The London Stock Exchange is home to a wide range of top dividend stocks. Considering a lump sum investment in some of the UK’s high-yielding companies could lead to an enormous passive income now and in the future.

Here are two great dividend shares that have caught my attention today. I think they might prove lucrative and are worthy of further research.

| Dividend stock | 2025 dividend yield | Annual dividend growth |

|---|---|---|

| Primary Health Properties (LSE:PHP) | 7.9% | 2% |

| M&G (LSE:MNG) | 10.7% | 3% |

Let’s say an investor has £20,000 to invest in these income shares today. If broker projections are right, spreading that money equally across them would yield £1,860 in passive income this year alone.

Should you invest £1,000 in M&G right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if M&G made the list?

Dividends are never guaranteed. But here’s why I’m optimistic these dividend stocks could deliver a large and growing passive income in 2025 and beyond.

Healthy dividends

As a real estate investment trust (REIT), Primary Health Properties is set up to deliver dividends to investors. Sector rules demand that 90% of annual rental profits are paid out, if not more.

This doesn’t mean shareholders are guaranteed a decent passive income, of course. Dividends remain correlated to the level of earnings these businesses produce.

But I’m confident in this trust’s ability to pay a solid dividend year after year. This is because of its focus on the ultra-defensive medical property market, where its rents are also effectively guaranteed by government bodies such as the NHS.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Primary Health’s future earnings could be at risk depending on future changes to healthcare policy. But at the moment things are looking rosy. Investment in primary healthcare facilities is, in fact, rising as the Department of Health and Social Care tries to take the pressure off of packed hospitals.

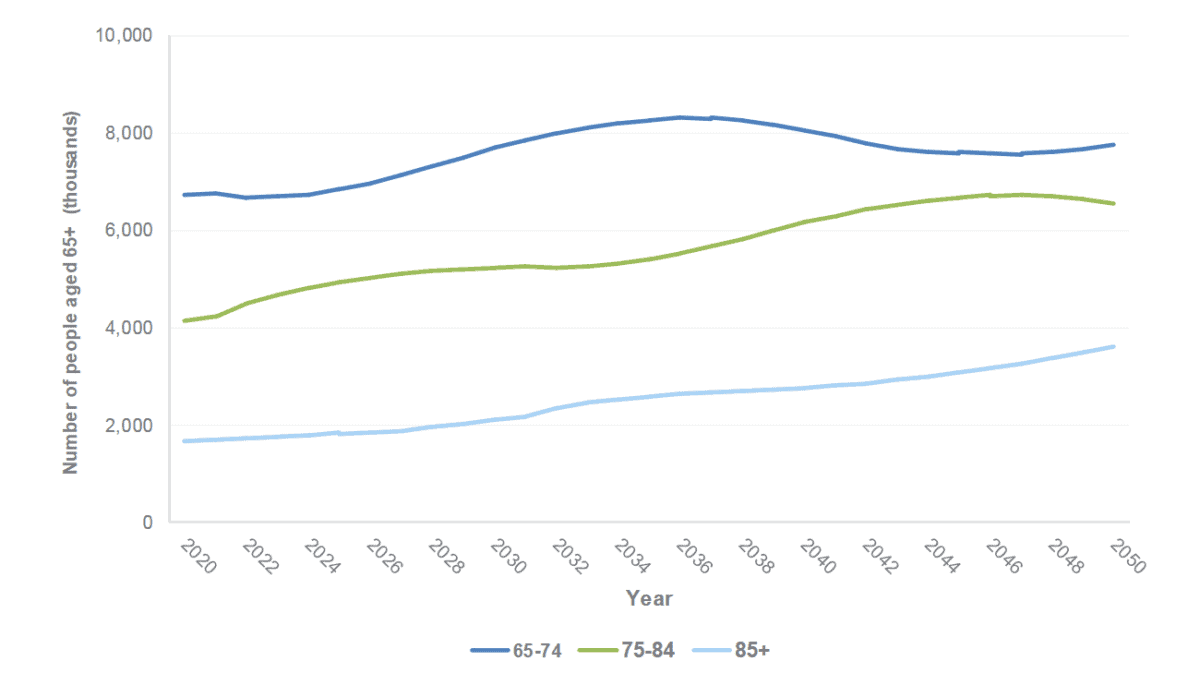

This is a sector with significant long-term growth potential too, driven by the rapid pace at which the UK population’s ageing. The same demographic changes are happening too in Ireland where the FTSE 250 company also operates.

Primary Health Properties has raised annual dividends every year since the mid-1990s. I think it’s in good shape to keep this proud record going for a long time to come.

M&G

Financial services provider M&G’s also in one of the box seats to profit from an ageing population. As people live longer, demand for savings, wealth, and retirement products is expected to rise significantly. And especially so as worries over the level of future state benefits, and pensioners’ eligibility for them, grows.

This could underpin long-term earnings growth. What I like particularly about M&G is its broad geographic footprint spanning the UK, Europe and Asia. This gives it abundant growth opportunities along with a chance to offset trouble in one or two countries at group level.

But what makes the company such a brilliant dividend stock? After all, its operations are highly cyclical and profits can fall during downturns, hurting shareholder payouts.

Despite that clear risk, M&G’s a cash machine, giving it the means and the confidence to pay large and growing dividends even during tough times. With a Solvency II capital ratio of 210% as of June, it certainly looks in great shape to remain an impressive dividend payer for a long time to come.