The London stock market is a great place to go hunting for top dividend shares. Many top stocks have the sort of high yields that can supercharge an investor’s passive income.

Take Assura (LSE:AGR), for instance. This is a FTSE 250 share that’s raised its annual dividend every year for more than a decade.

Its shares have sunk since 2022 and remain at depressed levels. This is due to interest rate hikes — and speculation over future rate levels — that hit net asset values (NAVs) and push up borrowing costs.

Should you invest £1,000 in BP right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if BP made the list?

However, as a long-term investor, I still feel Assura’s a top dividend stock to consider. Here’s why.

Healthy dividends

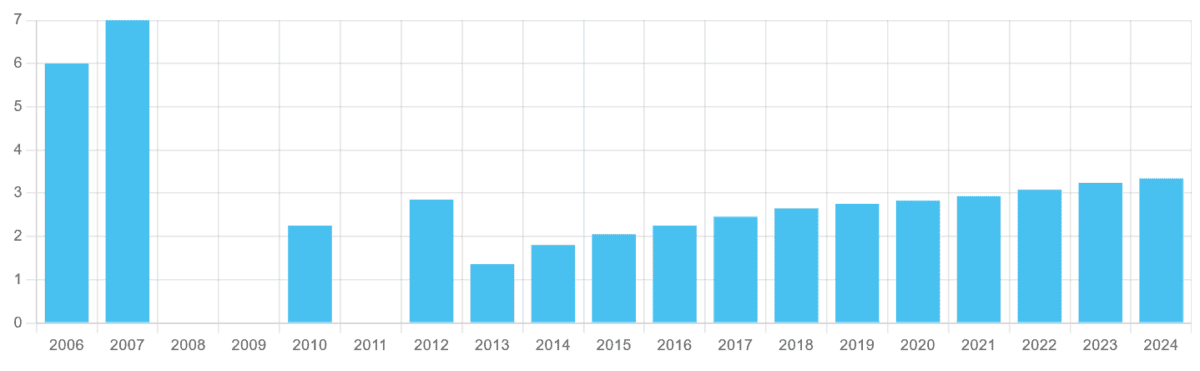

Assura’s defensive operations mean it’s delivered a decent and growing dividend for 11 straight years. In spite of massive economic and geopolitical uncertainty, City analysts expect this record to roll on for the next few years at least too.

This real estate investment trust (REIT) specialises in leasing primary healthcare properties like GP surgeries and treatment centres. As of September, it had 625 facilities worth a cumulative £3.2bn criss-crossing the UK and Ireland.

Like many healthcare stocks, its earnings are largely unaffected by broader economic conditions. But this UK share provides added protection insofar that most of its rents are essentially guaranteed by government bodies like the NHS.

A large proportion (49%) of Assura’s rents are also subject to fixed or inflation-linked uplifts. This gives the firm added strength to consistently raise dividends.

Furthermore, its REIT status means that at least 90% of annual rental profits must be paid out in the form of dividends.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

In good shape

That’s not to say that future dividends are unaffected by risk. Changes to NHS policy could impact later payouts, for instance. This is a possible scenario given the state of Britain’s public finances.

But on balance, the odds appear to be in Assura’s favour. Government funding for primary healthcare should continue rising to relieve the pressure on Britain’s overused hospitals.

Indeed, healthcare investment is especially critical at this moment in time. This is not only a result of Britain’s rapidly-ageing general population. It also reflects the large number of ill people the government is seeking to urgently return to the workforce.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

9.2% dividend yield

Combined, these qualities mean Assura’s annual dividends are tipped to rise through the next few years at least.

This, along with the heavy share price weakness I mentioned at the top, mean the yield on Assura’s shares eventually marches above 9%.

| Year ending March | Dividend yield | Dividend growth |

|---|---|---|

| 2025 | 8.7% | +2% |

| 2026 | 8.9% | +3% |

| 2027 | 9.2% | +3% |

To put this into context, the average forward yield on FTSE 250 shares sits way back at 3.3%.

I already own Primary Health Properties shares for a large and growing dividend income. If I didn’t, I’d consider adding industry peer Assura to my portfolio today.