The FTSE 100‘s enjoyed healthy gains in 2024 following years of underperformance. It’s up 7% since the turn of the year as investors have woken up to the compelling cheapness of UK shares.

There are various measures share pickers can use to recognise value. The price-to-earnings (P/E) ratio and dividend yield are a couple of popular ones. So is the price-to-book (P/B) ratio, which assesses a company’s share price relative to the value of its assets.

Based on these metrics, I think the following Footsie stocks could be worth considering as they’re very cheap.

Standard Chartered

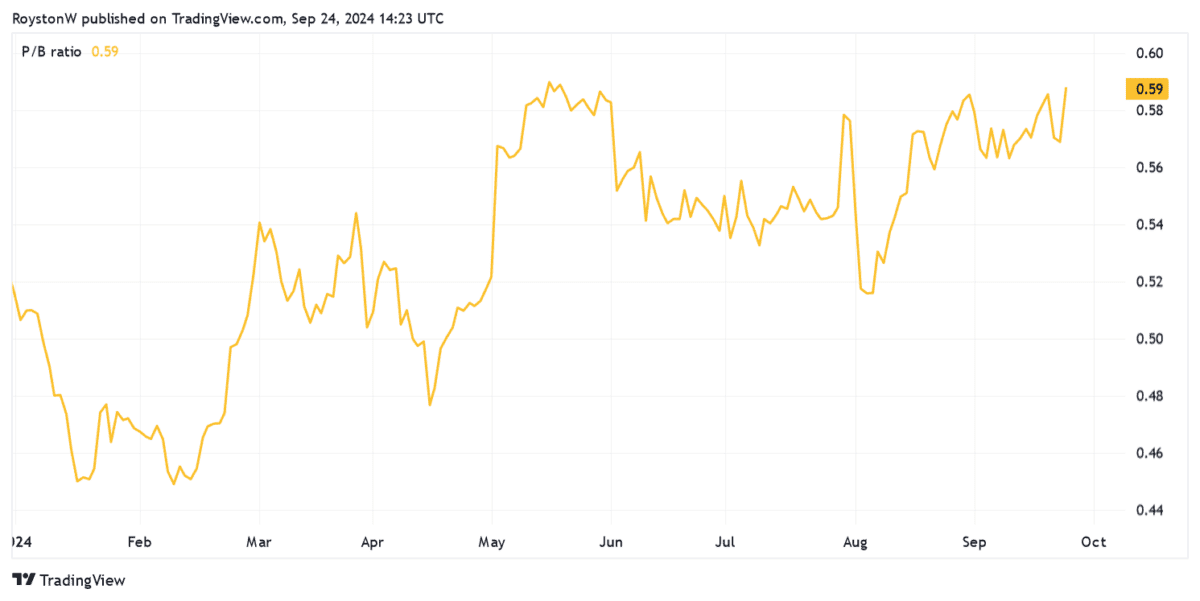

Standard Chartered (LSE:STAN) looks cheap across a variety of measures. Its P/B ratio of around 0.6 is well below the bargain watermark of 1, as the chart above shows.

The bank also offers excellent value relative to predicted earnings. An 81% earnings bounce is expected by City analysts in 2024. This results in a P/E ratio of 6.5 times.

Furthermore, StanChart’s price-to-earnings growth (PEG) ratio of 0.1 is also below the value benchmark of 1.

Like HSBC, it’s cheaper than other major Footsie banks due to its extensive exposure to China. Earnings are in danger as Asia’s largest economy — and in particular its ailing property sector — struggles for traction.

However, I believe StanChart’s low valuation already accounts for the challenges in China. On top of this, I’m encouraged by local lawmakers’ ongoing determination to avoid a major downturn, as the People’s Bank of China’s massive stimulus measures last week illustrate.

I think Standard Chartered could prove a top long-term pick to consider as wealth levels in its Asian and African markets steadily grow.

National Grid

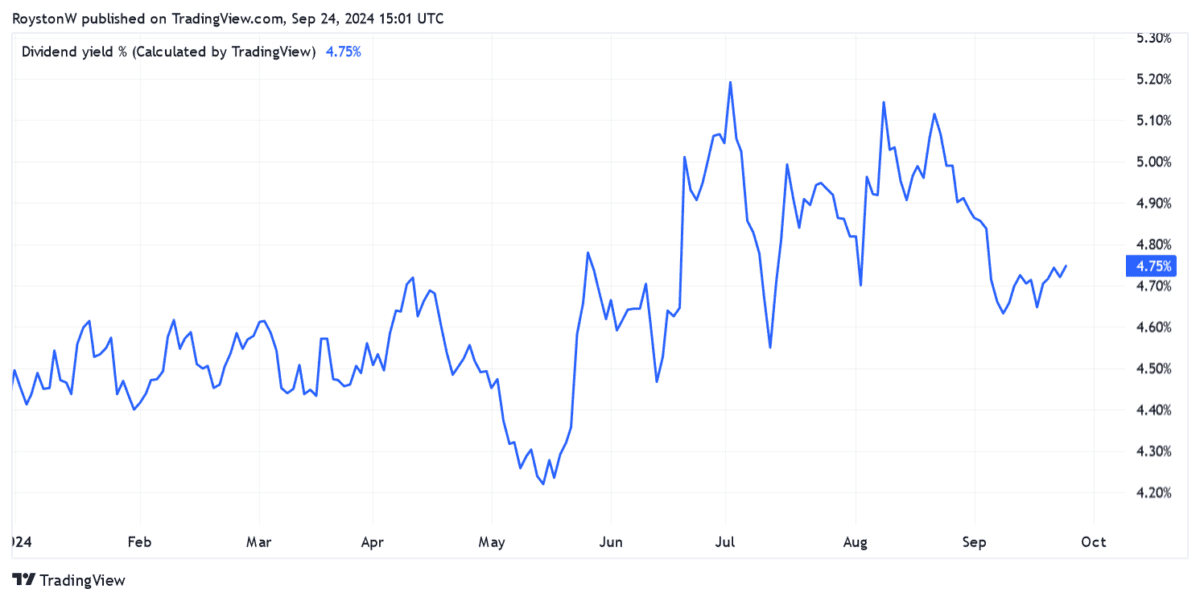

Even following this year’s dividend cut, the dividend yield on National Grid shares sits at a healthy 4.5%. This beats the FTSE 100 average by a full percentage point.

For the following two years (to March 2026 and 2027), the dividend yield marches closer to 5% too, with City analysts tipping an immediate return to dividend growth. Yields are 4.7% and 4.8% respectively.

National Grid slashed dividends this year following a rights issue to fund its infrastructure building programme. Further such action can’t be ruled out later on, and especially in light of the firm’s debt-loaded balance sheet.

However, I’m optimistic National Grid’s huge green energy investment will prove lucrative over the long term. Plans to grow its asset base by approximately 10% a year through to 2029 could deliver sustained profits (and consequently dividend) growth.

United Utilities Group

United Utilities looks cheap when it comes to predicted earnings and dividends, in my opinion. Its forward PEG ratio is 0.4, created by expectations of a 55% year on year earnings improvement.

Meanwhile, the FTSE firm’s dividend yield is an index-beating 4.8%.

Investing in water suppliers like this carries greater regulatory risk than usual. Complaints over customer charges, leaks, and environmental impact, mean that strict new rules from regulator Ofwat could be approaching.

However, a severe clamp down on the likes of United Utilities is yet to materialise. And such action isn’t tipped to come any time soon by industry commentators. I still think such water companies are attractive defensive shares to consider right now.