Comparing yields is the most common way of identifying the best income stocks. The table below shows the current top 5 yielders on the FTSE 250.

| Stock | Yield (%) |

|---|---|

| Close Brothers Group | 17.76 |

| Ithaca Energy | 15.66 |

| Energean | 10.86 |

| NextEnergy Solar Fund | 10.57 |

| Burberry | 9.60 |

But which is the ‘best’? By best, I mean which is the one with the dividend that’s most likely to be sustained at this level?

Not what it seems

When examining yields it’s important to be cautious. The information presented in the table is based on amounts paid during the past 12 months.

However, we know that Close Brothers Group has suspended its payout. Dividends won’t be resumed until the Financial Conduct Authority concludes its investigation into the possible misselling of car finance.

And following disappointing sales in Asia, Burberry has also ceased paying a dividend. Recently relegated from the FTSE 100, the luxury fashion brand has issued a profit warning and changed its chief executive. It’s uncertain as to when it will resume its payout.

And then there were three

Of the remaining three, Energean, the Mediterranean energy (predominantly gas) producer, is the highest-yielding.

After listing in March 2018, it paid its first dividend of $0.30 a share in September 2019. Since then, it’s maintained the same amount for eight successive quarters.

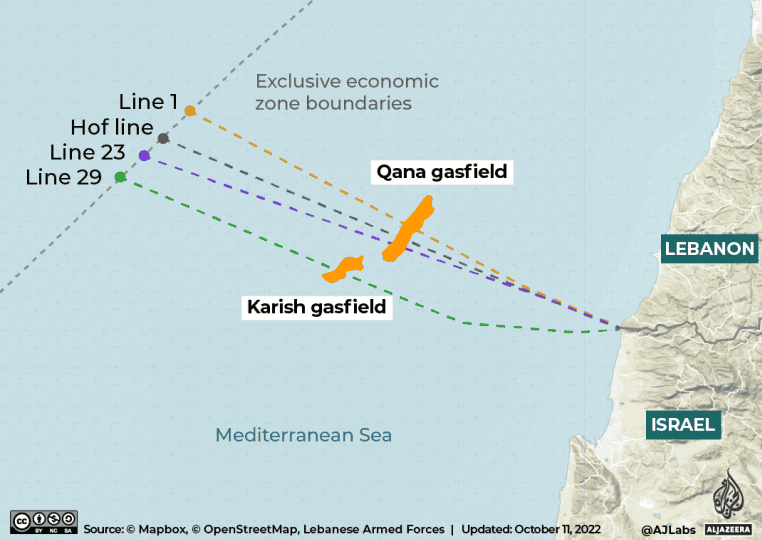

However, I wouldn’t want to invest at the moment. That’s because its Karish gas field, which accounts for approximately 70% of the group’s output, is located off the coasts of both Israel and Lebanon.

The current instability in the region makes me anxious about taking a position.

Ithaca Energy (LSE:ITH) is a North Sea oil and gas producer and faces an effective tax rate of 75% on its UK profits. And the government’s talking about increasing this further, which means its payout could come under pressure.

It’s only been listed since November 2022 meaning it doesn’t have a long track record on which to judge how sustainable its dividend is. However, as a result of falling energy prices, it’s already cut its first interim payout for the current financial year by 25%.

A deal to acquire most of the upstream assets of Eni is intended to reduce the group’s net debt, increase reserves, and improve its credit rating. But it requires regulatory approval and more shares to be issued. It’s therefore difficult to know what will happen to the yield. There’s too much uncertainty for me to invest.

A little ray of sunshine?

As its name suggests, NextEnergy Solar Fund (LSE:NESF) invests in renewable energy. At 30 June, it had enough capacity to power 300,000 homes.

The majority of its revenue is earned from long-term contracts that are linked to the retail prices index. It therefore offers a hedge against inflation. And with reasonably secure income streams, the fund has visibility over its future cash flows (and dividends).

Now could be a good time to consider taking a position. That’s because its shares currently trade at a 22% discount to its net asset value.

The closing of the gap in recent months – in March it was over 30% — suggests an increasing number of investors believe the fund offers good value. This could help push its share price higher.

I’d have to do more research before deciding whether to take a position but, at first glance, I think it offers the most reliable source of dividend income of the FTSE 250’s big five.