Tesla (NASDAQ: TSLA) shares were having a rough year in 2024 until the US election on 5 November. For the first three quarters, it looked like the world’s most famous electric vehicle (EV) company would end the year down.

Now, the stock is up over 100% since this time last year. A committed investor who held throughout the year would have doubled their money. Even shares bought on the day of the election result would be up 69%.

That’s a profit of £6,900 on a £10k investment, equating to over $100 (£82) per day!

Should you invest £1,000 in Vodafone right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Vodafone made the list?

The rapid rise means Tesla’s market cap has dwarfed that of competitors Toyota, Ford, and BYD. Now at around $1.33trn, the ballooning stock has also helped push CEO Elon Musk’s net worth close to half a trillion dollars.

Challenges ahead

Despite appearances, the road ahead may not be smooth for either Tesla or Musk. The US government advisory body he was picked to lead has already attracted several legal challenges. Not to mention the potential conflict of interest that such a position would bring about.

This could matter for Tesla because the company’s sky-high share price is not representative of earnings. Despite bringing in significantly less revenue than all the top 10 car companies in the US, the stock is now worth more than all 10 combined.

It doesn’t take much imagination to realise why that could be problematic. The EV giant’s price-to-earnings (P/E) ratio has skyrocketed above 100, suggesting the price is in highly speculative territory.

How long can it ride on the coattails of Musk’s political aspirations?

Growth for growth’s sake

Despite the fervour and fanfare around Tesla, there have been no notable developments in the past three months — nor any significant boost in sales. Last October’s much-anticipated ‘robotaxi’ event failed to impress, with a vague “before 2027” being the only timescale provided for launch.

With nothing to back the rapid growth, some analysts fear Tesla could have a “$1trn gap to fill.” If it fails to deliver results worthy of the valuation, brokers could turn on the stock with a dreaded Sell rating.

Then again, this is Musk we’re talking about. If history is anything to go by, he’ll likely find a way to keep the overweight ship on a steady keel.

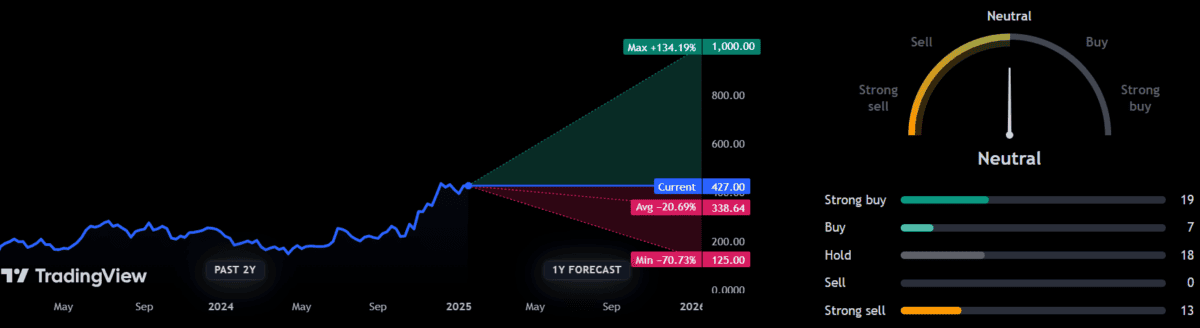

Analysis of the stock is almost as divided as US political opinion. Out of 57 analysts, 13 give a strong Sell, 18 a Hold and 19, a strong Buy. The remaining seven are a moderate Buy. The most optimistic give it a 12-month price of $1,000, a massive 135% increase. The most bearish expect a 70% decline in the coming 12 months.

Personally, I wouldn’t be surprised with either outcome. Trying to understand the current US economic situation is headache enough without Musk’s political forays throwing a spanner in the works.

So, as an investor with a strong inclination toward predictable returns, I will be giving Tesla stock a wide berth for the foreseeable future. However, for investors with a strong risk appetite, the potentially sky-high gains might make it worth considering.