Investing in FTSE 100 value shares provides an opportunity for share pickers to supercharge their long-term returns. The theory is that undervalued companies may rebound strongly as market perceptions improve, delivering spectacular capital gains in the process.

Vodafone Group (LSE:VOD) is one cheap-as-chips Footsie stock on my radar today. Its shares seem to offer exceptional value across a range of metrics, including predicted earnings and dividends, as well as the value of its assets.

While they’re not without risk, here’s why I think Vodafone shares are worth a close look from value investors.

Should you invest £1,000 in Prudential right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Prudential made the list?

Earnings

First we’ll look at how the telecoms titan is valued using the price-to-earnings (P/E) ratio.

For this financial year (to March 2025), Vodafone has a P/E of 9.9 times. To put that in context, the FTSE 100 average sits on a higher 14.3 times.

But how does this compare with readings across the wider sector? As the table shows, Vodafone also scores fairly well on this metric versus other major industry players.

| Company | Forward P/E ratio |

|---|---|

| Telefónica | 15.1 times |

| Orange | 9.7 times |

| Deutsche Telekom | 16.4 times |

| A&T | 10.5 times |

| Verizon Communications | 9.6 times |

| T-Mobile | 25.9 times |

Dividends

Telecoms companies are famed for providing large dividends thanks to their stable, recurring revenues and high cash flows.

Earlier in 2024, Vodafone announced plans to rebase its dividends in order to cut debt. Yet despite this, the forward dividend yield, at 6.3%, still soars above the Footsie average of 3.6%.

Furthermore, the yield on Vodafone shares also beats the corresponding reading of most of its sector rivals.

| Company | Forward dividend yield |

|---|---|

| Telefónica | 6.9% |

| Orange | 7.4% |

| Deutsche Telekom | 2.9% |

| A&T | 4.9% |

| Verizon Communications | 6% |

| T-Mobile | 1.2% |

Assets

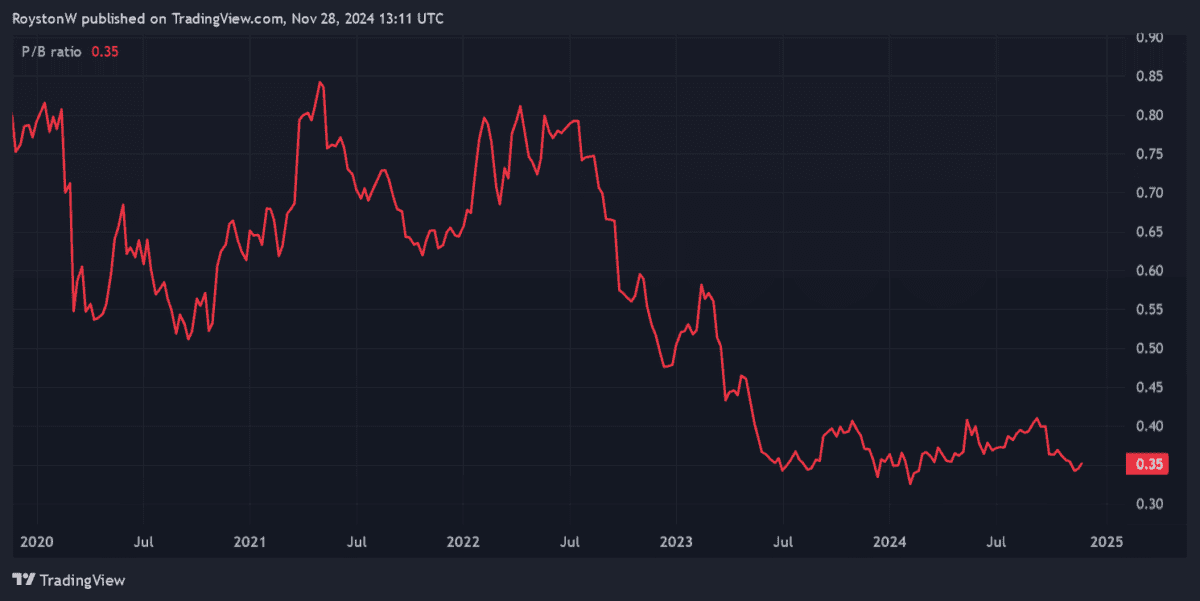

The final thing I’m considering is how cheap Vodafone shares are in relation to its book value. This is the value of the firm’s total assets minus total liabilities.

