With a lump sum investment, investors could start a journey with a Stocks and Shares ISA that might eventually see them become totally financially independent.

Personally speaking, I don’t want to take a chance with my retirement by relying on the State Pension. The size of the benefit I receive, along with the age at which I can draw upon it, is increasingly uncertain as the UK struggles to fund its fast-growing elderly population.

So I have a plan to build long-term wealth. It’s a strategy that, for investors with a £20,000 lump sum today, could potentially provide a monthly passive income above £3,000.

Should you invest £1,000 in Scottish Mortgage right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Scottish Mortgage made the list?

Ta-ta, taxman

The first step I’ve taken is to invest in a tax-efficient product like a Stocks and Shares ISA. This way, I’ve managed to keep any capital gains and dividend interest I receive out of the hands of the taxman.

Over decades of investing, this can add up to tens of thousands of pounds, perhaps more.

Asset manager Netwealth recently told the Financial Times that an additional rate taxpayer investing £100,000 in a Stocks and Shares ISA would, based on an average annual return of 5.9% over 10 years, save a whopping £44,000 in taxes.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

A big passive income

The next thing I’ve done is build a diversified portfolio of shares, funds and trusts with my ISA. I own around 10-15 companies that span a multitude of sectors and regions. I’ve also sought out a combination of value, dividend, and growth stocks.

By spreading my investment like this, I’m boosting my chances of achieving steady, long-term portfolio growth while balancing potential risks.

With this strategy, I believe an average annual return of 8.5% is a realistic and achievable goal. This figure sits at the midpoint between the FTSE 100‘s historical long-term average return of around 7%, and the S&P 500‘s higher average return of approximately 10%.

Past performance is no guarantee of future profits. But investors who can achieve that 8.5% return would — with a £20k investment, and an additional £300 top-up each month — have a Stocks and Shares ISA worth £749,061 after 30 years.

They could then enjoy a healthy monthly income of £3,121 a month by switching this into 5%-yielding dividend stocks. This is the next stage of my own investing plan.

A top trust

A simple and cost-effective way to hit this goal could be by considering an investment in a trust. Alliance Witan (LSE:ALW) — which is about to be promoted to the FTSE 100 from the FTSE 250 — is one such pooled investment I’m thinking about today.

This is one of the UK’s largest investment trusts following the recent merger of Alliance Trust and Witan Investment Trust. It has total assets of around £5.5bn, and holds shares in more than 230 companies.

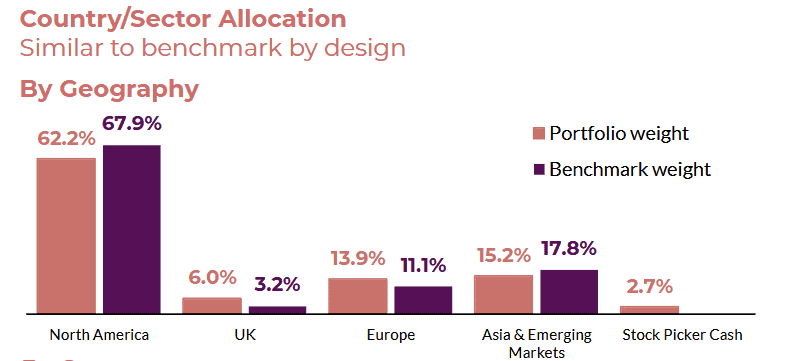

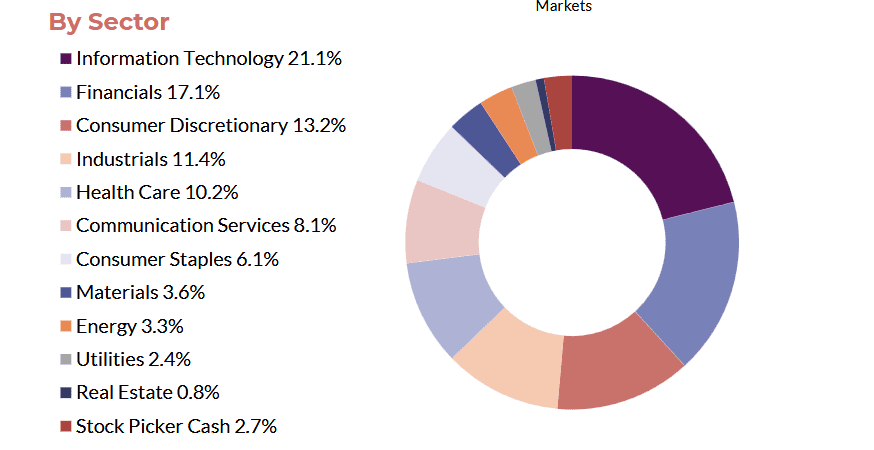

These shares are spread far and wide, by industry as well as region, as shown below. This helps investors to manage risk, as well as obtain exposure to a wide variety of investment opportunities.

On the downside, the trust has significant exposure to cyclical sectors like technology, industrials and financials. This can result in disappointing performance during economic downturns.

But over the long term, I’m optimistic it can continue delivering a healthy return. It’s why it’s near the top of my ISA shopping list today.