I recently noticed a potential opportunity for me in a penny stock on London’s AIM index.

Anexo‘s (LSE: ANX) a small but growing company that provides credit hire and legal services related to motor accidents in the UK. Founded in 2006, it has a 7p share price and a market-cap of £85m. Among its services are replacement vehicles for no-fault accident victims, personal injury claims and recovery of costs.

Valuation

It’s not often I see a stock with strong numbers on multiple valuation metrics. And even rarer to see a stock with strong numbers on almost every metric.

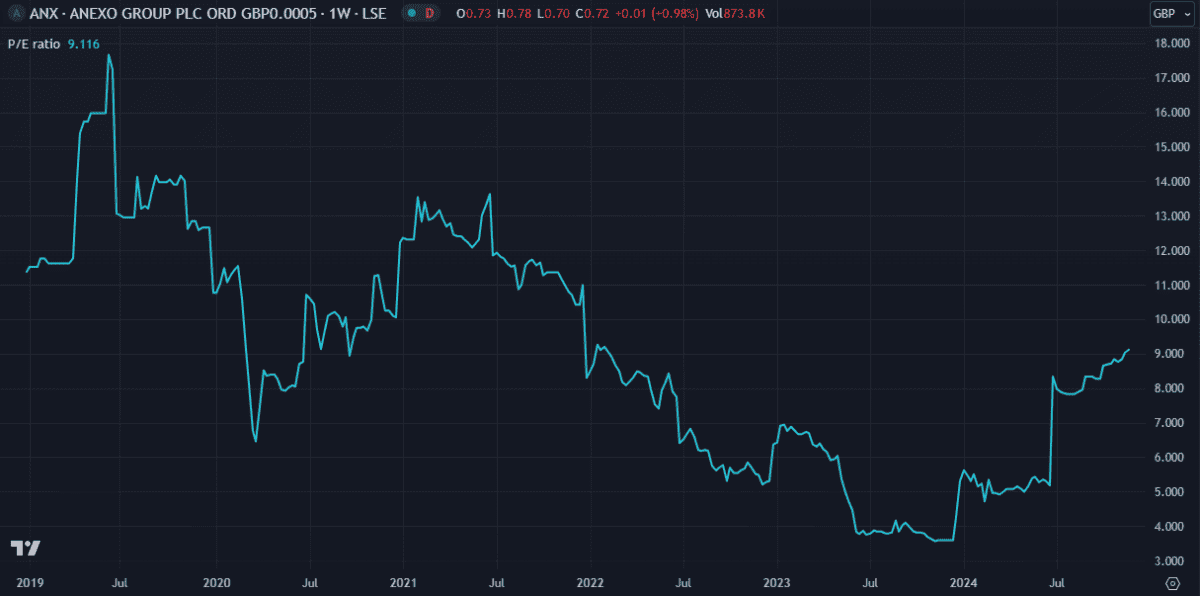

Anexo seems to tick all the boxes. Its price-to-earnings (P/E) ratio of 9 is way below the UK Consumer Services industry average of 36.1. Plus, it’s estimated to be trading at 61.4% below fair value, using a discounted cash flow model.

