Interest rates are falling, and this means that those of us with money in savings accounts will start to receive less passive income. In fact, with interest rates set to fall to around 3.5% in 2026, savers will likely only receive a modest premium to the targeted rate of inflation.

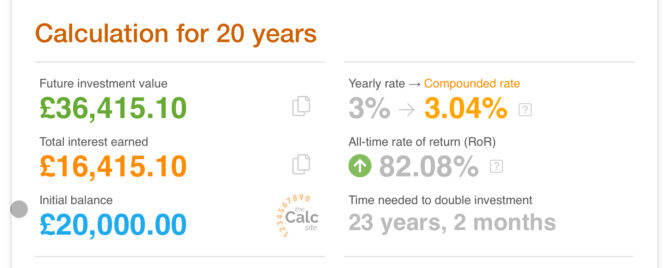

Just take a look at this illustration. £20,000 in a savings account with a 3% yield generates a very limited return. Assuming a long-term average inflation rate of 2%, the net gain would be a mere 1% per year.

Why stocks

Investors might choose stocks for passive income over traditional savings due to the potential for higher returns and inflation protection. UK dividend stocks, particularly from established FTSE 100 companies, often provide regular payouts exceeding the low interest rates offered by savings accounts.

While savings rates can struggle to keep pace with inflation, dividend stocks can offer income growth and capital appreciation. For instance, sectors like utilities, healthcare, or consumer goods often deliver consistent dividends even during economic downturns.

Additionally, tax-efficient investment options like ISAs allow UK investors to shield dividend income from tax. Despite market volatility, long-term dividend investing offers a balance of steady income and the potential for greater financial growth than typical savings accounts.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Choosing dividend aristocrats

Investors looking for a steady passive income that grows over time will likely want to focus on buying Dividend Aristocrats. These are companies that have continually paid and grown their dividend payments over time. Of course, past performance is not reflective of future performance, but a strong track record is always appreciated.

Investors may want to consider Legal & General (LSE:LGEN). The stock stands out as a compelling Dividend Aristocrat option for investors seeking steady passive income growth, with its remarkable track record of dividend consistency, having maintained or increased its payout every year since 2010. This commitment to shareholder returns has earned Legal & General a place in the prestigious S&P UK High Yield Dividend Aristocrats Index.

Why passive income investors pick Legal & General

There are several reasons why passive income investors pick Legal & General. One is the underlying strength of the business, with a strong solvency ratio of 223%. What’s more, Legal & General continues to offer modest earnings growth. CEO António Simões expects mid-single-digit growth year on year, indicating a stable outlook.

Looking ahead, the firm’s financial targets are encouraging. The company aims for a 6%-9% compound annual growth rate in core operating earnings per share from 2024 to 2027, with an operating return on equity of over 20%. Additionally, it anticipates generating £5bn-£6bn in cumulative Solvency II operational surplus across 2025, 2026, and 2027.

However, investors are clearly most attracted by the headline dividend yield, which could reach an impressive 9.36% in the coming year. The company’s board has announced plans to grow the dividend per share by 5% for the full year 2024, followed by 2% annual growth thereafter.

Unfortunately, investing doesn’t come without its risks. While insurers are known for strong free cash flows, Legal & General’s dividend payout appears to exceed free cash flows, potentially presenting a threat to the sustainability of the dividend in the long run.

Nonetheless, that doesn’t mean the business can’t afford the dividends, and the earnings forecast suggests the payments will become more manageable over the medium term.