As a shareholder in Legal & General (LSE: LGEN), I do not feel I have much to complain about when it comes to passive income streams. The FTSE 100 financial services giant currently has a yield of 9.4%. That means the Legal & General dividend is among the highest of any blue-cap share on the London market relative to its cost.

But what if things get better – much better?

Investing for the long term

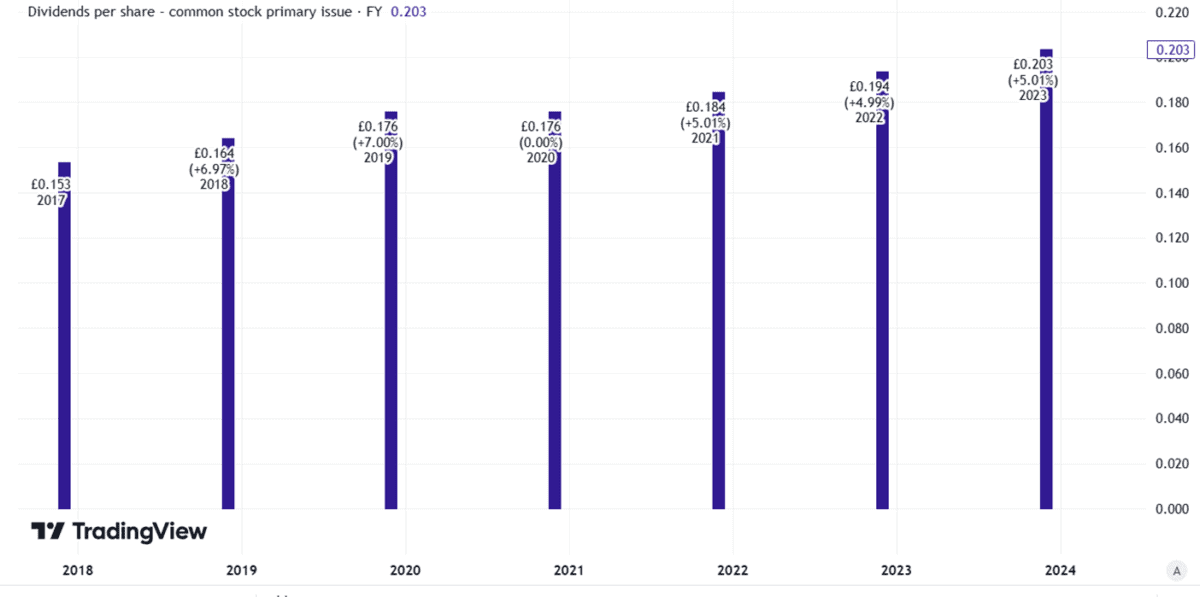

The company has outlined plans to grow the dividend at an annual clip of 2% from next year. So, over time, the yield earned buying the share at today’s price ought to grow.

Created using TradingView

If it grows at 2% per year, after 24 years, the prospective yield based on today’s price would be over 15%.

Twenty-four years is a long time to wait. But I am fine with that – I am a believer in the lucrative potential of long-term investing, after all.

Not only that, but I would be earning big and growing annual dividends along the way, unless the company cut or cancelled the payout per share.

On top of that, there are two ways the prospective Legal & General dividend yield could hit 15% even sooner!

Waiting for a stock market crash

Yield is a function of dividend per share and share price.

So, if the Legal & General share price goes down to about £1.42, the expected annual dividend for this year would impute a 15% yield.

That is a fall of 35%, a considerable amount. Even in the depths of the 2020 market crash, the Legal & General share price did not fall as low as £1.42. Go back to the prior crash though, in 2009, and the share was selling for pennies.

If a crash comes on a big enough scale, it could make investors worry about financial services companies scrambling to meet liquidity requirements. We saw that in 2009 and it could happen again in future.

So, Legal & General is on my watch list of shares to buy if a future stock market crash sends it down far enough in price. That may happen much sooner than 24 years from now – but it may not.

Back to the future

What, though, if we put aside the question of a crash for one moment and just re-examine the Legal & General dividend policy?

In recent years, the annual increase in dividend per share has been 5%. That is now expected to be 2% between next year and 2027.

But if the 5% rate comes back in 2028, then buying the share today, the prospective yield just 14 years from now would be over 15%.

The company has not set out its plans for that point. So, is a 5% annual increase for 2028 and beyond a plausible scenario?

I would say yes.

The company continues to generate so much excess cash it has been buying back its own shares. With a large customer base, strong brand, and strategic focus on the lucrative retirement market, I think it could continue to be a significant cash generator.

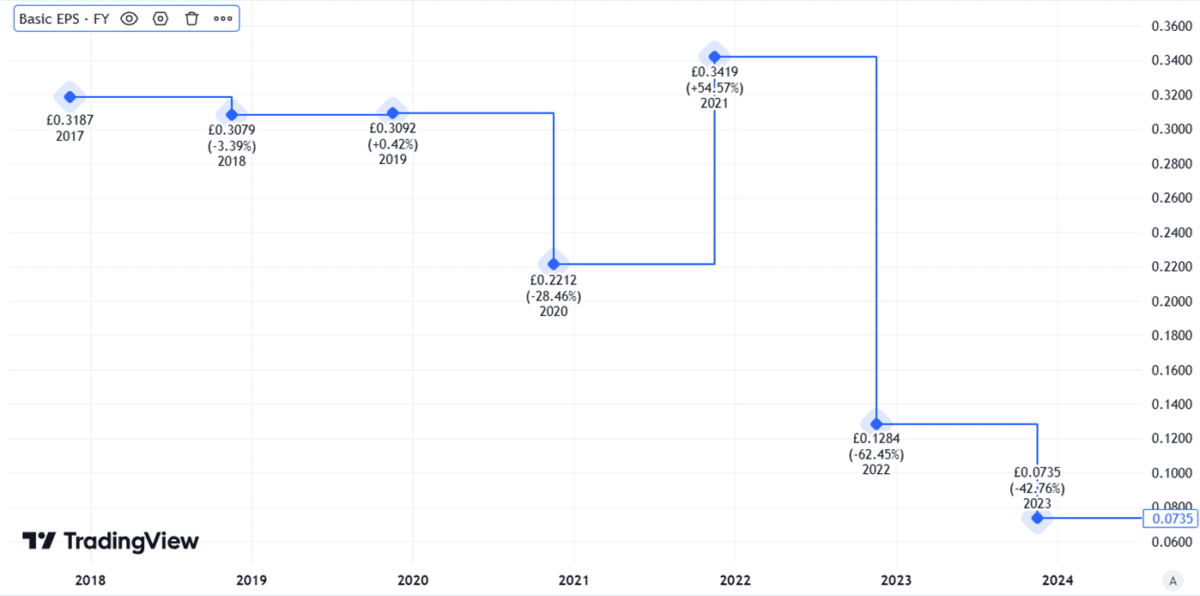

Still, the cut in dividend increase size gives me pause for thought. Earnings have fallen over the past couple of years and Legal & General faces strong competition.

Created using TradingView

In any case, I plan to hang onto my shares.