The Individual Savings Account (ISA) is an excellent investment product, in my view.

With an annual allowance of £20,000, the Stocks and Shares ISA and Cash ISA meet the needs of most investors. With these tax wrappers, investors don’t pay a single penny in capital gains tax or dividend tax.

But while they’re good products, many investors make poor decisions when it comes to using their ISAs. Here are two mistakes I’m constantly seeking to avoid.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

1. Holding too much cash

It’s crucial that investors like me diversify across ‘risk on’ and ‘risk off’ assets.

Like many people, I do this by holding some of my capital in a savings account, and investing the rest in a variety of shares, trusts, and funds.

I can potentially get a better return with the stock market. But share investing can be volatile, and the value of my holdings could potentially sink. This is where the safe savings account comes in — my money is protected, and I can make a guaranteed return.

There’s no correct answer as to how much to hold in cash versus in stocks. This is a personal choice depending on one’s investing goals and risk tolerance. But I’m an ambitious investor, and worry about making poor returns by alloting too much capital in a savings account.

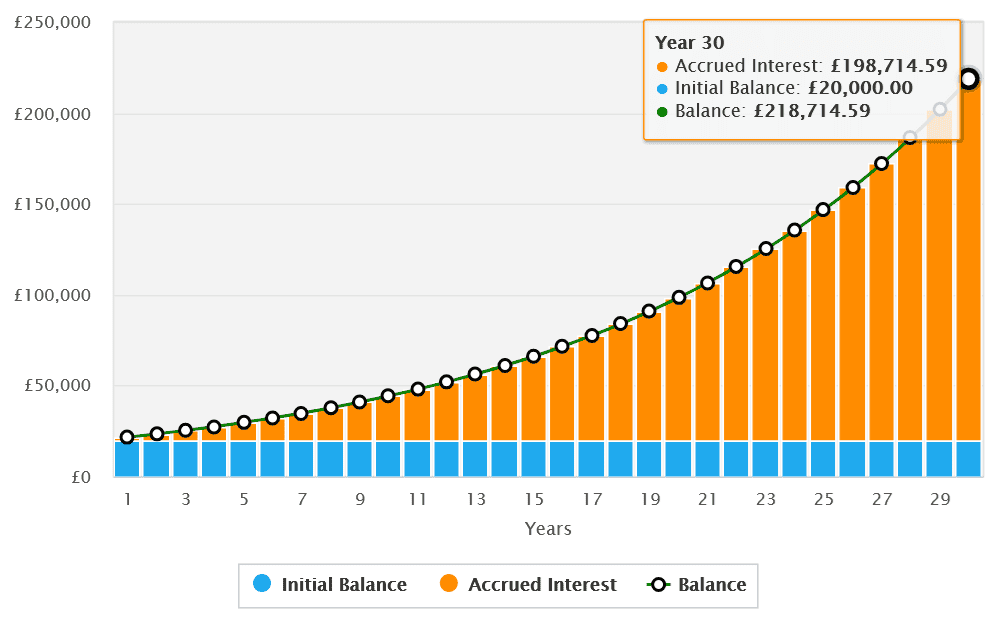

My money might be safe in a 4%-yielding cash account. But after 30 years, a £20,000 lump sum investment would turn into just £66,270.

By comparison, an 8%-returning basket of shares could make me more than three times as much (£218,715). This is why I constantly monitor my portfolio to check I’ve got the balance right.

2. Owning too few shares

Diversifying my stocks portfolio across a number of shares is another important concept for ISA investors. Failure to do this raises risk. It also limits my exposure to different investment opportunities.

A portfolio holding just two or three shares, for instance, could crash in the event of a single disappointing trading update.

I own roughly 10 to 15 individual shares across multiple sectors in my own portfolio. I also own several exchange-traded funds (ETFs).

Funds like this let me invest in dozens, even thousands, of underlying assets. And I only get charged a single transaction fee when I put in a buy order. Conversely, if I purchased each individual stock I’d pay a broker fee on each one.

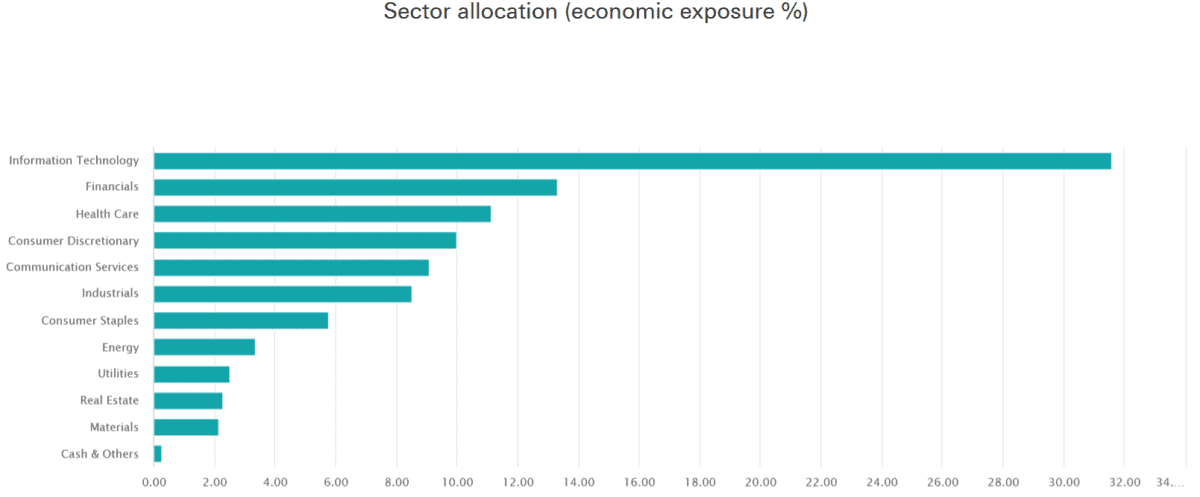

The HSBC S&P 500 ETF (LSE:HSPX) is one such fund I currently own. As the name implies, it spreads my investment across the entire S&P 500, which in turn diversifies my holdings across many companies and industries.

What’s more, its focus on large-cap multinational companies reduces my risk still further by providing exposure to different regions.

The past is not a reliable indicator of future returns. But the fund has delivered an average annual return of 13% over the last decade. This is the sort of figure that could supercharge my long-term wealth.

On the downside, the fund is likely to deliver a disappointing return during temporary economic downturns. But I’m confident it will be a great wealth creator for me over a few decades, driven by the strong US economy and 21st century technology boom.