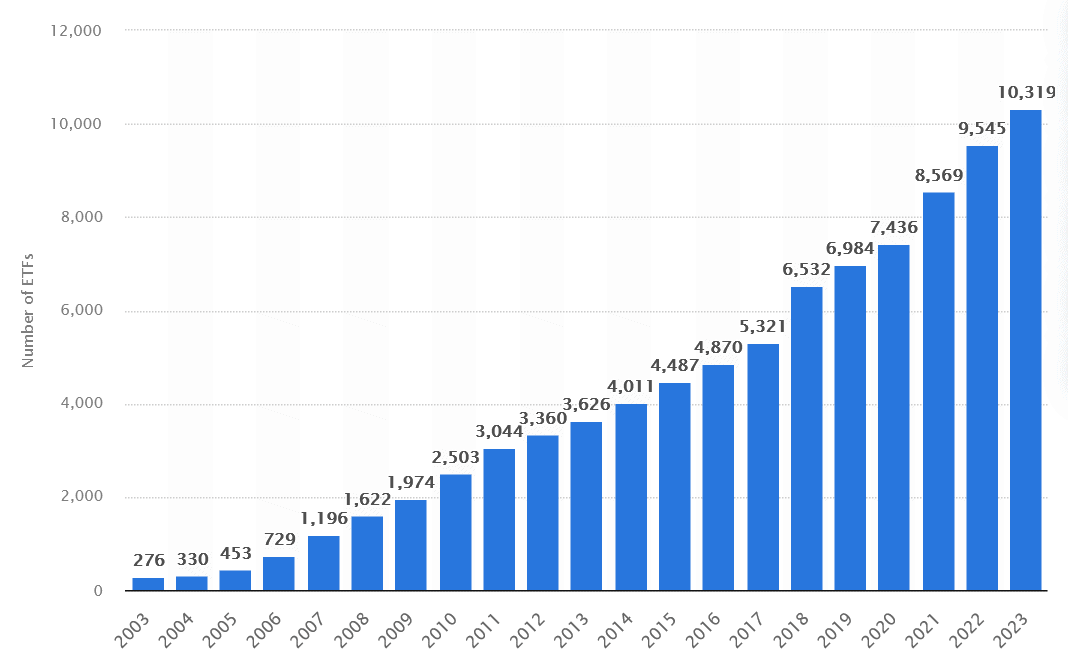

Demand for exchange-traded funds (ETFs) is soaring across the globe. Twenty years ago there were 330 of these financial instruments for investors to choose from.

That number grew to 10,319 last year. And the choice of funds has continued to climb in 2024.

ETFs offer a number of advantages for investors. They can provide exposure to a variety of assets like shares, bonds, or commodities, which helps individuals build a diversified (and thus less risky) portfolio.

And because they are traded on stock exchanges, they are also cheaper to buy and sell and more liquid than mutual funds.

Choosing individual shares can deliver better returns than funds like these. But that’s not to say these vehicles can’t deliver spectacular returns in their own right.

With this in mind, here are three top ETFs I think are worth considering for the New Year. If past performance continues, an equal investment across them could provide an average annual return of 14.8%.

Of course, history is not a reliable guide to future returns.

1. A passage to India

As its name suggests, the Franklin Templeton FTSE India ETF provides targeted exposure to Asia’s second-biggest economy.

This means it poses more risk than a more global fund. But it also creates enormous opportunity given the pace at which the Indian economy is growing. The fund’s delivered an average annual return of 11.7% since it was created in 2019.

With £1.2bn in assets, the fund is invested in 244 mid-sized and large Indian stocks like HDFC Bank and Infosys. Its exposure to multiple industries helps spread risk still further.

2. Up and atom!

The VanEck Uranium and Nuclear Technologies ETF (LSE:NUCG) hasn’t been going nearly as long as some other funds. So its 41.5% return since its creation in February 2023 — translating to an average annual return of 20.9% — isn’t much of track record.

Yet I’m confident the fund has enormous investment potential as the world switches from fossil fuels to other energy sources.

You see, this VanEck product invests in companies that are vital to the growth of nuclear power. Its 25 holdings include uranium producers like Cameco and suppliers of reactor components such as BWX Technologies.

Nuclear power remains a controversial subject. And souring appetite from politicians could hit the fund hard. But as the rush to substitute oil and gas heats up, the outlook for the sector for the moment appears extremely bright.

3. Security guard

Amid rapid growth in the number of global cyber attacks, the L&G Cyber Security ETF has soared in value. It’s delivered an average annual return of 11.8% since its inception in 2015.

I’m expecting it to continue delivering blockbuster returns, too, as the digital realm grows and with it the amount of internet crime. Analysts at Spherical Insights believe the cybersecurity market will grow at a compound rate of 11.6% between 2022 and 2030.

With $2.3bn locked into industry giants like Crowdstrike and Palo Alto, the fund is well placed to capitalise on this.

The annual charge of 0.69% is higher than many other ETFs and will eat into returns. But I think its massive growth potential still makes it worth considering.