban Logistics (LSE:SHED) is set up to provide a steady flow of dividends.

Under sector rules, companies of this type must pay a minimum of 90% of annual rental profits out to shareholders. That’s in exchange for the favourable tax environment they enjoy.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

This doesn’t necessarily guarantee a large and stable income over time. The trust’s weighty exposure to cyclical sectors (like parcel services and retail) could leave earnings, and therefore dividends, vulnerable during economic downturns. Higher interest rates also have an impact on profits.

But on balance, I think Urban Logistics is pretty rock solid for dividend income. Like the aforementioned ETF, it’s well diversified to limit the risk of tenant defaults on overall returns (its top 10 tenants account for just 32% of total rents).

On top of this, Urban Logistics has long-term contracts in place to limit the threat of falling occupancy. As of September, its weighted average unexpired lease term (WAULT) was 7.6 years.

For this financial year (ending March), the dividend yield on Urban Logistics shares is 7.5%. This nudges higher to 7.6% for next year.