I’m searching for the hottest UK shares, funds, and trusts for ISA investors to consider for the New Year. This involves looking for cheap stocks that have potential to soar if the market recognises their mis-valuations.

With this in mind, here are two undervalued FTSE 100 and FTSE 250 shares I think could rocket in value. But that’s not all. I’m also looking at a surging exchange-traded fund (ETF) I believe may have further to go in 2025.

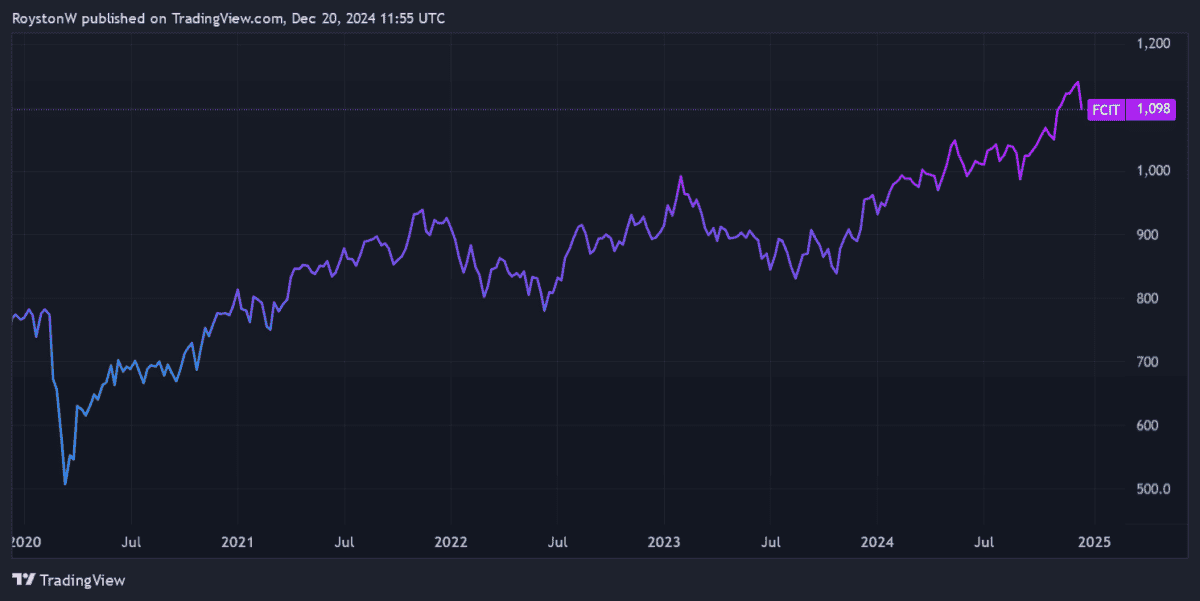

F&C Investment Trust

The F&C Investment Trust (LSE:FCIT) has put in an index-beating performance in 2024. To date, it’s up around 15%, far ahead of the Footsie’s 4% rise.

Yet it still looks cheap on paper. At £10.90 per share, it’s trading 6.5% below its net asset value (NAV) per share.

For me, the trust offers a perfect blend of quality and diversity. It counts top-drawer names like Nvidia, Microsoft, Apple, Mastercard, and Eli Lilly among its 10 largest holdings. But with stakes in more than 400 global businesses, it also helps investors to effectively spread risk.

There is a danger that F&C’s fund could endure some turbulence next year, however. The cyclical shares it holds may drop if, for instance, inflationary pressures persist or new trade tariffs are introduced.

That said, I think its low valuation still makes it worth a very close look.

