Shopping for ultra-cheap dividend stocks is a great pleasure of mine right now. Both the FTSE 100 and FTSE 250 indices are loaded with shares that are trading way, way below value.

Take Phoenix Group (LSE:PHNX) for instance. Not only does it look dirt cheap when it comes to predicted earnings. Its dividend yield’s approaching double-digit percentages.

Phoenix isn’t a household name like Legal & General or Aviva. But it certainly isn’t a minnow in the financial services sector, with a market capitalisation of £5.5bn.

The business — which offers savings and retirement products in the UK — has around 12m customers on its books. And right now, its shares look like a brilliant bargain to me.

Too cheap to ignore?

Its forward price-to-earnings (P/E) ratio of 12.2 times doesn’t look that impressive. However, scratch a little deeper and the firm looks like a bargain in the context of possible profits.

Predicted earnings growth of 37% in 2024 leaves Phoenix on a price-to-earnings growth (PEG) ratio of 0.3 times. Any reading below 1 implies that a share is undervalued.

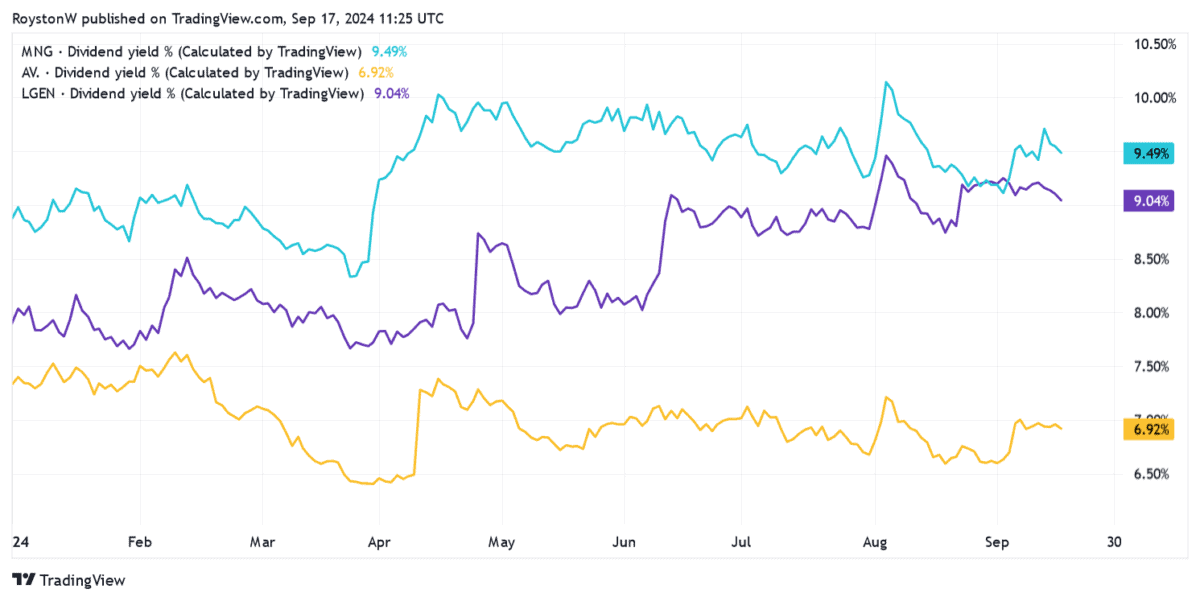

Meanwhile, the dividend yield on its shares is a massive 9.8%, reflecting predictions of a 54p per share dividend for 2024.

Not only is this miles above the 3.5% FTSE 100 forward average. It also beats the corresponding yields on Aviva, Legal & General, and M&G shares.

Bright future

Of course, these attractive PEG ratios and yields are based on broker forecasts, neither of which can be guaranteed.

For instance, Phoenix’s earnings could fall short of estimates if tough economic conditions dent financial product demand. They may also disappoint if the global stock market sinks.

However, as a patient investor I’m prepared to take a little risk in the immediate future if the long-term picture’s compelling enough. And in the case of Phoenix, the profits picture’s extremely bright, driven by rising demand for pensions and other retirement products.

10%+ dividend yields

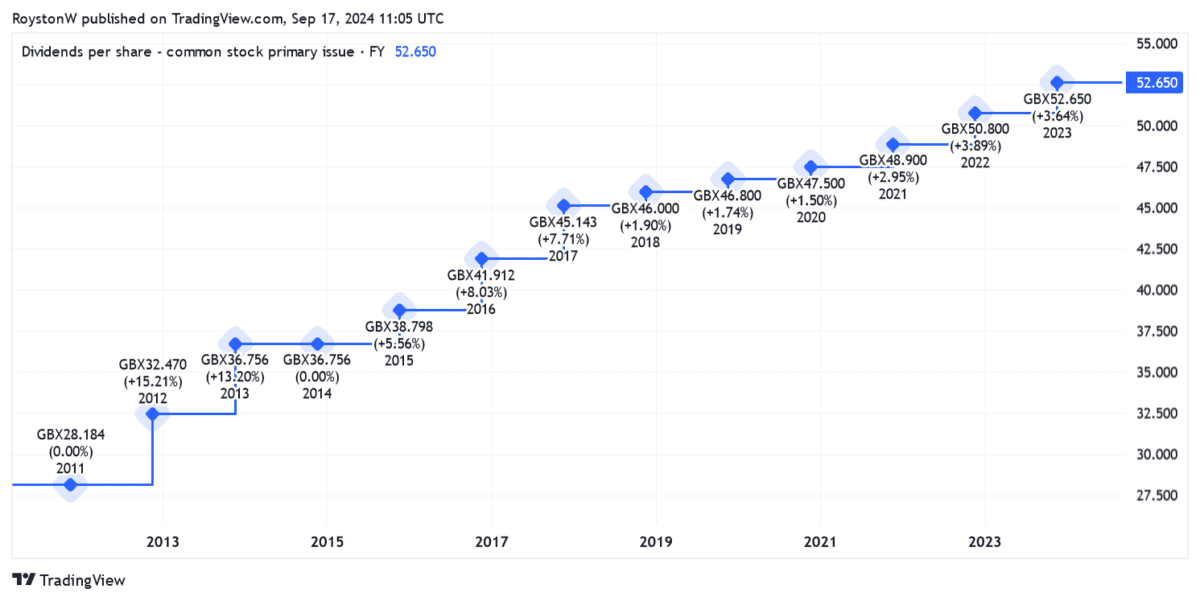

I believe the company will continue paying large and growing dividends from 2024 onwards.

I mentioned earlier that the dividend yield on Phoenix Group shares falls just short of double-digit territory. Well, that’s only half true. It sits at below 10% for 2024. But predictions of further dividend growth, to 55.9p and 57.3p for 2025 and 2026 respectively, drive the yield to 10.1% and 10.4%.

Again, dividends are never guaranteed. But I’m not about to bet against the Footsie firm. It has a great track record of growing shareholder payouts, as the chart above shows.

Phoenix’s strong balance sheet certainly puts it in good shape to continue raising dividends. Its shareholder capital coverage ratio was 168% as of June, at the upper end of its 140-180% target.

And the firm remains on course to achieve total cash generation of £4.4bn during the three years to 2026. While it’s not without risk, I think Phoenix is a brilliant FTSE bargain to consider right now. And especially for passive income investors.