The pandemic had a devastating effect on many companies. Some UK stocks dropped 50% or more as their profit margins were hit badly.

Thankfully, many shares have since recovered, with some at or near all-time highs. Others have yet to fully bounce back and remain well down.

Here, I’ll look at two UK stocks with recovering profit margins, but markedly different share price performances in the aftermath of Covid.

Should you invest £1,000 in Sequoia Economic Infrastructure Income Fund Limited right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Sequoia Economic Infrastructure Income Fund Limited made the list?

A huge winner

The biggest turnaround stock in recent times has been Rolls-Royce (LSE: RR). Four years ago, as global travel was still at a standstill, the Rolls share price was 107p. Now it’s 410% higher at 546p!

The turnaround at the company has been stunning, as CEO Tufan Erginbilgiç reminded us back in August.

Our transformation of Rolls-Royce into a high-performing, competitive, resilient, and growing business is proceeding with pace and intensity…We are on track to deliver our mid-term targets.

Rolls-Royce CEO Tufan Erginbilgiç, H1 2024 earnings report

Since taking over in January 2023, he’s implemented a comprehensive transformation strategy to enhance the company’s profit margins. This has included renegotiating contracts, selling off non-core businesses, and implementing cost-cutting measures.

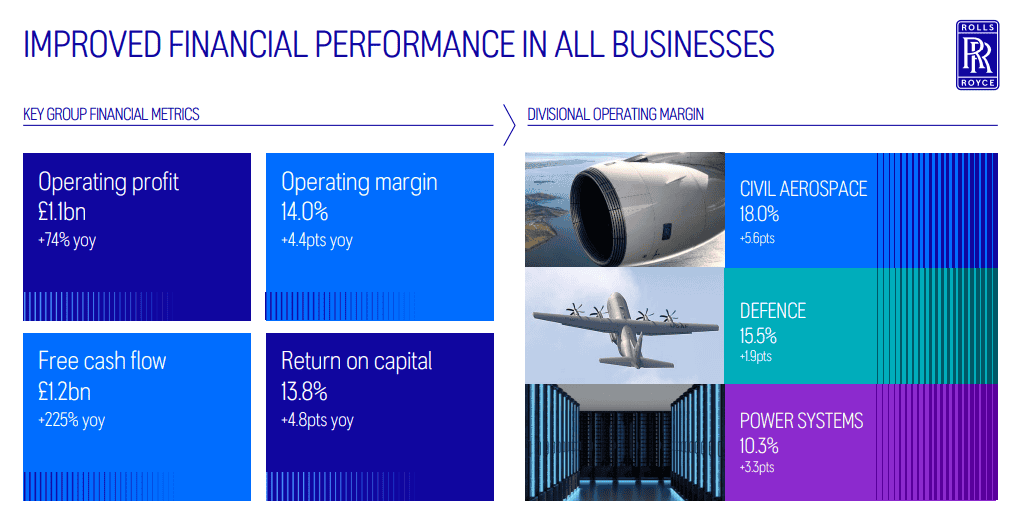

These actions have led to a significant improvement in operating profit, which rose to £1.6bn in 2023. The underlying operating margin was 10.3%, up from 5.1% in 2022.

And the progress continued in H1 this year, with the underlying operating margin improving to 14%. By 2027 (that is, medium term), it could reach 15%.

The issue here, of course, is that the market is fully up to date with this progress. And after the engine maker’s mighty rise skywards, the stock’s trading on a forward price-to-earnings (P/E) ratio of about 26.

There’s risk in that premium valuation if, for example, supply chain issues hamper growth or another pandemic suddenly sweeps across the world.

Nevertheless, I’ll be hanging on to my shares that I first bought at a much lower price. But I’m wary to buy any more at 546p.

A huge loser

One stock that certainly hasn’t bounced back yet is Fevertree Drinks (LSE: FEVR). This is the company that makes posh mixers like elderflower tonic water to enhance the taste of spirits.

The share price has crashed 70% in four years and now languishes near an eight-year low.

The firm has experienced significant cost increases, particularly surging glass costs driven by rising energy prices. This has resulted in huge gross margin pressure on the business.

Consider this contrast between H1 2016 and H1 2024.

| H1 2016 | H1 2024 | |

|---|---|---|

| Revenue | £40.6m | £172.9m |

| Gross margin | 54.8% | 35.9% |

| EBITDA margin | 30.7% | 10.5% |

While revenue has grown significantly, the gross margin has decreased from 54.8% to 35.9%. And the EBITDA margin has contracted significantly. In other words, Fevertree’s profitability has suffered badly.

However, the gross margin in H1 improved 520 basis points from the year before. This was due to improved glass pricing, reduced transatlantic freight expenses, and optimisation efforts. Management expects further ongoing improvement in profitability.

With a forward P/E ratio of 20.3, the stock’s a bit pricey for me, especially as consumer spending may remain weak for some time.

Still, Fevertree’s ongoing margin recovery isn’t being appreciated by the market at present. So I think the stock, which now carries a 2.5% dividend yield, has the potential to bounce back strongly over time.