When gearing up to build a passive income stream, there are a number of things to consider. One of the most important is the type of savings account to use.

Many UK citizens use a Cash ISA to minimise the tax they pay on their capital gains. While this can be a good option, falling interest rates leave them less attractive.

In the long term, I think it makes more sense to consider a Stocks and Shares ISA. It offers similar tax relief with the advantage of potentially beating the returns of a Cash ISA.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

So how much are we talking about?

It’s often best to save as much as one can each month. But it’s still important to get a rough idea of how much is sufficient. Investing few pounds here and there is unlikely to generate life-changing wealth — but that doesn’t mean investors need to stash every penny they have in their ISAs.

Each individual has different needs when it comes to financial requirements. So, for want of a better number, I’m using £10,000 of annual passive income as an example. That would be a decent bit of extra cash on top of a State Pension.

To draw down £10k a year for 30 years, a £300,000 pot is needed. However, with the money invested and earning a return, the amount could be less.

Using an average return of 5%, a pot of around £200,000 could last indefinitely (5% of £200k is £10k). But annual returns aren’t stable and some years may require reducing the pot. What’s more, inflation may necessitate larger withdrawals each year.

With that in mind, I’d consider £250,000 a responsible goal to aim for. This also ties in with the recommended 4% drawdown for retirement funds.

Building a portfolio

A quarter million pounds is no small amount of savings. It would take a decent portfolio about 25 years to reach that amount with £200 invested per month. That’s assuming an average return of around 6% with an average of 4% in dividends reinvested.

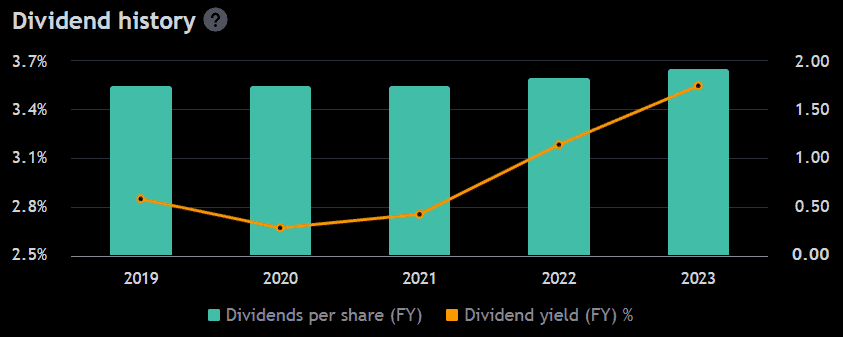

Consumer goods giant Reckitt Benckiser (LSE: RKT) may be one to consider. It has provided annualised returns of 6% per year for the past 20 years and currently has a 4% dividend yield. Plus, it has a solid history of reliable payments and consistent dividend growth.

But past performance is no indication of future results. Will it keep it up?

To figure that out, I’m checking its risks and valuation.

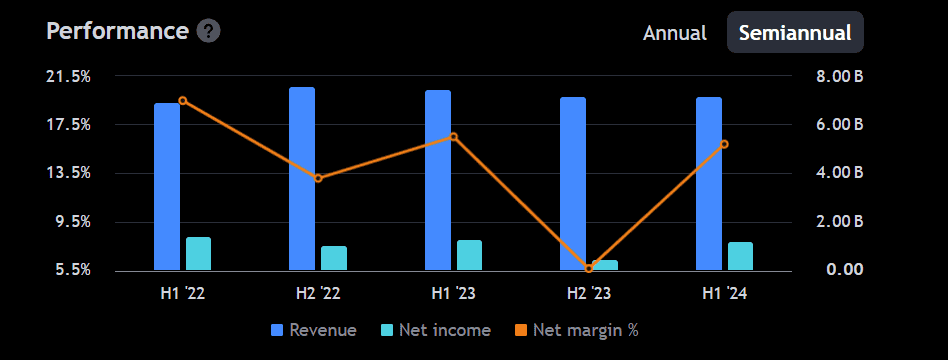

Reckitt took a big hit last year after acquiring the baby food business Mead Johnson. One of its products, Enfamil, was implicated in a lawsuit regarding an infant fatality. While that issue has reportedly been resolved, there’s always a risk of similar cases arising.

Acquisitions are critical for business expansion but they can be costly if things go wrong.

On the plus side, the falling price makes it look attractive. A recovery has already begun but the price remains 37% down from its five-year high. With earnings expected to improve, analysts forecast an average price increase of 14.21% in the coming year.

That’s why I consider it a good option as part of a passive income strategy. I’ll be regularly topping up my Reckitt position as the year progresses.