A boost in the easyJet (LSE:EZJ) share price over the past month has allowed the low-cost airline to cling on to its place in the FTSE 100 index. The company had been tipped for potential relegation from the UK’s leading benchmark in this week’s quarterly reshuffle.

As a shareholder, I’m pleased by this news. However, I’m also acutely conscious that easyJet shares are still down 62% from their pre-pandemic high.

Here’s what the charts say about the outlook for the Luton-headquartered business.

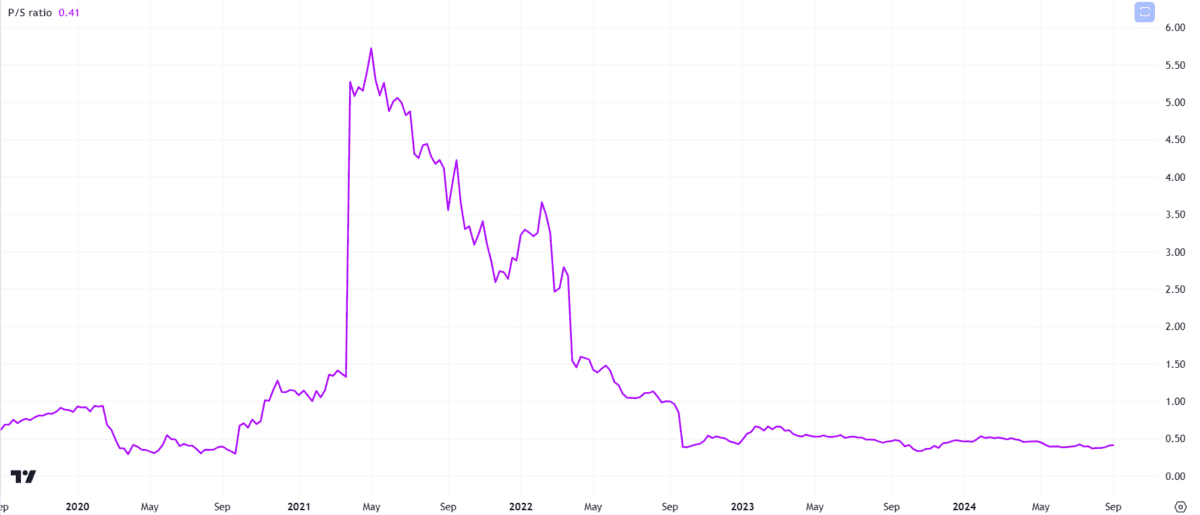

Valuation

Using the price-to-sales (P/S) ratio as a valuation metric, easyJet shares have traded firmly back in cheaper territory for the past couple of years. Back in 2021, the stock looked pretty expensive as sales were decimated amid pandemic travel restrictions.

Currently, the stock has a P/S ratio of 0.41, which suggests it’s a potential bargain at today’s price of £4.82. Generally, any ratio below one is seen as a very attractive number.

However, it’s worth treating this figure with a degree of caution. Multiple airline stocks have had their valuations depressed for a while now as the market digests their future in a post-Covid world.

For instance, FTSE 250 competitor Wizz Air looks a bit cheaper on this metric with a P/S ratio of just 0.36 and easyJet’s FTSE 100 bedfellow IAG also has a lower 0.39 multiple. Accordingly, the stock’s valuation isn’t especially cheap when compared to the wider industry.

