These FTSE 250 shares look dirt cheap, on paper. Here’s why I think investors should give them serious consideration.

Hochschild Mining

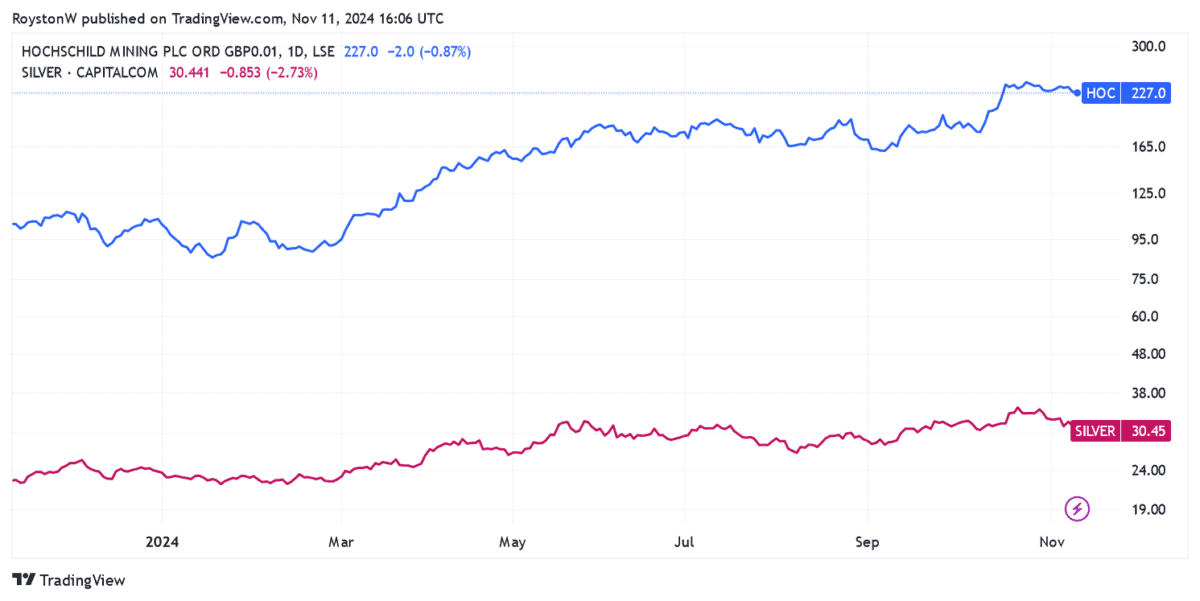

Silver stocks across the globe have soared in value amid exploding demand for the precious metal. At 227p per share, Hochschild Mining (LSE:HOC) for instance is up 41% over the past six months.

But rising metal demand’s only half the story. You see, silver’s up by a more modest 9% over the same period.

Hochschild’s outperformance reflects a steady string of impressive production updates this year. Its latest statement in October showed silver and gold production up 4% and 21% respectively during the third quarter.

This was the strongest third-quarter performance for five years. It reflects successful ramping up of production at Hochschild’s Mara Rosa gold mine in Brazil, along with ongoing improvement work at the Inmaculada flagship project in Peru.

Things are looking good for the firm as silver demand heats up. Safe-haven sales are rising as interest rate cuts fuel inflation, and geopolitical uncertainty rises following this month’s US election. Silver consumption could also rise for industrial applications as the global economy improves.

Yet despite recent price gains, Hochschild shares still look dirt cheap to me. For 2025, they trade on a price-to-earnings (P/E) ratio of just 6.2 times.

Furthermore, the South American miner also deals on a forward price-to-earnings growth (PEG) multiple of 0.1. Any reading below 1 implies that a share is undervalued.

Commodity prices are notoriously volatile. And a sharp silver retracement could play havoc with Hochschild’s revenues. But on balance, I think it’s an attractive stock to consider.

NCC Group

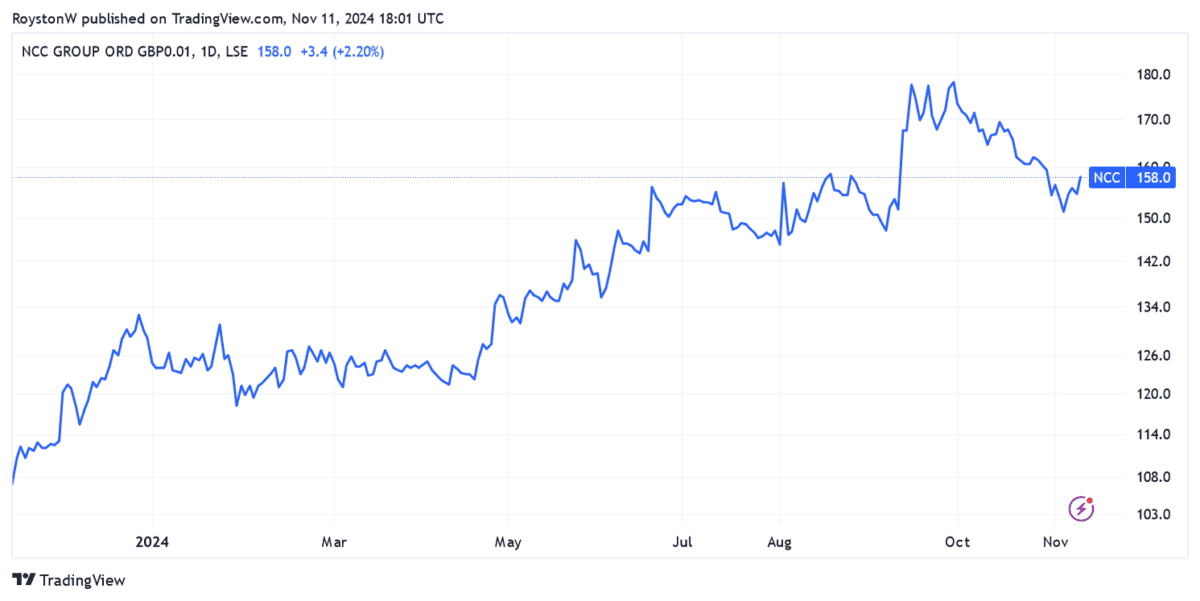

Like many tech stocks, NCC Group (LSE:NCC) doesn’t look cheap, based on its prospective P/E ratio. This stands at a meaty 20.5 times, above the FTSE 250 average of 14.5 times.

However, a corresponding PEG multiple of 0.2 suggests the cybersecurity specialist is actually trading below value.

NCC shares have risen an impressive 17% in six months, to 158p per share. Business is recovering strongly following previous problems in the US tech sector. And a series of forecast-beating trading statements in 2024 have driven its shares higher.

Latest financials showed sales up 4% between June and September, at £104m. This helped NCC swing to an adjusted operating profit of £6m from a £1m loss a year earlier.

I think sales should keep rising too, driven by a blend of falling interest rates and the growing prevalence of cyber threats facing companies.

I’m also encouraged by the direction of NCC’s gross margins, which improved 200 basis points to 41.4% in the 12 months to May. This reflected successful restructuring efforts and a better product mix as managed services sales increased.

NCC has a market-cap of £486m. But it’s a small fish compared with US rivals like Palo Alto and Crowdstrike. These businesses have significantly higher R&D budgets and better brand recognition, and therefore pose a large threat.

But the rate of market growth suggests NCC may still be a great stock to consider. And especially at current prices.