The FTSE 250 index provides investors with a wealth of investment opportunities and a chance to spread risk.

More of its earnings are generated in the UK than the international FTSE 100. But with hundreds of companies spanning many different industries and countries, it still offers an excellent way for individuals to potentially diversify their portfolios.

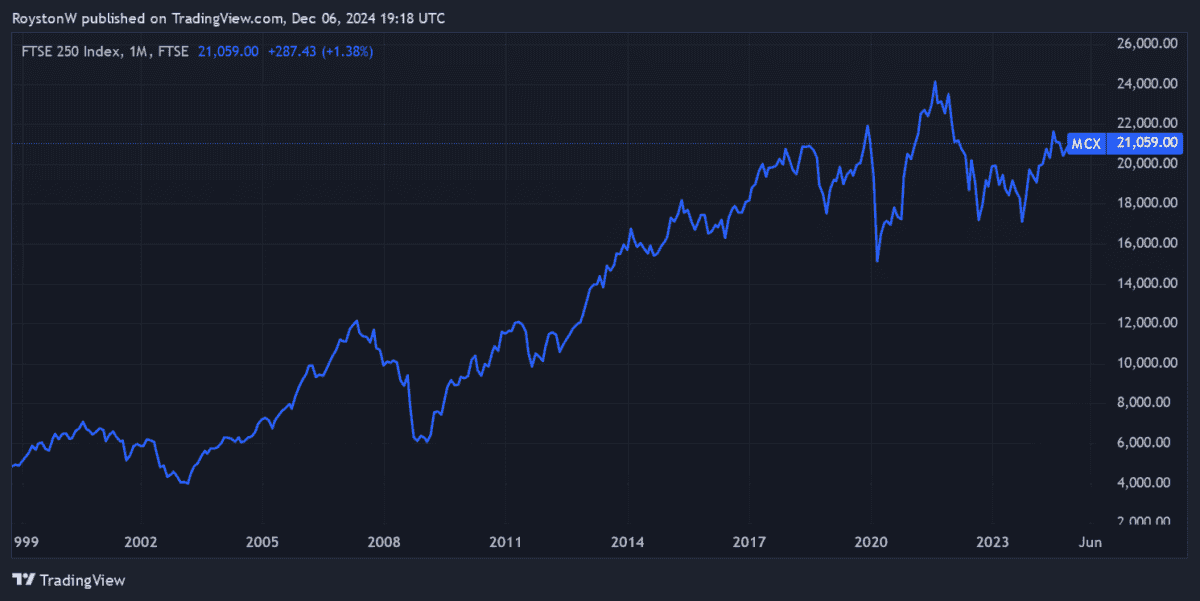

Indeed, FTSE 250 tracker funds have delivered robust shareholder returns during the past decade, as I’ll now illustrate.

Should you invest £1,000 in Bloomsbury right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Bloomsbury made the list?

Solid return

Since 30 November 2014, the index has risen 32.8% in value. That’s better than the 23.6% that the FTSE 100 has delivered over the period.

If I’d bought a tracker fund like the iShares FTSE 250 ETF a decade ago, I’d have made a tidy profit from this healthy rise. I’d also have received some juicy dividends to bolster my retirement fund.

But how much would I have made? Assuming I’d parked £30,000 in an index fund just over 10 years ago, I could now — with dividends reinvested — be sitting on a portfolio worth just over £52,295.

Good and bad

This sum, which represents an average annual growth rate of 5.57%, isn’t bad by any stretch. Indeed, it’s important to remember that stock markets go up and down, and that profits are never, ever guaranteed.

Yet the FTSE 250’s average return trails that of some other major indexes. Factoring in price gains and dividends, the FTSE 100’s average yearly return since late 2014 is a superior 6.08%.

Looking overseas, the DAX‘s corresponding return is 6.46%. And the S&P 500 blows the FTSE 250 out of the water: it’s average annual return over the past 10 years is 12.73%.

So what next?

The good news is that interest rates are falling and the appetite for UK assets is picking up. And so the FTSE 250 may perform much more strongly over the next decade than it did between 2014 and 2024.

However, a gloomy outlook for the British economy means the opposite could also be true. This reflects the high proportion of earnings the index sources from these shores versus other major indexes.

This is why I’d rather choose individual FTSE 250 shares to buy today than to invest in an index fund. One such company I’m considering right now is Softcat (LSE:SCT).

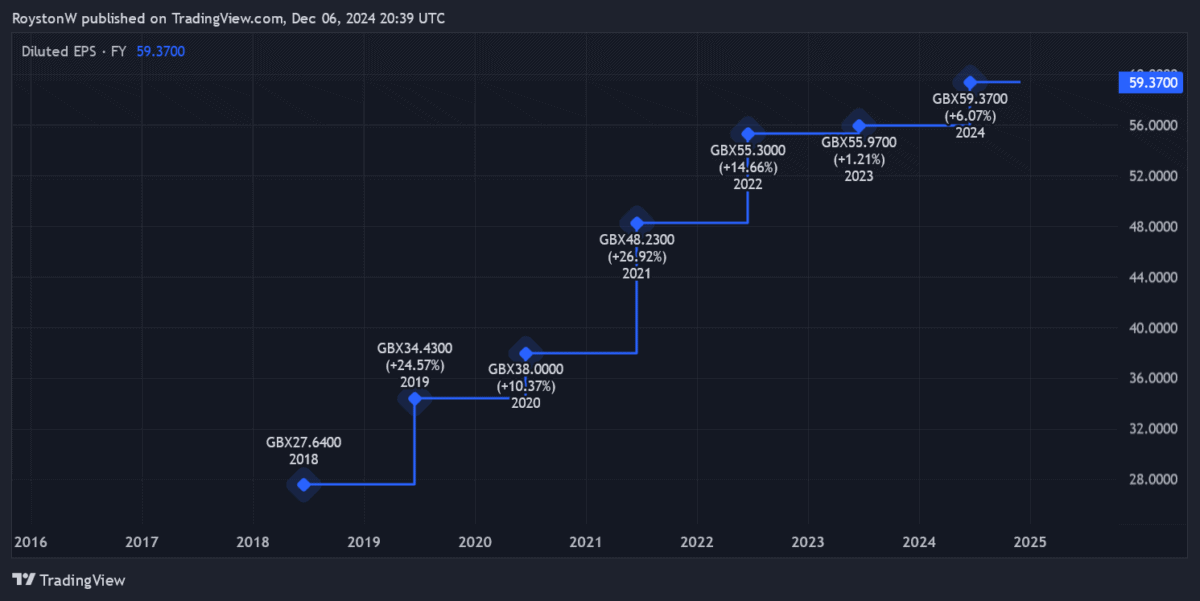

As you can see, earnings here have more than doubled since 2018. This reflects the software developer’s expertise in a variety of areas including cyber security, cloud computing and networking.

Profits remain vulnerable to a downturn in the global economy. But City analysts — for the time being, at least — aren’t expecting Softcat’s strong record of growth to end. And judging by latest trading commentary I’m not surprised.

The firm said in November that “customer demand remains resilient,” and predicted “double-digit gross profit growth together with high single-digit operating profit growth” in this financial year (to July 2025).

Since November 2015, Softcat has delivered an average annual return of 23.2%. As the digital revolution rolls on, I’m optimistic it will continue outperforming the FTSE 250 over the long term too.