I’m a big fan of stocks that pay generous levels of passive income. That’s because I’m able to use the dividends to buy more shares. But those apparently offering high yields must be treated with caution. The return could be artificially high due to a drop in its share price or it may be distorted by a one-off payment (or both).

Based on dividends paid during the past 12 months, Ithaca Energy (LSE:ITH) is currently yielding 18%.

But its first interim dividend for the year ending 31 December 2024 (FY24) — due to be paid on Friday (27 September) — is 25% lower than in FY23.

Even so, if its total payout over the next year is 14.8p — 25% below what it was during the previous 12 months — it implies an impressive yield of 14%.

Of course, dividends are never guaranteed.

Low profile

From what I can see, the company quietly goes about its business. The stock doesn’t feature much on discussion forums and my fellow Fools rarely write about it.

Ithaca extracts oil and gas from the North Sea and is seeking to develop the Rosebank and Cambo fields in Scotland.

Although strongly cash generative at an operating level, it’s subject to a ‘windfall tax’ of 75% on its profits. I suspect this is the principal reason behind the 54% fall in its share price, since it was listed in November 2022.

Acquisition

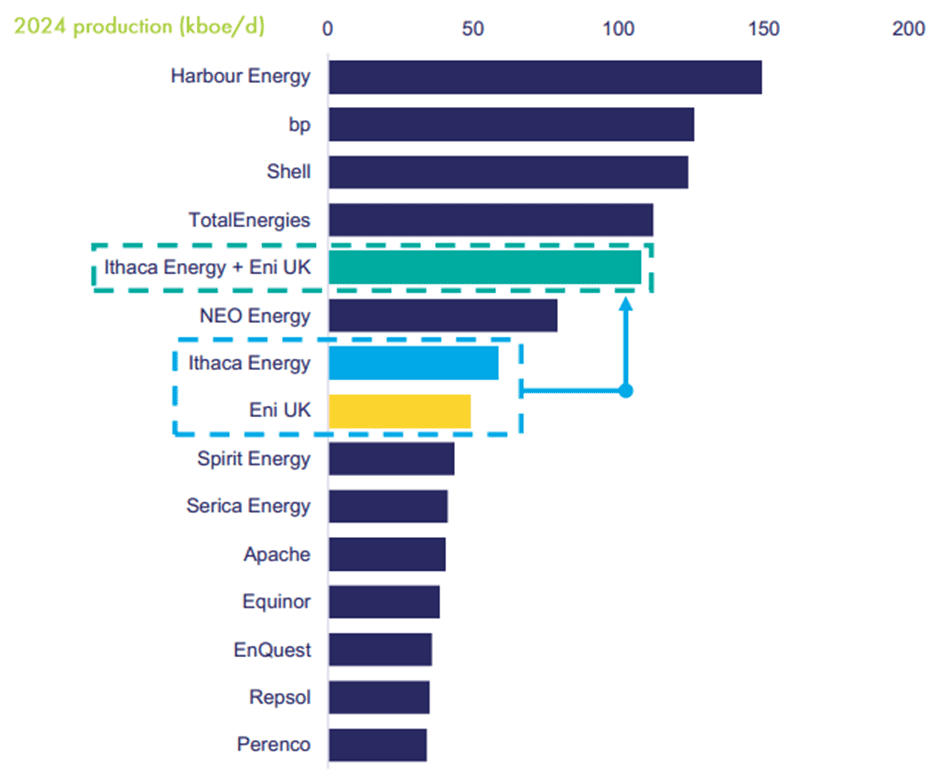

However, despite this, the company has struck a deal to acquire most of the upstream assets of Eni.

If concluded, Ithaca’s two major shareholders will be Delek Group (52.7%) and Eni (37.3%). This leaves a ‘free float’ of only 10%. With relatively few shares being actively traded, this could be good news. Small purchases could disproportionately push the share price higher.

The “transformational” transaction is intended to reduce costs, cut net debt relative to earnings, increase reserves, and improve the group’s credit rating.

The directors have also stated that it’s their intention is to pay dividends of $500m in 2024 and 2025.

But there will be many more shares issued as part of the transaction. A payout of $500m will equate to 30 cents (22.4p) a share. However, the yield will depend on the post-deal share price, which is hard to predict.

I’m especially cautious about making any forecasts given that Harbour Energy (a company in which I’m a shareholder) recently concluded a similar deal that will see it increase its production — all outside the reach of the UK’s windfall tax — by 156%.

And it’s expected to lower costs by 16%.

However, despite these positives, the group’s stock market valuation is currently (25 September) only 76% higher than before the merger.

It appears to me that the industry has fallen out of favour with investors.

Should I buy?

As I already have exposure to the sector I don’t want to include Ithaca Energy in my portfolio.

But if I didn’t, I’d still steer clear, despite its healthy dividend.

Although I like the sound of its deal with Eni, I’m nervous about the government’s attitude towards North Sea oil and gas.

The energy profits levy is likely to be increased further in October. And there are no plans to issue any more production licences.

I fear Ithaca Energy may be too exposed to the UK.