Today the price-to-book (P/B) multiple is around 0.4. This comfortably comes in below the value watermark of one.

Time to consider buying?

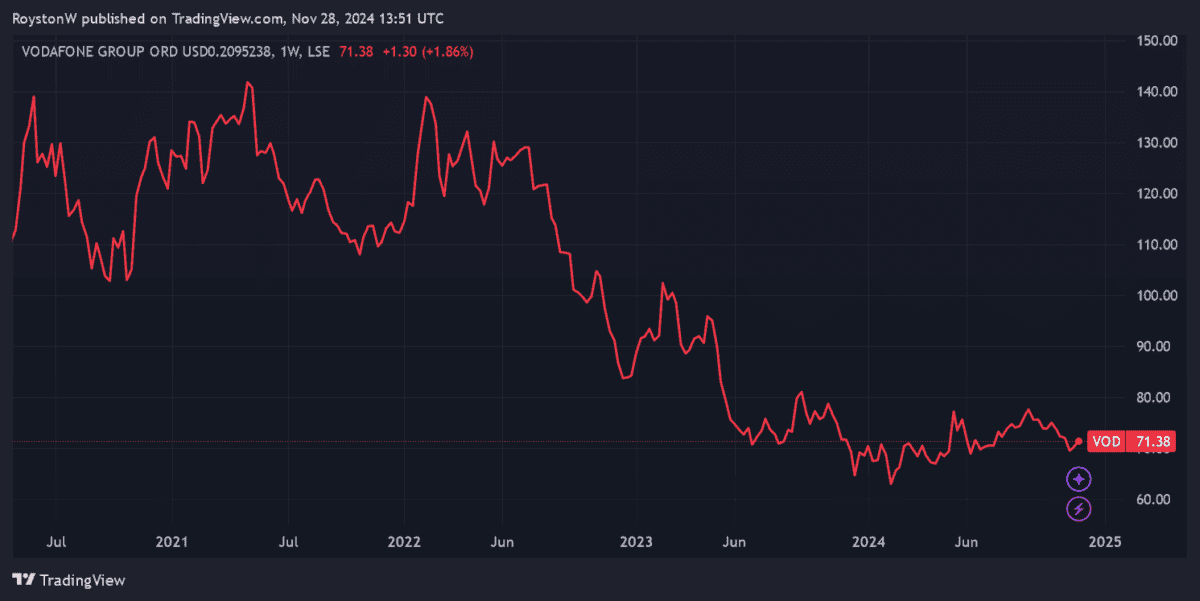

So all in all, Vodafone scores pretty well. But surely there must be a catch? After all, the firm’s share price is down 54% in the last five years, indicating potential internal and/or external problems.

Arguably the biggest concern is the size of the company’s debt pile. Despite recent divestments, this remained at an eye-watering €31.8bn as of September.

This could significantly impact Vodafone’s growth plans and weigh on future dividends. Given how capital intensive its operations are, such high debts are especially worrying.

Yet on balance, I believe the potential benefits of owning Vodafone shares may outweigh the risks. It still faces problems in Germany following changes to service bundling laws. But sales are rising strongly in its other European territories, not to mention in Africa (where organic first-half revenues soared 9.7%).

Vodafone’s refocussed efforts on its Business division are also paying off, with organic service revenue growth speeding up to 4% in the six months to September.

With its scale and market-leading brand, I think Vodafone could be a great way for investors to capitalise on the growing digital economy over the long term. At current prices, I think it demands serious consideration.