Taking a diversified approach to investing doesn’t have to mean disappointing returns. The performance of Scottish Mortgage Investment Trust (LSE:SMT) shares over the past decade provides a perfect illustration of this.

Since around the start of the Millennium, this investment trust has been focused on high-growth technology (and tech affiliated) stocks. And since 2015, the FTSE 100 share has delivered an average annual return of 15.2%.

By comparison, the broader Footsie has delivered a yearly average of 6.2%.

Should you invest £1,000 in Barratt Developments right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Barratt Developments made the list?

Past performance isn’t a guarantee of future returns, however. And there are challenges facing the tech sector that could impact the trust’s future earnings.

So what are Scottish Mortgage’s profits and share price prospects for the next couple of years? And should I buy it for my own portfolio today?

Growth opportunities

Obtaining earnings forecasts for investment trusts is challenging. This is because their earnings depend on the performance of the underlying investments, which can be extremely volatile and difficult to predict.

In total, Scottish Mortgage has holdings in 95 different tech shares and trusts. Some of its biggest holdings are microchip manufacturer Nvidia, e-retailers Amazon and MercadoLibre and social media giant Meta.

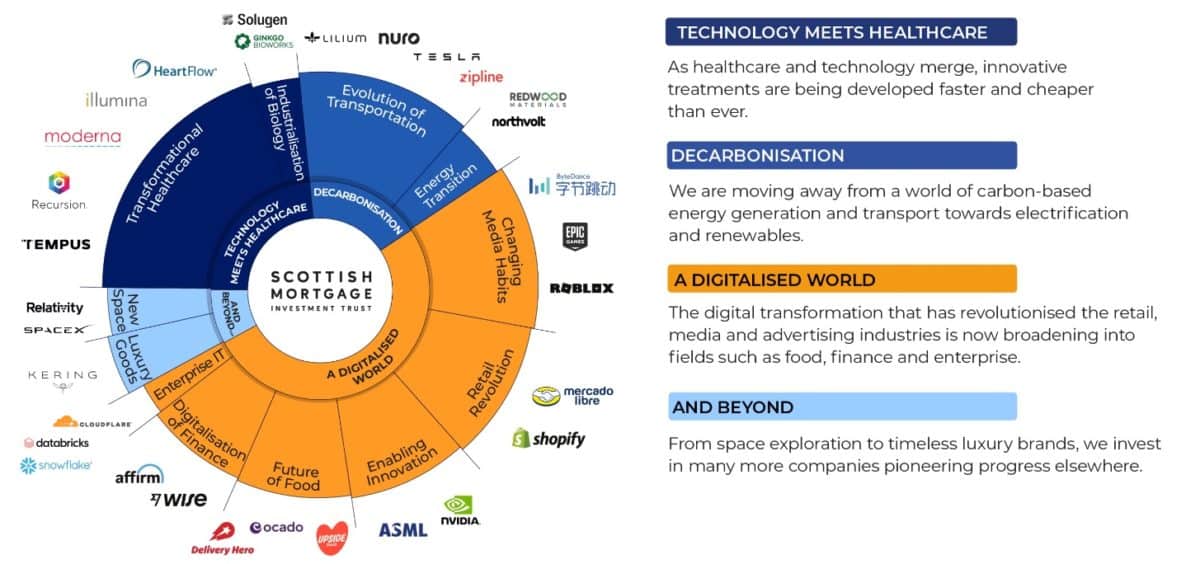

While near-term earnings are tough to nail down, the trust has significant growth potential over a longer horizon. As the graphic below shows, it provides a multitude of ways for investors to capitalise on the growing digital economy.

Another benefit of this particular trust is that it gives investors exposure to non-listed companies they can’t invest in directly. These include Elon Musk’s space transportation company SpaceX, whose value has roughly doubled in a year to around $350bn.

Around 7.5% of the trust is dedicated to this specific company.

Danger ahead?

But like any investment, there are risks to Scottish Mortgage’s earnings and share price performance in the near term and beyond.

One is a potential slowdown in the global economy that damages corporate and consumer spending. Technology shares are some of the most cyclical out there, and they often sink sharply in value during downturns.

Fresh trade tariffs across key regions are another danger that could affect the tech sector especially severely. Possible consequences include weaker sales, supply chain disruptions, greater production costs and reduced innovation, all of which could significantly dent the trust’s performance.

Here’s what I’m doing

Yet I believe these threats may be baked into the trust’s low valuation. At £10.54 per share, it trades at a near-8% discount to its net asset value (NAV) per share of £11.40. This leaves a healthy margin of error that could protect against severe share price volatility.

I already have significant exposure to the tech sector through a couple of funds I hold. Alongside an S&P 500-tracking exchange-traded fund (ETF) from HSBC, I’ve also invested in the more targeted iShares S&P 500 Information Technology Sector ETF.

Without my existing tech exposure, I’d seriously consider adding Scottish Mortgage shares to my portfolio. I think its diversified approach is a great way to capture growth opportunities while simultaneously spreading risk.

For investors seeking exposure to the booming tech sector, I believe the trust is worth serious consideration.