Looking for the best investment trusts to buy for a winning passive income? Here are three I think deserve a close look.

As you’ll see, their forward dividend yields are more than double the average for FTSE 100 shares.

Greencoat Renewables

Dividend yield: 8.3%

Should you invest £1,000 in Franklin Templeton Icav - Franklin Ftse India Ucits Etf right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Franklin Templeton Icav - Franklin Ftse India Ucits Etf made the list?

The stable nature of energy demand provides trusts investing in power-generating assets with excellent stability. As a consequence, they have the means and the confidence to pay decent and often growing dividends over time.

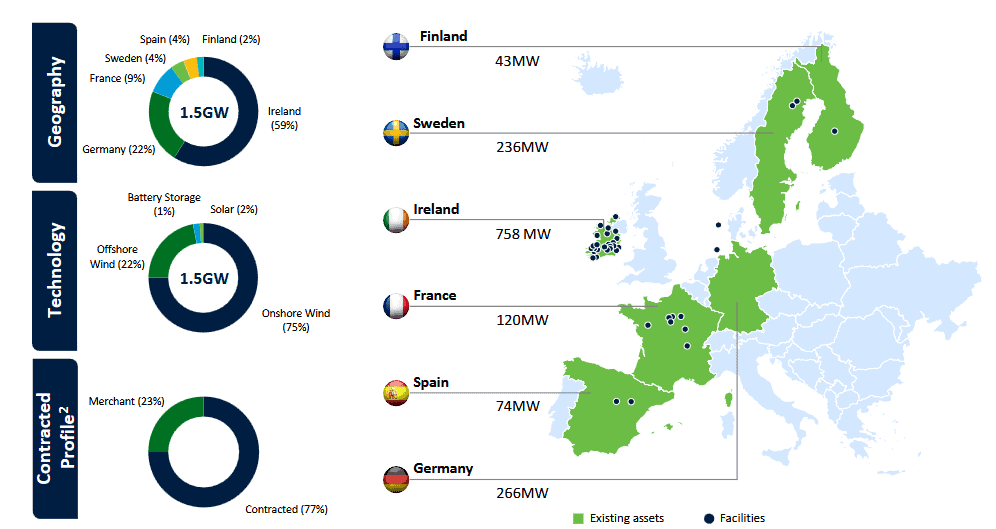

This is the case with Greencoat Renewables (LSE:GRP), which specialises in onshore and offshore wind across Ireland and Continental Europe. It’s provided a growing annual payout in six of the past seven years.

Unfavourable weather conditions can significantly impact returns from these companies. When the wind doesn’t blow, for instance, their turbines can’t produce profit-making electricity.

However, Greencoat Renewables’ wide geographic footprint reduces the impact of localised weather issues at group level, providing earnings (and thus dividends) with excellent stability.

The trust predicts Europe’s investible renewables market will be worth €1.3trn by 2030, and €2.5trn by 2050. This suggests enormous long-term investment potential.

Supermarket Income REIT

Dividend yield: 8.9%

Trusts that specialise in food retail also enjoy excellent earnings stability from year to year. This is what can make Supermarket Income REIT (LSE:SUPR) such a great investment for risk-averse income seekers.

Today it owns 73 grocery properties that it lets out to some of the industry’s biggest players. These include Tesco, Sainsbury‘s, Aldi, and Morrisons. Needless to say, Supermarket Income doesn’t have to worry about rent collection problems with blue-chip tenants like these.

The steady growth of e-commerce poses a structural threat to the trust. However, its focus on omnichannel supermarkets servicing both physical and online customers is — for the time being, at least — helping to mitigate this threat.

One final reason I like Supermarket Income is because of its classification as a real estate investment trust (REIT). REITs are obligated to pay at least 90% of annual rental profits out in the form of dividends, whether they like it or not.

This provides dividend-hungry investors with added peace of mind.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

CVC Income & Growth

Dividend yield: 8.4%

The London stock market hosts plenty of trusts that derive their earnings from debt instruments. However, CVC Income & Growth‘s (LSE:CVCG) focus on sub-investment-grade credit means it can charge far higher interest rates than other trusts, supercharging the earnings it makes.

This in turn fuels its enormous dividend yields.

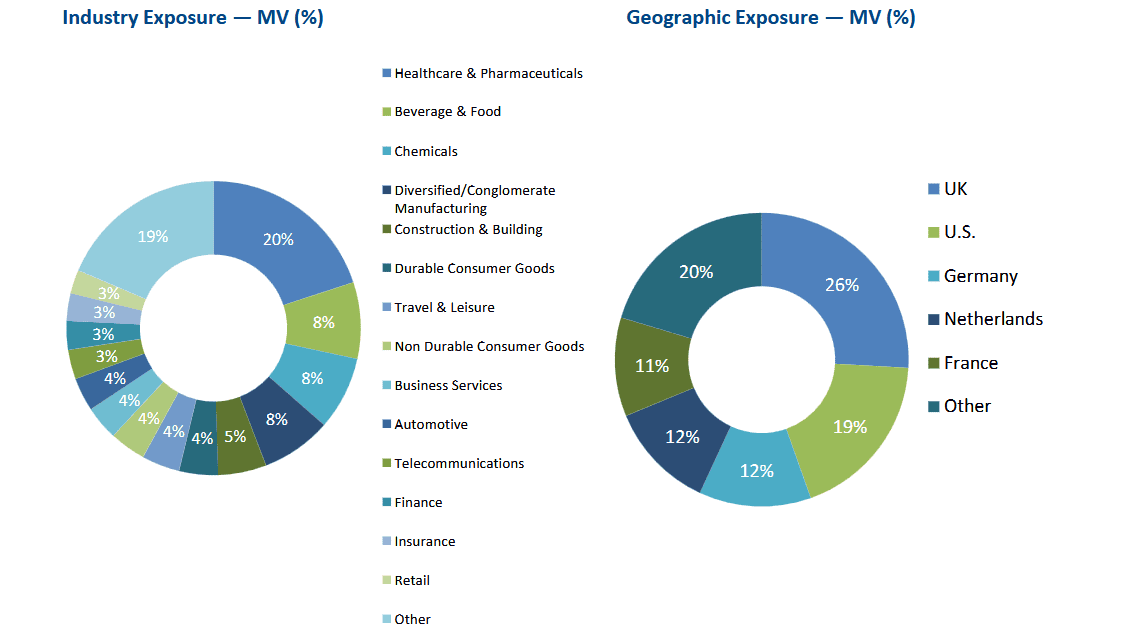

Returns here can be at risk if one or more companies fail to meet their debt obligations. However, the trust’s impressive diversification means such events can be absorbed without decimating total returns.

CVC Income & Growth has investments in between 40 and 60 companies at any one time. And these are pretty evenly spread across a wide variety of sectors and regions, a quality that reduces risk still further.

Like Supermarket Income and Greencoat Renewables, I think it’s worth serious consideration from savvy investors.