Tesco (LSE: TSCO) shares haven’t really set the world on fire over the past couple of decades. The group’s ambitious international expansion plans didn’t pan out as hoped while an accounting scandal in 2014 led to a dividend suspension and rocked investor confidence.

More recently though, there seems to have been a reassessment of the investment case. The FTSE 100 stock is up 81% from a low in October 2022.

Indeed, the share price is up 26.2% since just the beginning of 2024. This means anyone who invested £15,000 in the UK’s leading supermarket back then would now be sitting on £18,925. And they’d also have received around £635 in dividends, taking the total return to approximately £19,500.

Should you invest £1,000 in Tesco right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Tesco made the list?

That’s a very solid result in a relatively short space of time.

Still dominant

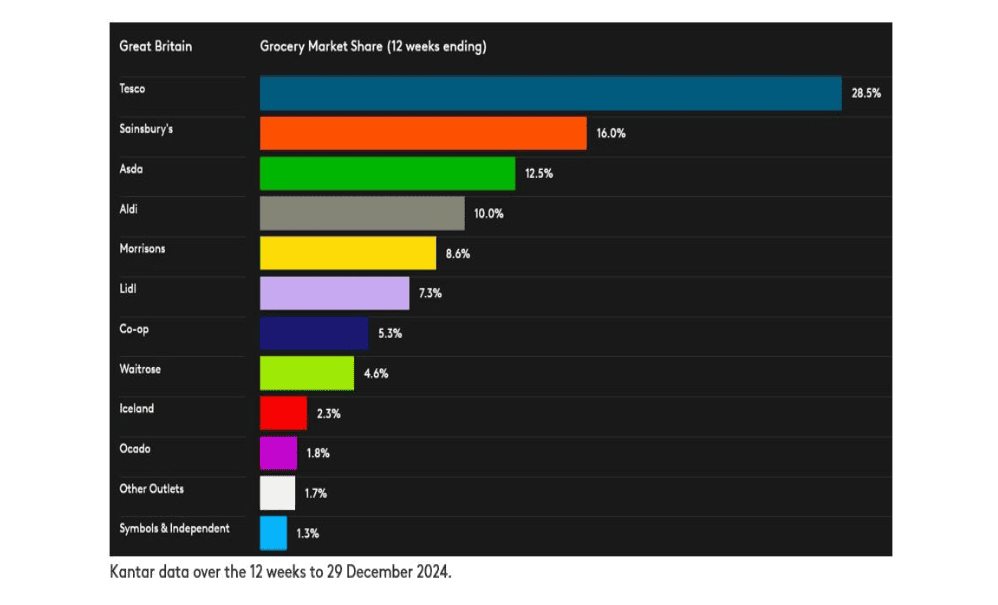

Every month, industry insights and trends are released from data provider Kantar. We got these earlier in January, just before Tesco released a Christmas trading update.

Together, they painted the same picture, which is that Tesco is performing very well. Over the 12 weeks to 29 December, it enjoyed 5% growth in sales across its convenience, superstore and online channels.

This saw its market share increase by 0.8%, the largest gain of any supermarket, taking its hold to 28.5%. That’s Tesco’s highest market share since 2016!

CEO Ken Murphy commented: “We delivered our biggest-ever Christmas, with continued market share growth and switching gains.”

Online opportunity and challenge

One potential risk for Tesco is online, where spending for December reached a record £1.6bn. According to Kantar, Ocado boosted its sales by 9.6% over the 12 weeks to 29 December, taking its overall market share to 1.8%.

Of course, Tesco has its own online business. This channel saw 10.8% growth in UK sales over the Christmas period, including over 1.2m orders placed through Tesco Whoosh, its rapid delivery service.

Meanwhile, the company leverages its extensive store network for click-and-collect services, which pureplay online grocers do not offer.

Unlike online-only Ocado though, Tesco must balance this opportunity with maintaining its physical operations. True, its massive scale gives it advantages when it comes to negotiating prices with suppliers. But Ocado uses robots to pick and pack orders efficiently, reducing costs and improving order accuracy.

The long-term aim is to translate these operational efficiencies into more competitive pricing for customers in order to take market share and (possibly) boost profit margins. If that happens, Tesco might one day feel compelled to invest heavily in automation technologies to remain competitive. And that could weigh on margins and investor sentiment for the stock.

Will I invest?

The forward-looking dividend yield is 4%, with the payout expected to be covered two times by forecast earnings. While no dividend is guaranteed, this reassuring coverage suggests to me that the payout should be met. Looking ahead, I do like the dividend growth prospects here.

However, a more immediate concern for me is the increase in costs related to the recent Budget. Due to Tesco’s massive workforce, this will add an extra £250m to its costs each year, according to management. Passing this on to customers through higher prices could result in lower overall basket sizes.

Therefore, I have no plans to invest in the stock right now.