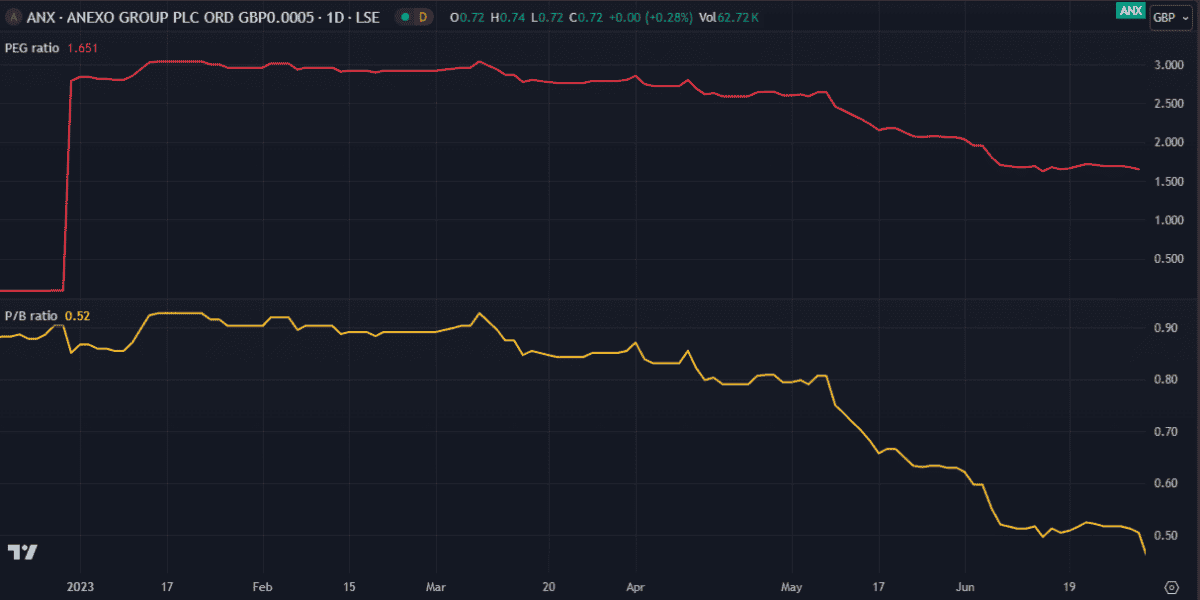

But most notable is the low price-to-book (P/B) ratio of 0.52 and the even more impressive price-to-earnings growth (PEG) ratio of 0.16. I seldom see both of these figures below 1. Earnings are also forecast to double by the end of next year, growing at a rate of 44.8%.

With all these factors combined, analysts offer an average 12-month price target of £2.58 — an increase of 112% from today’s price.

Financials

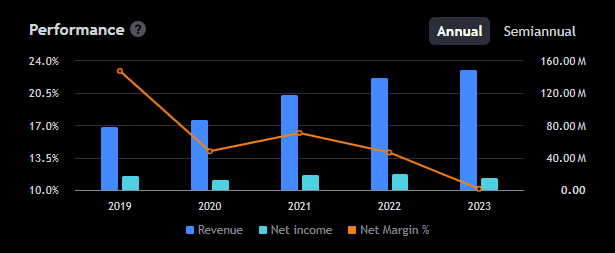

Revenue increased 8% between 2022 and 2023, with operating profit up 30%. But adjusted earnings per share (EPS) fell 22.4% and debt saw a 7.1% rise. Still, the share price reacted well, gaining 12% that month.

It’s been a volatile year since, with prices fluctuating between 6.5p and 7.5p. June and July saw losses but a recovery kicked in again after the first-half results announced on 20 August.

For H1 2024, revenue declined 11.7% and earnings per share (EPS) fell a further 57%, to 8.6p. Pre-tax profit declined 61.2% while net debt increased 10.9%. Some off the losses were attributed to costs related to a legal settlement. This is a slight concern as it could risk further losses if similar issues recur.

Yet despite the weak performance, the share price has increased 20.7% since. The shares are now up a total of 27% in the past year.

Balance sheet

Anexo has a fairly clean balance sheet although it may lack sufficient debt coverage. Operating cash flow’s only 11% of debt and its interest coverage ratio’s only 1.8. Ideally, these numbers should be higher to ensure no issues arise if cash flows are suddenly reduced.

Overall, the stock looks like it has great value. This may be one reason the share price is rising despite weak revenue and earnings. If it were a well-established FTSE 100 firm, it would probably attract significant attention.

But penny stocks are inherently risky and prices can fall at the drop of a hat. A highly risk-averse investor looking for a hidden gem may consider it an excellent opportunity — and there’s a good chance they’d be right!

But with today’s shaky economy, my risk appetite’s low so I don’t plan to buy any more penny stocks today. However, I’ll be interested to see how its full-year results turn out next February.