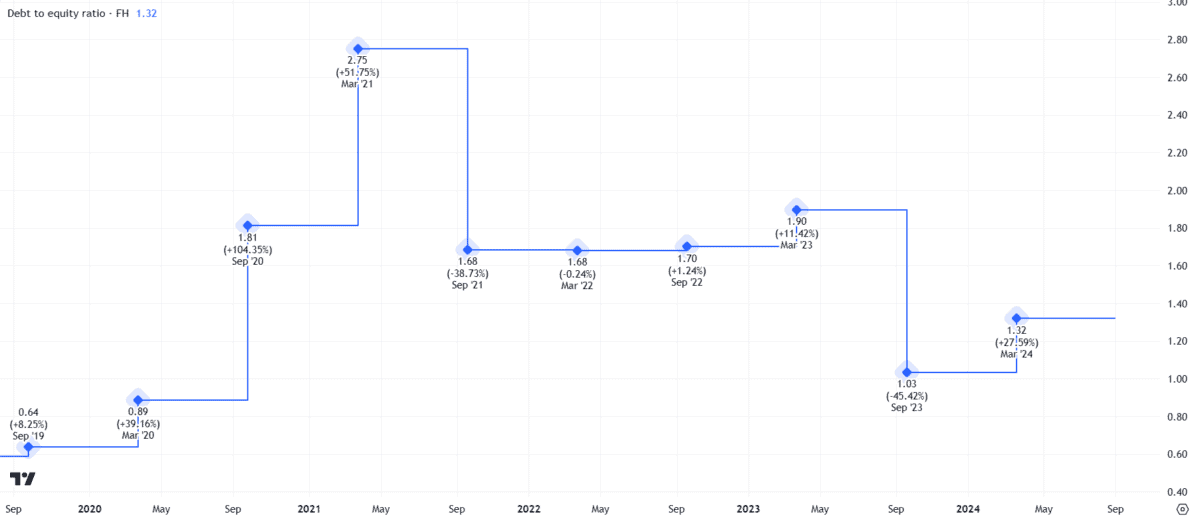

Debt

Overall, easyJet’s balance sheet appears to be in good shape. In the first half, the company moved into a net cash position of £146m, having ended FY23 with £485m in net debt on the books.

The debt-to-equity ratio of 1.32 suggests the business shouldn’t have too much difficulty in paying off its creditors. Considering the airline had to increase its liabilities considerably to stay afloat during the pandemic, I’m encouraged by the firm’s progress.

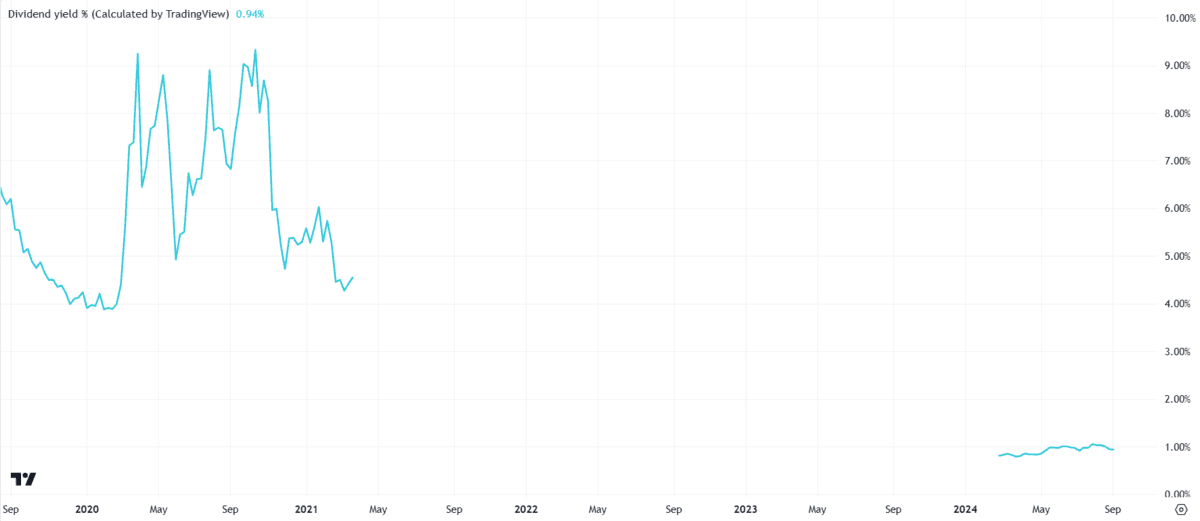

Dividends

On the passive income front, it’s nice to see easyJet has resumed dividend payments. However, a yield below 1% means the stock is a shadow of its former self.

At some points in the past five years, easyJet shares were yielding above 9%. Unfortunately, I don’t see those glory days returning any time soon.

Nonetheless, Wizz Air doesn’t reward shareholders with dividends currently and IAG’s yield of 1.3% is only marginally better than easyJet’s.

Can the share price fly higher?

Overall, I’m optimistic about the prospects for further growth in the easyJet share price.

Granted, the stock faces risks. Margins are tight and expansion is difficult in a notoriously competitive industry. There’s also a risk of environmental taxes being levied on the company amid growing concern around climate change.

On the flip side, retaining a coveted FTSE 100 spot helps to maintain investor confidence. The airline’s post-Covid recovery remains intact and it has taken prudent steps to repair its balance sheet in recent years.

In addition, the package holidays division — launched in 2019 — has proved to be a huge success. It adds diversification to the business model and the board projects this arm will deliver £180m in pre-tax profit this year, which would represent an impressive 48% uplift.

I’ll continue to hold my easyJet shares for the long term.