Recently, I examined the performance of the FTSE 100 over the last 20 years. I wanted to see how the UK’s blue-chip stock market index has performed over the long term.

Interested to know what kind of return the index generated over this period? Read on to find out.

My analysis

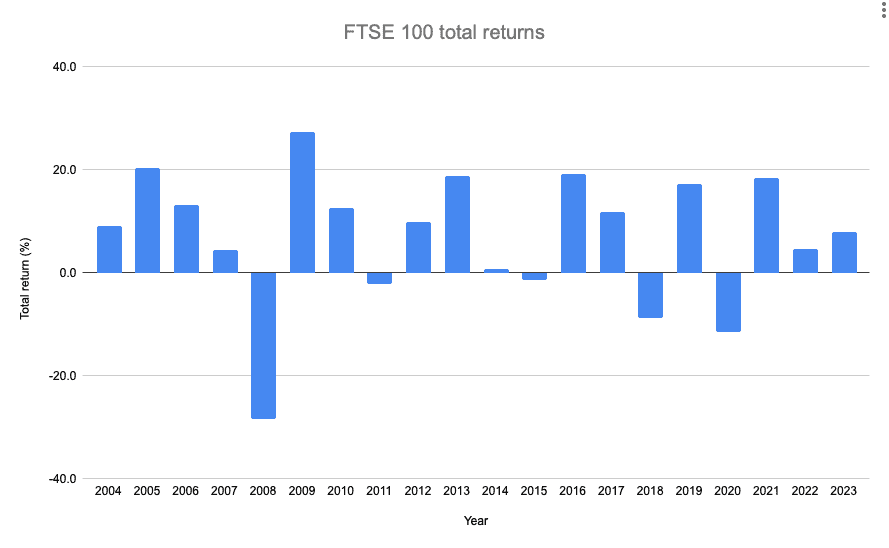

My analysis focused on the returns generated by the index over the past 20 calendar years. So my calculations don’t factor in the gains or dividends the index has generated in 2024 (the index rose 6.5% in the first nine months of the year).

And I focused on total return every year. This is gains plus dividends. It’s worth noting that with the FTSE 100, dividends are a major component of overall returns. Currently, the yield on the index is about 3.3%.

Average returns

Crunching the numbers, I found that over the 20-year period, the Footsie returned 241% in total. That equates to about 6.3% on an annualised basis.

Now, a 6.3% annualised return over 20 years isn’t a disaster. But let’s face it, it’s a bit underwhelming.

It’s often said that shares as an asset class tend to provide returns of around 7-10% a year over the long run. Well, the FTSE 100’s fallen short here over the last two decades.

Takeaways

For me, there are a couple of takeaways from this analysis. One is that when investing in shares, it’s crucial to build a diversified investment portfolio that includes more than just a FTSE 100 index fund.

If investors want to achieve returns of 7-10% a year from stocks, they need to have exposure to different areas of the market (eg US shares, small-caps, etc).

Another is that, with the Footsie, investors might be better off picking individual stocks within the index instead of owning the index as a whole. Because a lot of Footsie stocks have generated far higher returns for investors over the last 20 years.

A Footsie star

One example of a stock that’s done really well for investors over this period is food catering and support services company Compass Group (LSE: CPG). It has been a member of the FTSE 100 since 2001.

Over the 20-year period to the end of 2023, its share price rose about 430% (an annualised return of around 9%). Investors also received dividend yields of around 1-2% for most of this period, meaning that total returns were above 10% a year.

Of course, no one knew 20 years ago that this stock was going to provide such great long-term returns. But there were some clues that this company would turn out to be a good investment.

One was that it provides essential services (catering, cleaning, etc). Typically businesses require its services on an ongoing basis.

Another was that it has a high level of profitability (a high return on capital). Companies that are very profitable often turn out to be winning investments.

Now, I’m not saying investors should rush out and buy this stock today. Right now, its valuation’s quite high. Meanwhile, a slowing economy could slow its top and bottom-line growth.

But there are plenty of high-quality stocks in the Footsie that look attractive right now. And these could be worth considering as long-term investments.