I’ve held the Fundsmith Equity investment fund in my Self-Invested Personal Pension (SIPP) for many years. And over the long run, it’s made me quite a bit of money. However, the fund’s been underperforming the broader market. This has got me wondering whether I should dump it and buy a S&P 500 tracker fund instead.

Underperforming the market

It has been a while since Fundsmith beat the market on an annual basis. The last time was in 2020 when it returned 18.3% versus 12.3% for the MSCI World index.

I’ve put the returns since then in the table below. As you can see, it’s lagged the MSCI World index significantly since 2022.

| Year | Fundsmith | MSCI World index |

| 2021 | 22.1% | 22.9% |

| 2022 | -13.8% | -7.8% |

| 2023 | 12.4% | 16.8% |

| Jan to Oct 2024 | 6.9% | 15.5% |

This underperformance is disappointing. Especially when you consider the fund has ongoing charges of 0.94% on Hargreaves Lansdown (my broker).

The problem

The issue here’s pretty clear – Fundsmith’s an underweight mega-cap technology stocks and this is hurting its performance. In recent years, these stocks have generated huge returns. And Fundsmith hasn’t fully participated in the rally.

It does have large positions in Microsoft and Meta Platforms, has a growing position in Alphabet and a small holding in Apple. But it doesn’t have exposure to Amazon (it did buy this stock a few years ago but sold it at the wrong time), Nvidia, or Tesla.

More tech exposure

Buying an S&P 500 tracker fund like the Vanguard S&P 500 UCITS ETF (LSE: VUSA) would solve this issue.

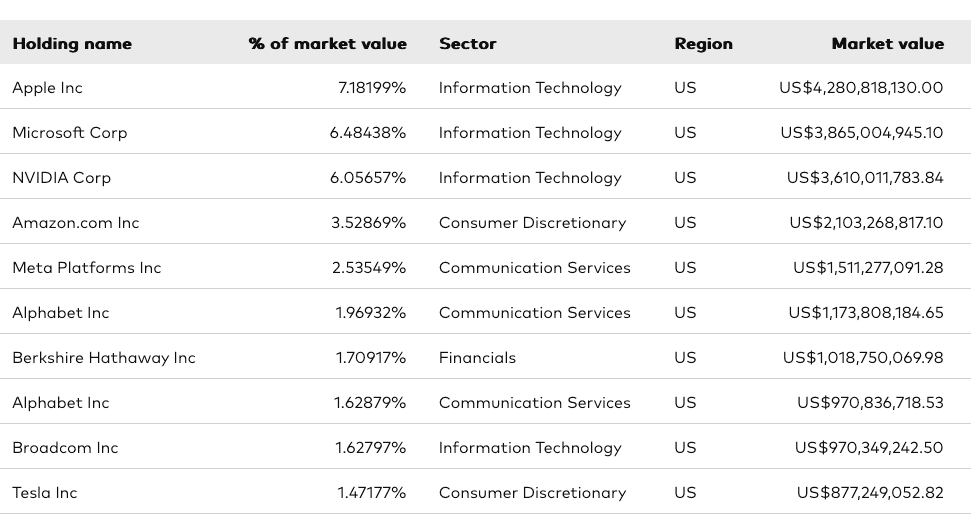

This product would give me a ton of exposure to mega-cap tech stocks such as Apple, Nvidia and Amazon as these kinds of stocks have large weightings in the S&P 500, as the table below shows:

Source: Vanguard

And I’d get them all for a low ongoing fee of just 0.07%. Additionally, my platform fees with Hargreaves Lansdown would be lower.

New risks

Having said that, buying this ETF would expose me to new risks. For starters, there would be more geographic risk. With an S&P 500 tracker, 100% of the product’s allocated to the US market. With Fundsmith – which is a global equity product – the US represents about 73% of the portfolio currently.

It’s worth noting here that the US market has had a huge run over the last two years and it now looks quite expensive. So there’s a chance we could see some volatility at some point in the near future.

There would also be more technology sector risk for me. I already own shares in five of the ‘Magnificent 7’ directly, so if I were to buy this ETF, my portfolio could take a big hit if the tech sector had a meltdown (which seems to happen every few years).

In theory, holding on to Fundsmith should provide me with some protection against a US market or Tech sector meltdown. But there are no guarantees here, of course.

My move now

For now, I’m going to hold on to Fundsmith. I like the fund’s focus on quality stocks and I see it as a good hedge against mainstream market risks.

That said, I will be watching the performance closely. For the fees I’m paying, it needs to start delivering again.