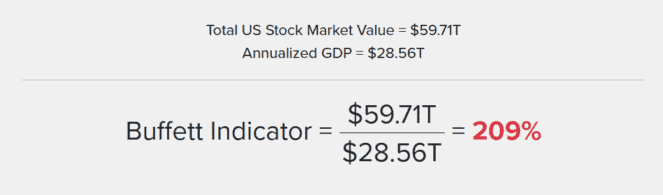

Named after billionaire investor Warren Buffett, the ‘Buffett Indicator’ is a market valuation metric that divides the total market-cap of US stocks by the country’s GDP. Often viewed as one of the best single market valuation indicators, the metric traditionally flashes warning signs when it surpasses 100%.

Recently, it’s climbed to a staggering 209%. This figure is well above the historical average, indicating that stocks are highly overvalued relative to the economy.

The current level has spurred speculation that the stock market is entering bubble territory. When valuations are this high, it often signals future downturns as the gap between stock prices and economic fundamentals grows.

The last time the Buffett Indicator reached such highs was in the lead up to the dot-com crash in 2000 and, more recently, before the pandemic-driven downturn in 2020.

Adding to this, Buffett’s Berkshire Hathaway fund has recently sold large portions of its portfolio. The company reportedly holds $325bn in cash — an unusually high amount even by its standards. This move suggests it may be preparing for a potential correction, as Buffett has famously advised against overvalued markets.

The decision to sell rather than buy reflects his cautious approach, particularly given ongoing concerns about high interest rates and uncertain economic growth.

What to do in a market downturn

For individual investors, the temptation might be to follow Buffett’s lead by trimming overvalued stocks or reallocating to less risky assets. While a market crash is never certain, high valuations are a good time to evaluate a portfolio.

Holding some cash or diversifying into defensive sectors could provide stability if a downturn hits in 2025. Paying attention to valuation signals and preparing for increased volatility is a prudent approach amid current market dynamics.

For UK investors, several defensive FTSE stocks have historically shown resilience during economic downturns. One of my favourites is data analytics firm RELX (LSE: REL).

As a global provider of information-based analytics, it has a strong foothold in legal, scientific and risk markets. It has a diversified revenue stream and a recurring subscription-based model, so it’s often seen as a stable, cash-generative company.

Over the past 30 years the share price has increased at an average rate of 7.36% a year.

Pros and cons

It may be defensive, but RELX still faces risks tied to economic cycles and regulatory changes. A slowdown in legal or financial services could impact its business segments.

A recent focus on artificial intelligence (AI) and analytics has strengthened its competitive edge, enhancing its digital offer and data services. But competition is also intensifying as digital and AI-driven analytics become standard in the industry.

Recent stock performance has been positive but macroeconomic challenges, like inflation and interest rate hikes, could weigh on future growth.

Strong growth means it now has a relatively high valuation with a price-to-earnings (P/E) ratio of 36. This makes it susceptible to a pullback if growth slows. Still, its profit margin is good at around 20% and it has a high return on equity (ROE) of 56%, indicating efficient capital usage.

Although it has a low yield of only 1.64%, dividends are reliable and reveal a commitment to shareholder returns. In volatile times, I think it is worth considering as a stock that could add stability to a portfolio.