The Legal & General (LSE:LGEN) share price has fallen almost 20% over the last five years. But it’s worth noting the dividend means investors who bought the stock in 2019 are still up.

With a 9.3% dividend yield, the stock looks like a terrific passive income opportunity. But analysts don’t think it’s going to be around for long.

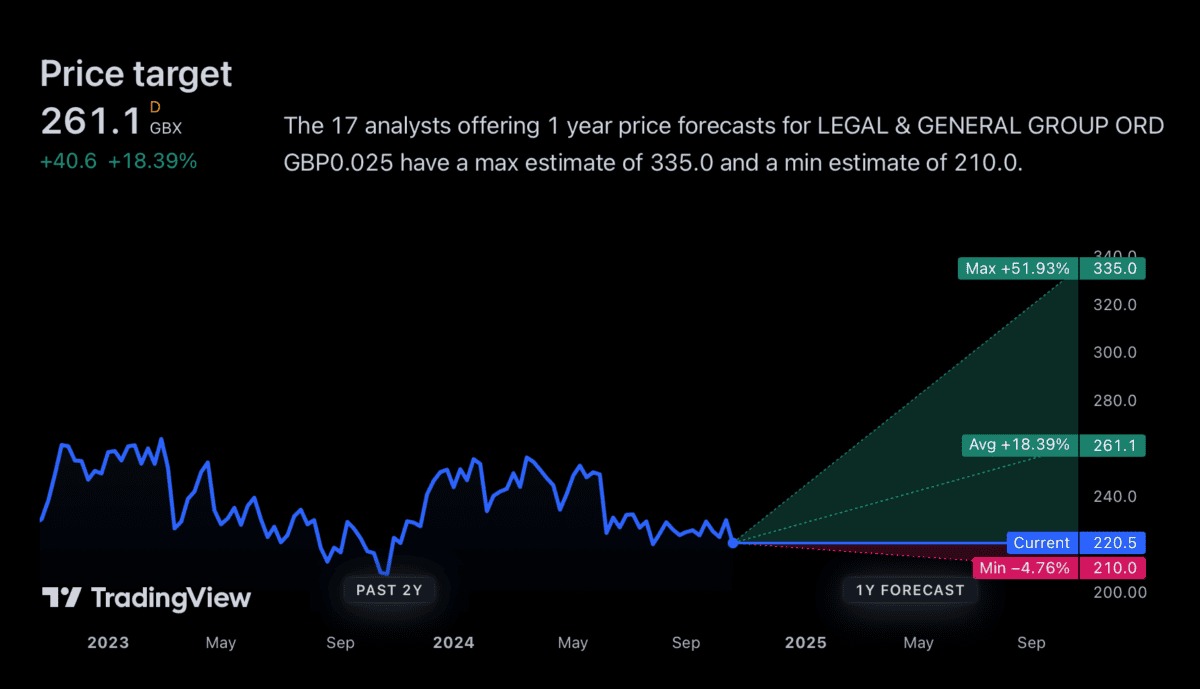

Analyst price targets

As I write this, Legal & General shares are trading at £2.20. But the average analyst price target is £2.61 and the most optimistic is £3.35 – a clear 51% higher than the current level.

Should you invest £1,000 in Central Asia Metals Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Central Asia Metals Plc made the list?

Created at TradingView

Even the lowest is only 4.75% below the current share price. So it seems reasonably clear that analysts have an optimistic outlook for the company.

By itself, that’s not enough to make me want to buy the stock. But it does give me reason to take a closer look and see whether there’s something that appeals to me here. As I see it, there could be a couple of significant challenges ahead for the business. The big question is whether or not these are already reflected in the current share price.

Risks and rewards

Legal & General’s business involves taking on potential future liabilities in exchange for large payments. The question therefore isn’t whether there are risks, it’s how well-managed they are.

The company’s the UK market leader in pension risk transfers. In other words, businesses pay the firm up front to cover the future obligations of their pension schemes. This has been a source of substantial growth for Legal & General over the last few years. And there could be more opportunities in the US, where the firm has an established presence.

Those are reasons to be positive about the stock – and the dividend. But there are also two big issues that I think investors should consider before thinking about buying the stock.

Challenges

There’s a reason billionaire investor Warren Buffett’s kept Berkshire Hathaway out of this type of business. It’s that working out what premium to charge involves trying to forecast a long way into the future.

Unlike car insurance – where policies typically last a year – there’s a lot of time for things to go wrong with an annuity. And it can result in significant losses when they do.

To offset this, the likes of Legal & General have to try and generate enough income using the premiums they receive. And that brings me to the second issue – this is getting harder.

Falling interest rates mean bond yields are going down. And I expect this to continue next year, presenting a challenge for insurers looking to invest their premiums at decent rates.

Is this a buying opportunity?

There’s a positive side to rising interest rates – the value of the bonds Legal & General holds should increase. And analysts clearly believe the market’s overestimating the future challenges.

They might be right, but I don’t think this is at all obvious. Even for passive income investors, I think there are better opportunities to consider elsewhere.