I don’t withdraw any dividends that are paid into my Stocks and Shares ISA. Instead, I use all of the passive income I receive to buy more shares.

That’s what I’ve been doing with one of my biggest holdings, Persimmon (LSE:PSN). I first bought the stock several years ago, just after the pandemic wreaked havoc on the world. I was initially attracted by its generous dividend — it paid 235p a share during the year ended 31 December 2020 (FY20).

Even when the shares reached their all-time high in February 2020, the stock was still yielding over 7%.

Should you invest £1,000 in Persimmon right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Persimmon made the list?

Difficult times

But a collapse in the housing market prompted by increased borrowing costs and a cost-of-living crisis, means the days of a triple-digit payout are long gone. For FY24, the company said its intention is to “at least maintain” the FY23 dividend (60p) “with a view to growing this over time as market conditions permit”.

I’m therefore expecting to receive a payout of 60p this year. Based on a current (22 November) share price of £12.74, this implies a yield of 4.7%. Despite its recent woes, this is comfortably above the FTSE 100 average of 3.8%.

To achieve my target of £206 a month in passive income, I’d need to buy 4,123 shares, costing £52,527. Now that’s a lot of money, but my income figure hasn’t been chosen randomly.

In fact, according to the latest data from the Office for National Statistics, it’s the average amount of investment income received by UK households each year (£2,474).

But it doesn’t really matter how much is invested as it’s the yield that really counts. A return on 4.9% is the same (in relative terms) irrespective of the size of the investment.

However, given its track record of paying generous dividends, I’d like to think Persimmon’s payout will increase over the medium term.

But how likely is this?

An improving picture?

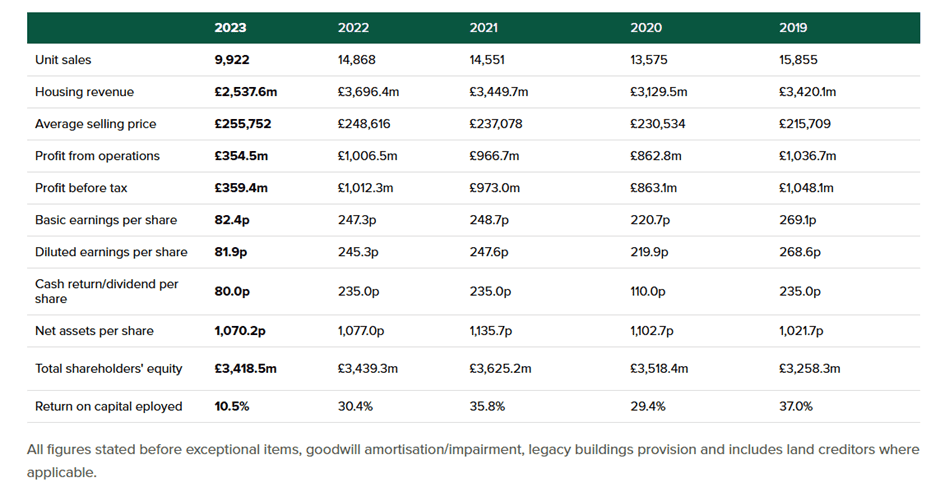

Analysts are expecting earnings per share (EPS) to be almost the same in FY24 (82.5p), as they were for FY23 (82.4p).

But things are predicted to get more interesting thereafter. EPS growth of 21% is forecast for FY25, and 24% in the following year. Persimmon has a reputation for paying out almost all of its earnings in dividends. From FY19 to FY23, it returned 84% to shareholders.

If it did this in FY26, the dividend would be 104p. Admittedly, it’s a long way shy of 235p but, if this was achieved, the stock’s currently yielding 8.2%.

But a recovery in the housing market isn’t guaranteed. And the housebuilder warned of early signs of supply chain inflation in its most recent update to investors. This is concerning given that the recent bout of price increases has already fundamentally changed the financial landscape for Britain’s construction industry.

Comparing 2023 with 2019, the average selling price achieved by Persimmon has increased by 18.6%. However, operating profit per house has fallen by 45.4%.

My verdict

Despite this, I’d still buy it today, if I was in a position to do so. I’m sitting on a large paper loss from my existing position in the company. And I’d like the opportunity to bring down the average cost price of my shares while benefitting from an above-average dividend. I do think it’s worth investors considering.