After reinstating dividends earlier this year, Rolls-Royce (LSE: RR.) shares have recaptured some of their old charm. And just in time, as growth appears to be tapering off.

I’m now wondering whether 2025 can continue to deliver the same exceptional returns of the past two years. Up almost 500% since November 2023, it’s hard to imagine that kind of growth will be repeated.

There’s been a notable dip in the UK market since the October budget was announced, further fuelled by trade fears following the US election.

Rolls-Royce appears to have taken a harder hit than most. The stock’s down around 8% since the US election result was announced, while the FTSE 100‘s slipped less than 1%. Fellow aerospace and defence giant BAE Systems is down 3.5%.

Forecasts for 2025 and 2026

In August, Rolls-Royce shares soared 8.9% after the company announced plans to payout 30% of underlying pretax profit as dividends for 2024. It further plans to increase this to between 30% and 40% thereafter.

The final dividend for 2024’s expected to be 5p per share, representing a yield of around 1%. This is forecast to rise to 6p in 2025 and 8p in 2026, with yields of around 1.2% and 1.5% respectively.

Earnings per share (EPS) is expected to come in at 18p per share this year, rising to 20p in 2025 and 23p in 2026.

With an expectation of further earnings growth, the company’s price-to-earnings (P/E) ratio will likely drop to 26.4 next year and 22.9 in 2026. Earnings are forecast to rise 22.4% in 2025 and 20.6% in 2026.

Mitigating factors

There are, of course, some factors that could derail these forecasts. Specifically, the escalating conflict between Russia and Ukraine that’s now threatening wider Europe.

As a producer of engines for military aircraft, Rolls is intrinsically linked to the conflict. Subsequently, defence spending has been a key driver of its growth in the past few years. But it’s a double-edged sword. The conflict has led to a myriad of problems for European businesses, from supply chain issues to rising energy costs. These costs could eat into profits for the company.

A delay in the supply of materials and components used in its factories could impact production, reducing sales and pushing up operational costs. And a significant escalation in the conflict could topple the economy into a recession, hurting its share price.

A sobering outlook

The reintroduction of dividends may have initially helped boost the share price but the past month has seen a 6.6% decline. While there is an expectation of moderate earnings growth, I don’t expect to see the same performance as previous years.

If the company can successfully navigate the challenges posed by the war in Ukraine, long-term prospects still look good. If dividends continue to increase as forecast, they will add notable value in a few years time.

However, I expect short-term returns will be disappointing compared to 2023 and 2024.

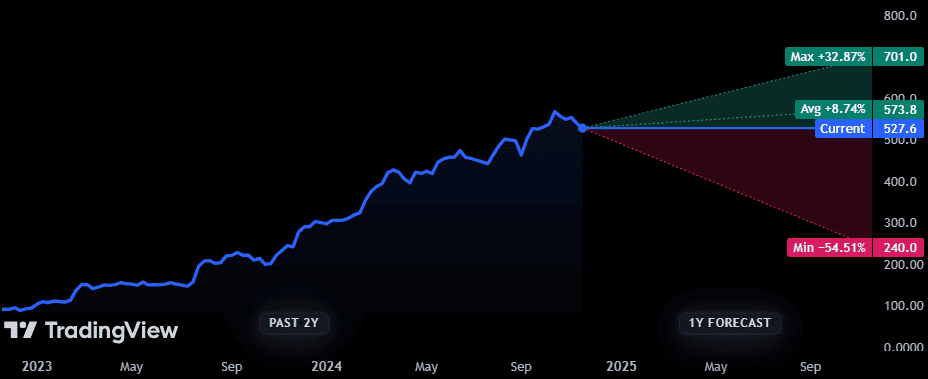

While UBS, JPMorgan and Goldman Sachs all maintain Buy ratings on the stock, price forecasts aren’t exactly inspiring. The average 12-month price target is £5.73, an underwhelming 8.74% rise from current levels.

I might consider the shares in future, but right now, they’re not high on my list.