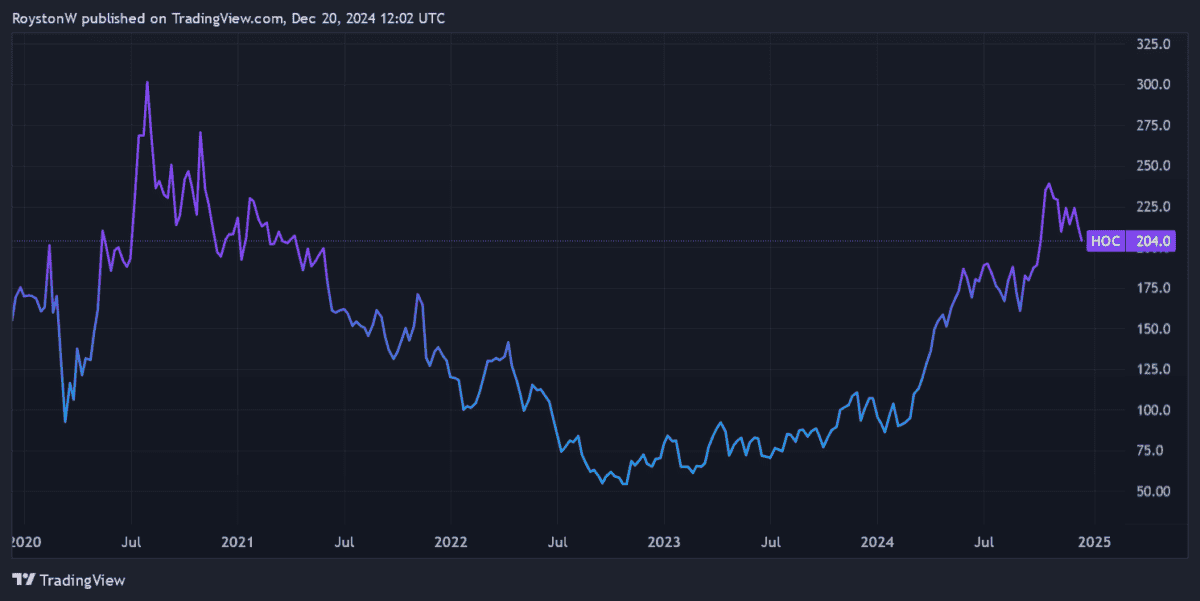

Hochschild Mining

Precious metals miner Hochschild Mining (LSE:HOC) has doubled in value over the course of 2024. However, at current prices of 204p per share, it also looks like an undervalued gem to me.

The FTSE 250 firm’s price-to-earnings (P/E) ratio is a rock-bottom 5.6 times. Meanwhile, its price-to-earnings growth (PEG) ratio, at 0.1, is well below the value watermark of one.

Hochschild shares have soared thanks to big rises in gold and silver values. And next year could be another big year for safe-haven metals given ongoing macroeconomic uncertainty and geopolitical tensions.

City analysts think so. It’s why they’re predicting Hochschild’s earnings to soar 58% year on year.

Strong production at its Brazilian assets gives the firm good momentum going into 2025. But remember that operational issues are a constant threat to even the best mining stocks.

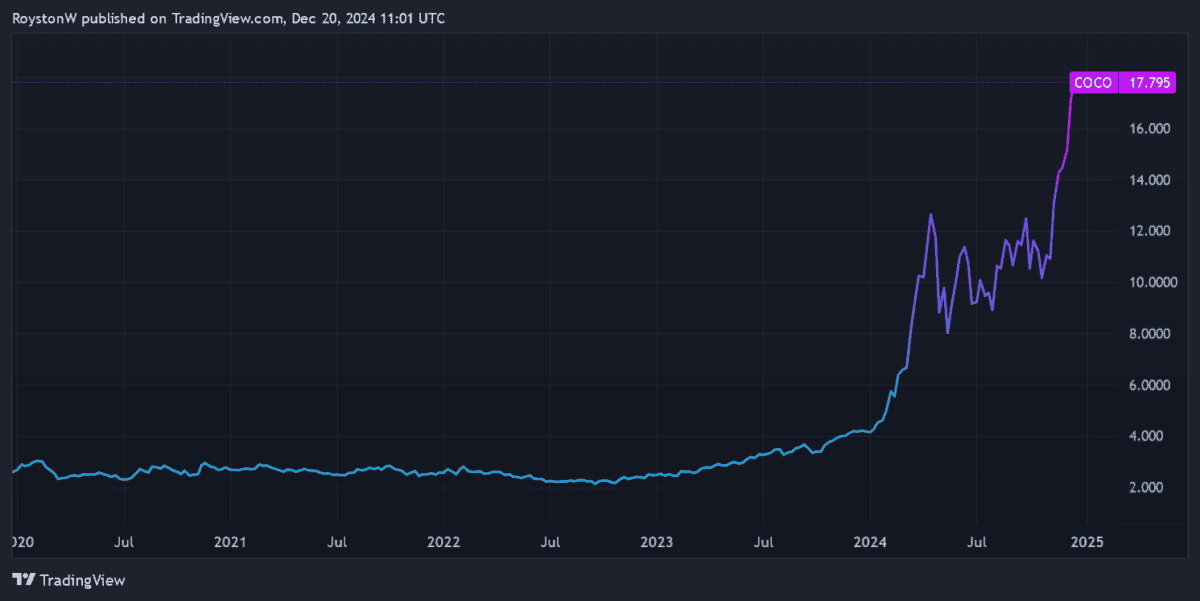

WisdomTree Cocoa

2024 has been a spectacular year for cocoa prices. The chocolate ingredient’s soared 170% in the year to date, driven by hedge funds exiting futures markets and poor weather conditions in key producing areas.

With supply issues lingering, I think WisdomTree Cocoa (LSE:COCO) — an ETF which mimics the Bloomberg Commodity Cocoa Subindex 4W Total Return Index — could enjoy another blowout year in 2025.

Poor harvests in West Africa have driven global cocoa stocks to multi-year lows. Recent weather issues threaten further crop issues in 2025 that could keep the market in a price-boosting deficit.

As with any commodity, investors need to be prepared for potential price volatility ahead. But as climate change causes more frequent extreme weather events, I think the WisdomTree Cocoa fund could deliver excellent long-term returns.