I’ve considered buying Fevertree Drinks (LSE: FEVR) shares a couple of times for my Stocks and Shares ISA in recent years. I’m relieved I didn’t because they’re now down 80% in six years!

Today (12 September) brought more misery for shareholders as the stock fell 11.5% to 762p. It was propping up the FTSE AIM 100 index.

You’d have to go back to the summer of 2016 and the feverish days of the Brexit vote to see the share price this low.

Is now the time for me to invest? Let’s find out.

Wet weather and weak guidance

Today, the maker of posh tonics and cocktail mixers released its interim results covering the six months to 30 June. They were a bit of a damp squib.

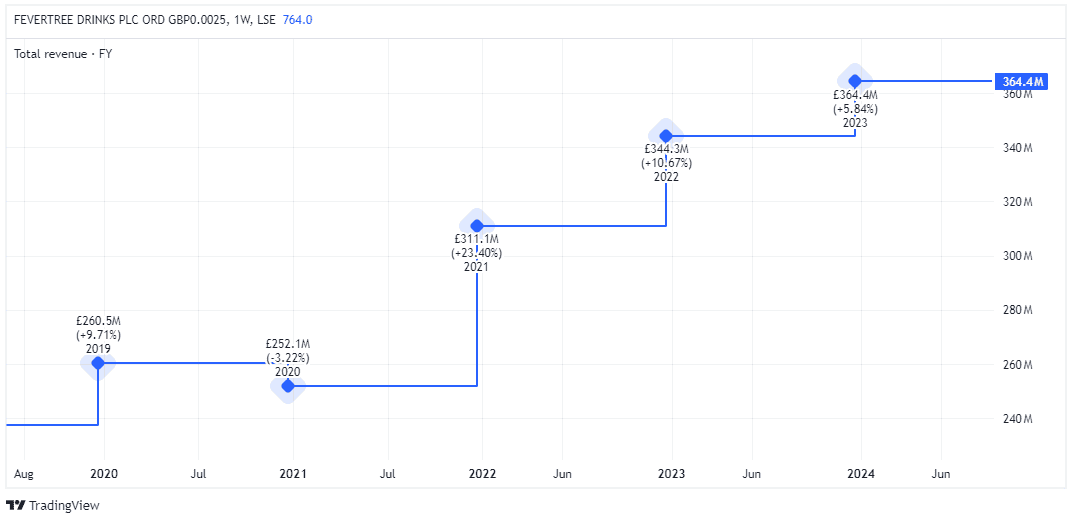

Revenue of £173m was basically flat at constant currency. Wet weather in the UK and Europe in the second quarter didn’t help, the firm said, but post-period trading in July and August had perked up.

A revenue decline of 6% in the UK and 10% at constant currency in Europe doesn’t look good. But there was strength in the US (the world’s largest spirits market), where revenue grew 10% to £60.3m despite a tough market backdrop.

Meanwhile, the brand continues to make good progress in a number of other markets around the world, including Japan and Canada. In Australia, it grew retail sales by 9% and now has more than 80% share of the premium mixer category.

EBITDA rose 79% to £18.2m, while normalised basic earnings per share (EPS) increased 109% to 7.37p. Both figures reflect last year’s big drop in profits. A 2% increase to the interim dividend was announced.

The chief culprit for today’s sell-off appears to be full-year guidance. Management expects revenue growth of about 4% to 5%. That’s much lower than the 7% previously expected by analysts.

Fevertree revenue (2019-2023)

Gross margin improvement

A key element of Fevertree’s premium brand image is its glass bottle. The sleek design represents superior quality and sustainability, as well as preserving the taste and carbonation of the beverage better than other materials.

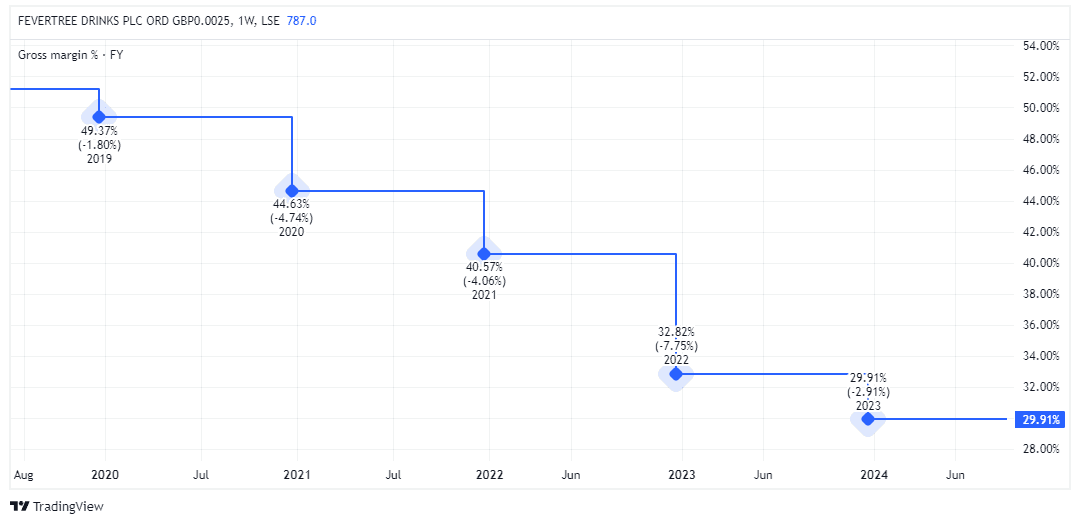

But in recent years, the impact of increased energy costs on glass bottle pricing, alongside wider inflationary pressures and high global shipping rates, have ravaged the firm’s gross margin.

It went from around 50% in 2019 to just 30% last year.

However, the gross margin improved to 36% in the first half, thanks to the re-tendering of glass supply contracts and better transatlantic shipping rates. The firm expects further recovery in gross margin during the second half.

Should I buy?

I still think there’s a lot to admire about the brand. Its drinks are appearing as an on-the-go option in more locations, including petrol stations, convenience stores, and airports.

In the UK, it remains the mixer of choice and is still growing in the US, where it has a leading position in tonic water and ginger beer. Meanwhile, profit margins are recovering.

As things stand though, the forward price-to-earnings ratio for the next 12 months is 24.7. That’s a little high for my liking given there’s the risk of sales slowing even further.

But I’m still very interested in the stock. I’ll keep watching it while buying other UK shares.