The Rolls-Royce (LSE: RR) share price continues to make steady gains despite some recent volatility. The company remains one of the UK’s most spectacular success stories since Covid, despite many questioning how much further it can climb.

Admittedly, the performance looked to be flagging a bit in September. But lo and behold, the aerospace and defence giant found yet another way to secure revenue.

Nuclear power

Last week, it was revealed that Czech state utility company ČEZ has partnered with Rolls for the supply of ‘mini’ nuclear reactors. Don’t get too excited, these aren’t pocket-sized reactors — they’re still about the size of a shipping container. Still, that’s comparatively small for a nuclear reactor.

Dubbed small modular reactors (SMRs), the value proposition of these devices is considered to be significant. Earlier this year, the European Commission hailed SMR technology as critical to the decarbonisation goals of the EU Green Deal.

They’re yet to be actively implemented in Europe so the Czech deal is the first of its kind. Investors certainly seem optimistic about their prospects, as the share price jumped 6% last week on the news.

Following the successful Czech deal, Sweden and the Netherlands have both expressed interest in the devices. A similar deal was already approved in Poland earlier this year but plans for a UK rollout have been delayed.

In early August, Rolls-Royce announced plans to sell a stake in its SMR business as part of a fundraising exercise. I’m not sure whether it has received any offers yet but there’s nothing in the news.

Financial position

Despite a slow summer, Rolls now looks on track to continue growing. Its latest earnings kicked off the growth, with revenue up 18% and earnings per share (EPS) exceeding analyst expectations by 95%.

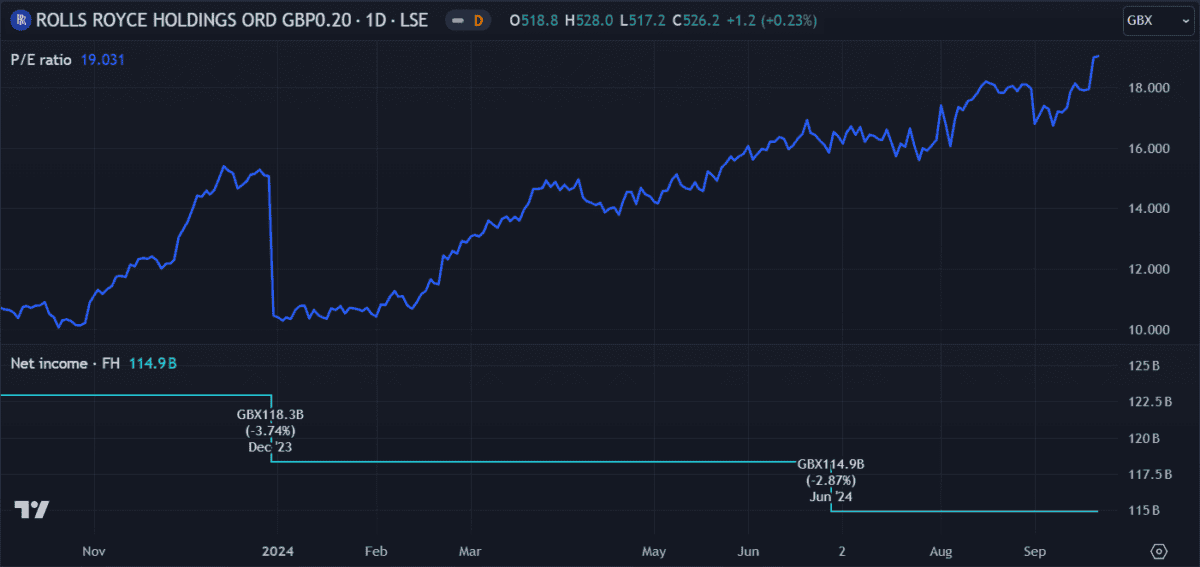

However, net income and profit margins fell slightly, down 6.5% and 16% respectively. The price-to-earnings (P/E) ratio meanwhile, has been steadily increasing.

Now, at 19 times earnings, it’s almost doubled this year, so Rolls is no longer the cheap and attractive price it was. Still, it’s just below the industry average, for now.

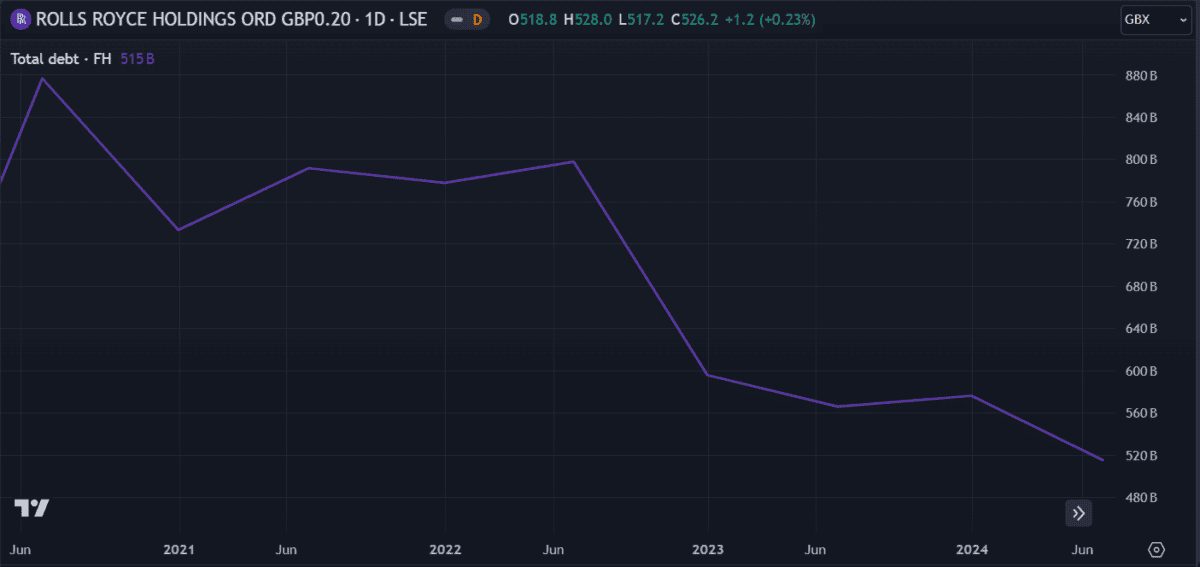

Investors also can’t fault the company’s efforts to reduce debt. It’s almost halved the load from £8.8bn to £5bn since June 2020. During the same period, it added around £6bn in equity.

But its debt-to-equity (D/E) ratio and return on equity (ROE) are still negative and have been for some time. That brings up concerns about its liquidity and solvency.

Looking ahead

Overall, Rolls’ financial position remains sensitive. According to its fundraising efforts, it’s running low on cash and needs to secure some before next year. But it has recovered significantly since the near-collapse of 2020.

By now, I’d have thought the price hype would have run dry but it appears it’s more concrete than I thought. Despite parabolic growth that’s ramped the price up 645% in the past 24 months, it doesn’t look like it’s done yet.

I guess when you’re an aerospace engineer, what goes up can keep going up.