Legal & General Group‘s (LSE:LGEN) one of the FTSE 100‘s most cyclical shares. During economic downturns, profits can dive as consumers rein in non-essential spending. Difficult financial conditions can also bring down the value of the firm’s investments.

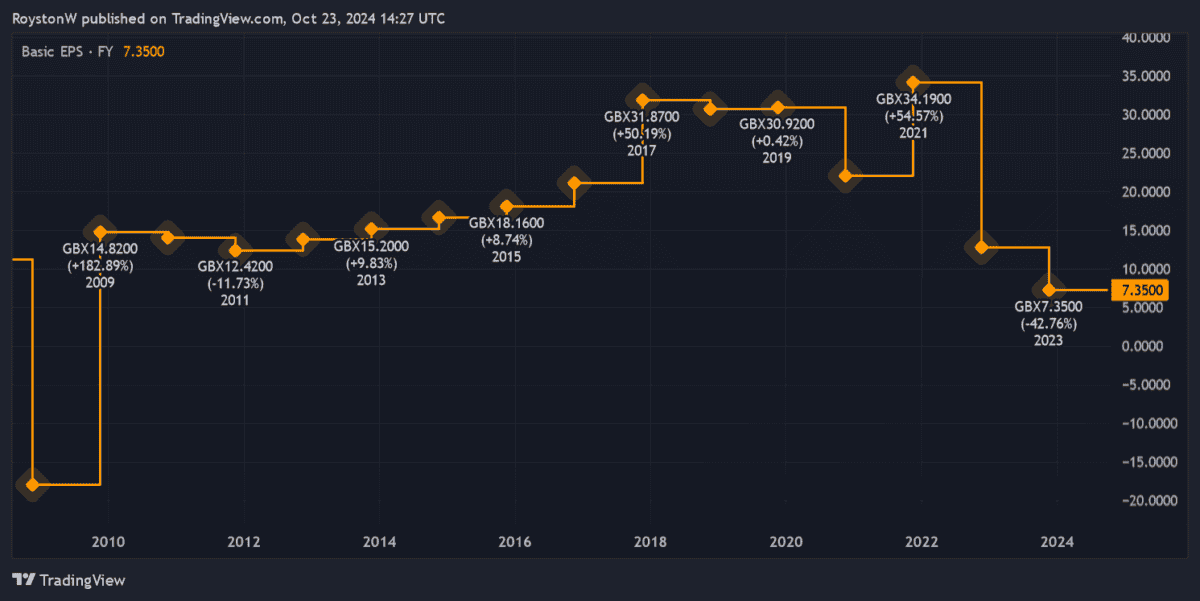

The financial services giant’s endured two heavy earnings falls in both of the last two years. Weak economic growth, high inflation and elevated interest rates in particular took big bites out of the company’s bottom line.

However, City analysts think earnings are about to experience a strong and sustained upturn. Their bright forecasts — which are supported by Legal & General’s plans for further share buybacks — can be seen below:

| Year | Earnings per share | Annual growth | Price-to-earnings (P/E) ratio |

|---|---|---|---|

| 2024 | 19.41p | 164% | 11.7 times |

| 2025 | 24.14p | 24% | 9.4 times |

| 2026 | 26.22p | 9% | 8.6 times |

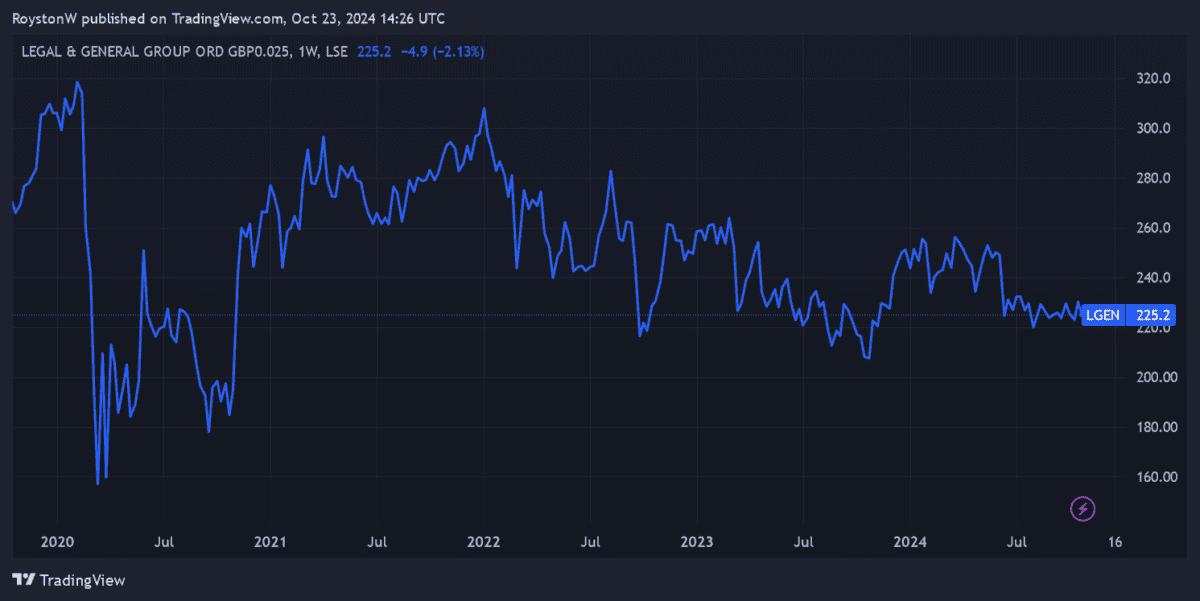

If forecasts are accurate, Legal & General’s flagging share price could be about to march significantly higher again. Over the past five year’s it’s dropped around 17%.

So how realistic are current profits estimates? And should I buy Legal & General shares for my portfolio today?

The bull case

Company profits only improved marginally during the first half of 2024. But an improving UK economy, falling inflation, and an anticipated drop in interest rates are tipped to light a fire under earnings from this point.

The Bank of England cut rates in August and is tipped to introduce several more over the next year.

Legal & General’s also benefitting from an improving bulk annuity market. The UK Pension Risk Transfer (PRT) market stood at record levels last year and — according to Hargreaves Lansdown analyst Matt Britzman — will remain “a medium-term driver of growth as pension plans look to shift their liabilities to insurance giants“.

Personally, I’m expecting demand for all of its financial products to rise over the long term, driven by demographic factors. As the number of elderly citizens grow across its markets, so should sales of its pensions, life insurance and wealth products.

The bear case

The City’s bright earnings forecasts reflect expectations of falling inflation and improving economic growth. But of course these events are by no means guaranteed.

China’s economy remains weak, and the US is still flirting with recession. Deteriorating conditions in either country could blow global growth off course. Meanwhile, a full-out war in the Middle East could drive inflation higher again and limit future interest rate cuts.

There’s also risk attributed to Legal & General’s plans to streamline its asset management division. It hopes restructuring will give performance a long-overdue push, but poor execution could cause more problems than it solves.

The verdict

While there’s clear risk, I think there’s a good chance Legal & General will stage a strong earnings recovery over the next few years. And this could lift its share price sharply from current levels.

And given the cheapness of its shares — the firm trades on a forward price-to-earnings growth (PEG) ratio of just 0.1 — I’m tempted to increase my current stake. Any reading below 1 suggests a share is undervalued relative to predicted earnings.

With a 9.4% dividend yield too, I think it’s a great value stock that’s worth further research by growth and income investors.