I’m searching for high-yield dividend shares to buy right now. I’m also looking to diversify my holdings by buying a big-paying exchange-traded fund (ETF).

Here are three such investments on my list today. As you can see, the dividend yields on these London Stock Exchange-listed instruments sail above a forward average of 3.6% for FTSE 100 shares.

| Dividend stock | Forward dividend yield |

|---|---|

| Greencoat UK Wind (LSE:UKW) | 7.6% |

| Invesco US High Yield Fallen Angels ETF (LSE:FAHY) | 6.7% |

Dividends are never guaranteed. But if forecasts are accurate, a £15k investment spread equally across these shares and this ETF would give me a £1,080 passive income in 2025.

Should you invest £1,000 in Glencore Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Glencore Plc made the list?

I’m confident, too, that dividends will march higher over the time. Here’s why I’d buy them if I had the cash on hand to invest today.

Greencoat UK Wind

Energy producers like Greencoat UK Wind are often considered some of the safest dividend stocks to buy.

Keeping turbines in good working order can be an expensive, earnings-damaging business. But companies like this also enjoy excellent profits visibility thanks to their ultra-defensive operations. This can make them more stable dividend payers than many other UK shares.

Electricity demand remains stable whatever economic, political, or social crisis comes along. And so Greencoat UK Wind, which produces power from 49 sites and sells it onto energy suppliers, enjoys a steady flow of income it can pay to its shareholders.

While dividends are never guaranteed, Greencoat’s vow to pay “an attractive and sustainable dividend that increases in line with RPI” has been in effect since its IPO a decade ago.

In fact, dividends in 2023 rose almost 30% year on year, soaring past retail price inflation (RPI) of 13.4%. Greencoat is able to keep this record up as the majority of its contracts are linked to either RPI or consumer price inflation (CPI).

Given the bright outlook for renewable energy demand, I think Greencoat UK could be a top dividend payer for years.

Invesco US High Yield Fallen Angels ETF

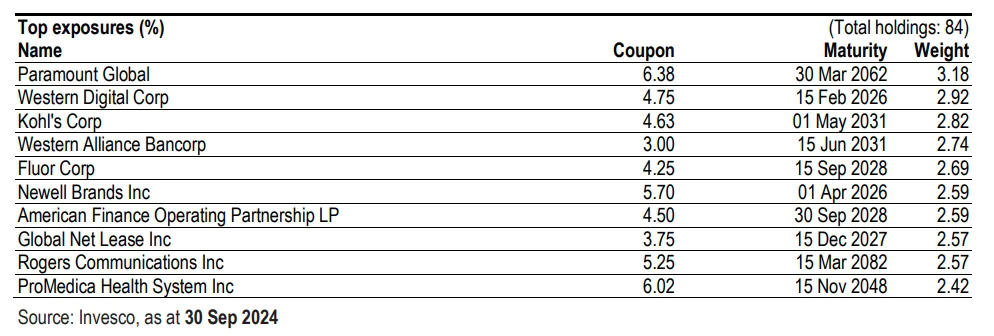

The Invesco US High Yield Fallen Angels ETF provides a way for investors to profit from the bond market. More specifically, it aims to measure “the performance of ‘Fallen Angels,’ bonds that were previously rated investment grade and were subsequently downgraded to high yield bonds”.

Around 85% of credit ratings on its corporate bonds are rated BB, with the remainder at B.

While ratings go much lower, these sub-investment-grade securities mean that investors are still exposed to a higher level of credit risk than other bond-holding funds. A downgraded rating is a sign of problems with the bond issuer’s underlying financial health.

However, with this greater risk comes the potential for greater reward. And in this case the dividend yield is a whisker away from 7%.

What’s more, the fund has an ongoing annual charge of 0.45%, which provides solid value. It’s another way I’d consider targeting a huge passive income next year.