Warren Buffett once said “whether we’re talking about socks or stocks, I like buying quality merchandise when it’s marked down“. I feel the same way about my Stocks and Shares ISA.

Anglo American (LSE:AAL) saw its stock fall by 4.5% this week. And that’s got me thinking about it as a potential investment.

Renewable energy

Like a lot of mining companies, Anglo American is attempting to shift its focus to commodities that will be useful in the transition to renewable energy. In this case, that means iron ore and copper.

In order to get to this point, the firm is looking to divest its diamond, coal, and platinum operations. This won’t be straightforward, but the business seems to be making good progress.

I like the look of Anglo American’s copper assets very much. According to data from Wood Mackenzie, the company has lower production costs than BHP, Glencore, or Antofagasta.

Since commodities businesses don’t set their own prices, a cost advantage is one of the most important advantages a firm can have. And that’s why I’m interested in the stock.

China

The stock has been falling this week, though. The main reason for this is the news that government stimulus in China might be lower than investors had been expecting.

Like a lot of mining companies, China is Anglo American’s largest market. The company generates around 30% of its sales in the world’s second-largest economy.

That makes the possibility of a prolonged downturn in the country’s industrial production a genuine risk with the stock. Exactly when it will recover is unclear and investors might have to wait a long time.

In my view, though, the latest drop in the share price means there’s now a margin of safety in the stock. That’s why I’m considering it for my Stocks and Shares ISA.

Margin of safety

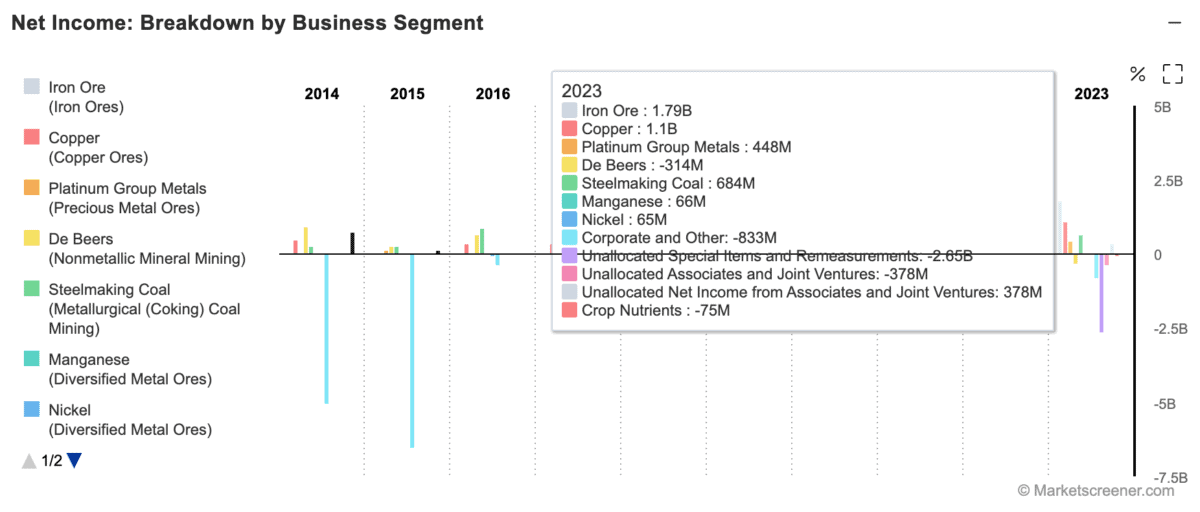

Anglo American currently has a market cap of £30.75bn. And in 2023, its iron ore and copper operations — the ones it intends to keep — generated £1.8bn and £1.1bn in profits, respectively.

Anglo American 2023 net income

Source: MarketScreener

This means the current share price implies a price-to-earnings (P/E) ratio of around 11 just for those assets, based on last year’s numbers. I think that looks like decent value.

That’s before getting into what the company might manage to generate by selling off its other divisions. Insofar as it can realise meaningful cash like this, that’s a bonus from my perspective.

Of course, this is based on the idea that the company can achieve something like its 2023 performance over the long term. That’s not guaranteed, but I think it’s highly possible.

A complicated value proposition

Anglo American isn’t the most straightforward investment proposition in the world. But I do think it’s one that has the potential to provide good rewards for shareholders.

Mining is a highly cyclical business, so whether this is one to hold forever is an open question. If the shares move higher after the company’s restructuring, I might take another look.

For now, though, I think there’s an opportunity here. That’s why I’m looking to make Anglo American part of my investment portfolio over the coming week.