The Unilever (LSE:ULVR) share price has gone from £38.24 per share to £48.07. But analysts disagree on their outlook for the next 12 months with price targets widely ranging £38.84 to £56.94.

I think the company’s plans to restructure are extremely interesting. And I think 2025 could yield a big opportunity that’s currently hidden beneath the surface.

A crossroads

Unilever shares are at a crossroads. There’s no doubt 2024 has been a strong year for the company, but the stock’s trading at an unusually high price-to-earnings (P/E) multiple.

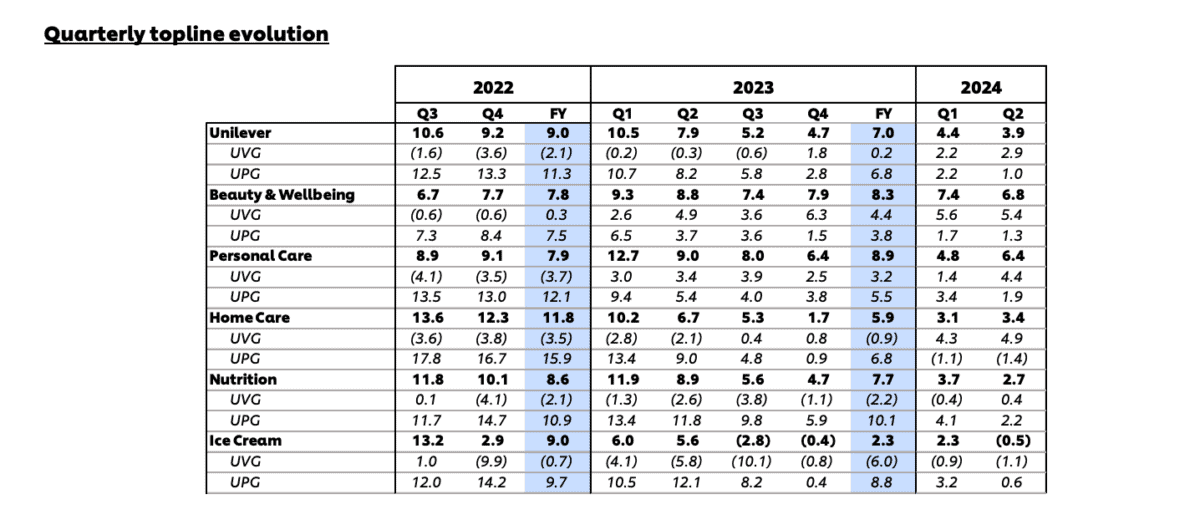

The highlight has been Beauty, where sales have grown over 7% during the first half of the year. Personal Care, Home Care, and Nutrition have also posted respectable results.

Source: Unilever pre-close aide-memoire Q3 2024

This isn’t what’s been pushing the stock higher though. Back in January, Unilever shares were trading at a P/E ratio of 17 and that’s increased to 21 today – a 23% rise.

That means the rising share price is largely due to investors paying higher prices. And the big question is whether the company’s sales can keep growing to justify the expanded multiple.

If they can, then the shares could have further to climb. But if revenue growth stalls, the P/E ratio at which investors are willing to buy the stock could fall, taking the share price with it.

A key catalyst

Which way Unilever will go from here is hard to forecast and I don’t think there’s much margin of safety for investors at the current share price. But I do see a potential opportunity here.

The company’s aiming to divest its ice cream business before the end of 2025. There are good reasons for this – its growth’s been relatively weak and it’s expensive to run.

Unilever might sell the unit to another business. But if it demerges its ice cream operations as a separate company – as it’s been suggesting – I think this could be very interesting.

If the ice cream business isn’t part of the FTSE 100, I’d expect a lot of selling when the stock hits the open market. A good amount of this should come from index funds that can’t hold it.

In this situation, I’d expect the stock to fall. And there could be an opportunity to buy shares in the new company at an unusually low price.

This has happened before

Last year, the business now known as Kellanova divested WK Kellogg. The remaining operations stayed as part of the S&P 500, but the cereal business didn’t.

As a result, the stock immediately fell 30% to just over $10 per share, implying a P/E ratio of 8. At that price, limited growth prospects become much less of an issue.

Since then, the stock’s up 70% and shareholders look set to collect a steady dividend. And I think something similar might happen with Unilever’s ice cream division in 2025.

I’m not saying I’d look to buy the divested ice cream company at any price. But I will be on the lookout for a potential bargain if institutions have to throw the stock out.

This is where my interest in Unilever is. The stock doesn’t jump out at me at today’s prices, but I’m looking for an opportunity in the ice cream business as things develop.