It has been another knockout month for shareholders in aeronautical engineer Rolls-Royce (LSE: RR). Rolls-Royce shares hit a new high and are now up around 83% so far in 2024, after having been the FTSE 100 index’s best performer last year.

This means that over five years, the shares have moved up 120% in price.

I do not own them at the moment and have missed out on the latest surge.

Given the momentum we have seen recently, ought I to add them into my portfolio as we head into November?

Investor enthusiasm continues apace

Some investors do make choices based just on momentum. But in the stock market as elsewhere, it is not the case that simply because things have been going up, they will continue to do so.

While the business has improved its performance in the past several years, I do feel that a lot of the meteoric rise in the price of Rolls-Royce shares reflects investor enthusiasm.

That can be a dangerous thing as if it shifts (something that can happen overnight), it could mean the shares lose some of their support, potentially leading to a price fall.

Business is doing well and may do better

The company has been doing well from a sales perspective. At the half-year point, revenue was 18% higher than in the prior year period.

That means revenues are now on track to surpass where they were before the pandemic, which brought about a very challenging several years for the business.

Created using TradingView

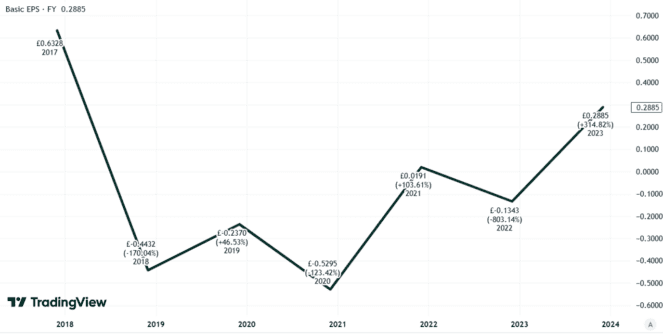

At the bottom line though, pre-tax profits actually slid slightly in the first half. Basic earnings per share fell a bit more to 13.7p for the six months under review compared to 14.7p for the same period last year.

Basic earnings per share have been volatile in recent years.

Created using TradingView

The company has set ambitious goals but is focusing more on operating profits. Those can be quite different to post-tax profits and basic earnings per share, due to non-operating costs such as interest.

Here’s why I’m not buying

From a valuation perspective too, many investors use a price-to-earnings (P/E) ratio that looks at earnings per share.

At the moment, Rolls-Royce shares are trading on a P/E ratio of around 20. I regard that as fully priced.

Valuations tread a fine line between current performance (which is knowable) and future performance (which is not knowable, but can be estimated). I feel the increase in the price of Rolls-Royce shares reflects current business performance, but also a large amount of expected value thanks to future performance.

The business has the wind in its sails. It benefits from an installed customer base, strong demand, well-known brand, high barriers to entry in its market and also technical expertise. But expectations about future performance, specifically whether Rolls can hit its ambitious medium-term targets, are only expectations for now.

At the current share price, I think there is little margin for error, should the company see sales fall due to circumstances it cannot control, such as a pandemic. So I will not be buying this November.