It has been an incredible few months for investors in Tesla (NASDAQ: TSLA). Since October, Tesla stock has doubled (yes, doubled). That is even after taking into account a fall of 11% over the past month, or so.

But with the company’s car sales falling last year for the first time, might the share price now follow?

Tough market getting tougher

In its car business, Tesla has build an incredible operation thanks to a few strengths that include its powerful brand, first mover advantage, proprietary technology and large customer base.

I continue to see those as advantages, though I think the benefit of the company being a first mover in key parts of the electric vehicle (EV) industry is of declining importance.

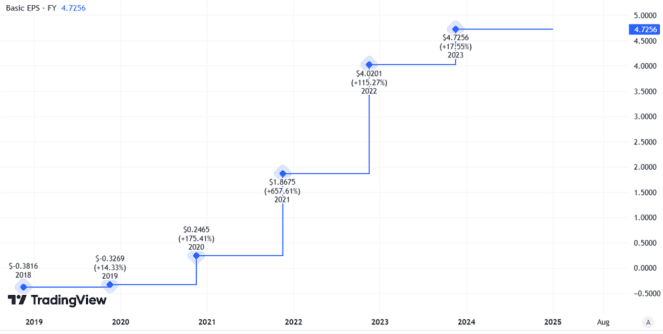

After years of losses, the company has been profitable for the past few years and earnings per share (EPS) have been moving upwards.

Created using TradingView

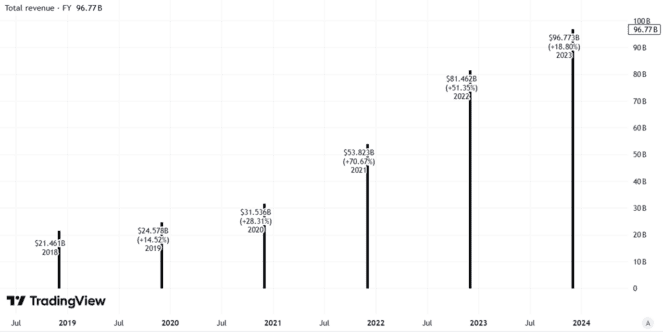

Not only have profits been marching upwards, but so too have revenues, in a big way.

Created using TradingView

The growing revenues and profit, plus Tesla’s long-term advantages, help explain why investors have been so enthusiastic about the stock.

But the carmaker is not alone in its field. A host of competitors have emerged and some are serious rivals. BYD, for example, trounced Tesla’s sales numbers last year, shifting more than twice as many cars – and also selling more TVs in Japan than local giant Toyota.

With large, successful competitors vying for customer spend, there is a risk that pricing in the EV sector will go down, making it harder for Tesla’s car division to maintain its profit margins.

More than one iron in the fire

I say ‘car division’ because Tesla is more than just a motor company. It has been applying its expertise in renewable energy to a wider set of challenges, and has a fast-growing energy storage division.

I think that could be a key growth driver and may mean (time will tell) that Tesla ends up being able to report revenue growth last year even though vehicle sales fell.

Over the long term, I think the Tesla investment case has a lot to like. The EV market getting tougher may squeeze profit margins, but it may also thin out the field, helping strong players like Tesla in years to come. Meanwhile I believe energy storage alone could end up being a massive business for the firm.

No plans to buy at this price!

But while I like the investment case, I do not like the current share price. In fact, I think Tesla stock looks wildly overvalued. That does not mean it could not go even higher. Clearly, the stock has a lot of momentum and some investors are wildly enthusiastic about it.

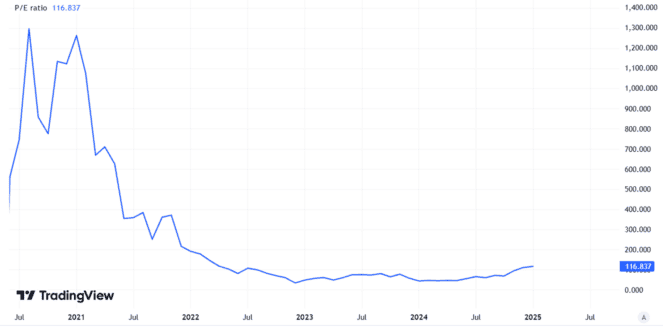

But I think the valuation – 117 times earnings – is too high (by a long shot) to justify on the fundamentals. Sure, it may look look cheap (!) by Tesla’s historical standards.

Created using TradingView

But that in itself does not make the share cheap. Instead, to me, it looks unjustifiably high, based on a realistic assessment of the current business prospects.

So at anything like the current price, I will not be adding Tesla stock to my portfolio.