I haven’t been closely following the recent developments of FTSE 250 media company Future (LSE: FUTR). It’s something of an under-the-radar stock that occasionally pops up on broker forecasts but seldom makes big news.

However, it became harder to ignore after closing up 10% last week following a positive set of full-year 2024 results. Print media’s been a dying industry for some time and online advertising revenue seems to be dominated by Google.

Yet Future seems to be finding new ways to capitalise on the market and may still emerge as a force to be reckoned with. Don’t just take my word for it. Brokers are taking note too. On 6 December, Barclays went Overweight and Berenberg put in a Buy rating on the stock.

Should you invest £1,000 in Legal & General right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Legal & General made the list?

I’m digging deep to see if the fuss is justified and if the stock’s worth considering.

Signs of recovery

Future’s the parent company of over 200 media brands, including magazines, websites and events. Its biggest brands include TechRadar, GoCompare, Marie Claire and The Week.

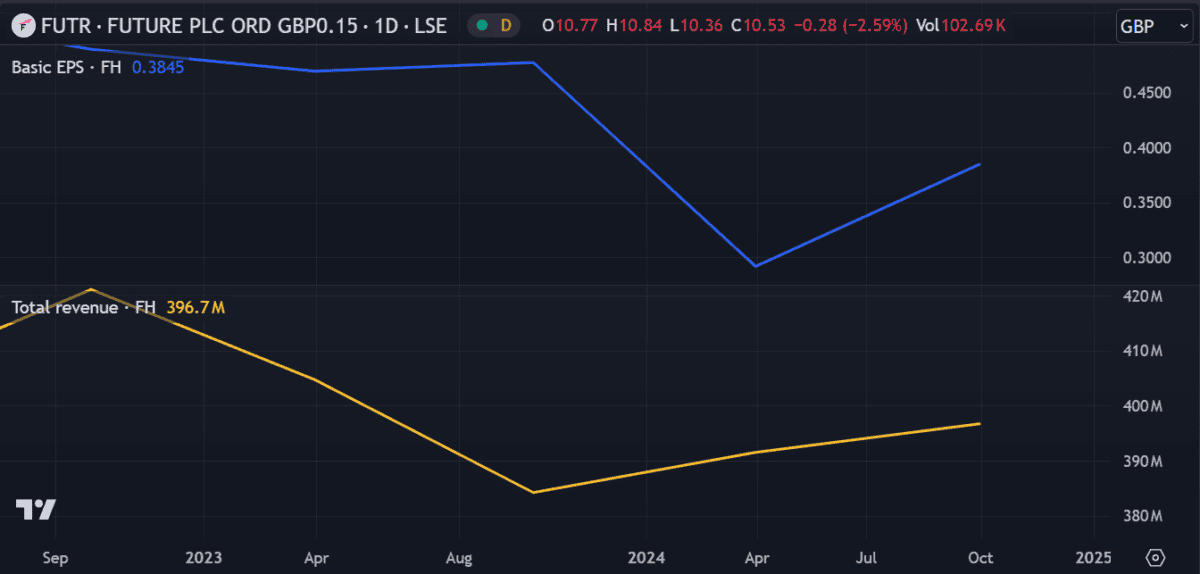

The key news from its latest results was a return to revenue growth in the second half of the year. This was driven largely by a 40% boost in voucher revenue and a 28% increase from GoCompare.

Interestingly, off-platform users rose to 250m while online monthly users decreased 6%. Adjusted operating profit fell 13% with the margin narrowing from 32% to 28%.

Earnings per share declined 29% to 66.8p compared to 94p in 2023. Cash also decreased by 5%.

On the face of things, it doesn’t immediately appear to be a very positive result. However, it exhibits early signs of success in the company’s Growth Acceleration Strategy (GAS).

After a bumpy period of audience declines and technical challenges, the initiative seems to be gaining some momentum.

Business developments

In October, the price dipped 11% following the resignation of CEO John Steinberg. After only two years in the role, he has decided to return home to the US to be with his family. Naturally, the departure has concerned investors who may question the true motivation behind the move. If unresolved issues exist within management, it could lead to further problems down the line.

Although a new CEO has yet to be named, chair Richard Huntingford remains optimistic, praising the new GAS initiative for yielding “good strategic and financial progress”.

A recent partnership with OpenAI suggests the company plans to start using artificial intelligence (AI). However, specific details haven’t been announced and it’s unclear yet if this will boost profitability.

Valuation

Valuation-wise, the stock still looks cheap, trading around 14 times forward earnings. It’s slightly above the industry average but still attractive for a company generating cash and innovating through partnerships.

Using a discounted cash flow model, the shares are estimated to be trading at 61.2% below fair value. The average 12-month price target’s £14.30, a 32% increase from today’s price.

But with profit margins down to 9.7% from 14.4% last year, it may be too early to call a recovery yet. As such, I’ll keep an eye on the stock but I don’t plan to buy the shares today.