Every investor has shares they kick themselves for not buying years ago. For me, RELX (LSE: REL) is one of those. The FTSE 100 stock is up 96% in five years and around 281% over a decade (excluding dividends).

RELX’s performance so far this year? Up 16.7%, outpacing the Footsie once again.

What it does

With a market cap of £67bn, RELX is the UK’s fifth-largest listed company. It’s bigger than household names like Lloyds and Rolls-Royce, yet gets a fraction of the financial media coverage.

Of course, its name isn’t on high street banks or engines powering the planes we travel on. So it largely flies under the radar, despite being the FTSE 100’s best-performing stock EVER(!).

What does it do? Well, the firm provides data analytics services that are deeply embedded across a broad range of industries.

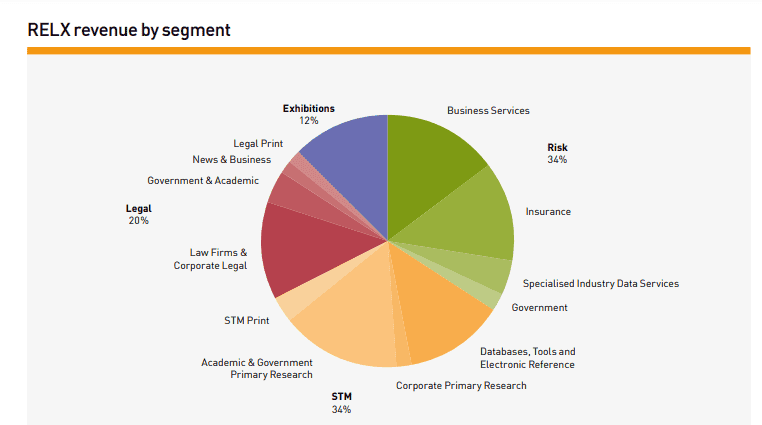

It operates through four main divisions:

- Scientific, Technical & Medical (STM) provides research information for scientists and healthcare professionals. This includes British medical journal, The Lancet.

- Risk offers data-driven solutions to help banks and insurers manage risk and prevent digital fraud.

- Legal provides tools for legal research, primarily centred around LexisNexis.

- Exhibitions organises trade shows and some of the world’s largest pop culture events.

2024 is chugging along nicely

Today (24 October), RELX released an encouraging trading update. It reported 7% underlying revenue growth in the first nine months of the year, with improvement across all four divisions.

Its Exhibitions unit was the standout performer, up 13%, while Risk (now the biggest division) grew 8%. Revenue increased 7% for Legal and 4% at STM.

For the full year, management expects strong underlying growth in revenue and earnings. According to forecasts, we’re looking at revenue increasing by around 4%-5%, to £9.54bn, with earnings growing at a faster pace.

The stock has responded positively, rising 1% to 3,625p, as I write.

Attractive features

As an investor, I find the company’s diverse end markets very attractive. It helps lawyers, doctors, bankers, scientists, and more. This gives it tremendous optionality for growth.

Meanwhile, an increasing amount of revenue is subscription-based and therefore recurring, providing a solid base for the business to keep growing through to 2030.

I also like that there’s a nice balance to the overall revenue mix, as we can see below.

That said, this is a data company, so could become a target for cyberattacks. Obviously, a security breach would cause reputational damage among customers.

Beyond this risk, the stock is valued highly at 27 times expected earnings per share for 2025. Any earnings slip-ups could cause the share price to dip sharply.

A data powerhouse

RELX has successfully transitioned from traditional print to the digital age and is well-positioned for the next tech revolution: artificial intelligence (AI).

The company’s vast, hard-to-replicate datasets give it a significant competitive advantage. By leveraging machine learning, it can create advanced insights and AI-driven services, enabling its customers to make quicker decisions.

For example, its new generative AI platform (Lexis+ AI) is like a legal-focused version of ChatGPT. It continues to grow in the US and was recently launched in more international markets.

To me, RELX looks well set up to continue thrashing the FTSE 100 at least until the end of the decade. As such, I think it’s finally time I bought some shares!