Dividends can make up a significant part of the total return of some shares over the course of time. At the moment, the average FTSE 100 dividend yield is around 3.5%.

Some FTSE 100 shares offer higher yields. Vodafone, for example, yields 10.3%. But it has announced a halving of the dividend, on top of a swingeing cut just five years ago.

By contrast, some shares in the index have raised their dividend per share annually for decades. They are what are known as Dividend Aristocrats.

Should you invest £1,000 in JD Sports right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if JD Sports made the list?

But regular dividend rises – which are never guaranteed to continue – can also help push up share prices. So Dividend Aristocrats may offer lower yields than some other shares.

Diageo

Let’s start with one Dividend Aristocrat I have added to my portfolio over the summer: Diageo (LSE: DGE).

The drinks company owns brands from Guinness to Johnnie Walker. Making and selling premium alcohol is a lucrative business: last year, the company managed to generate $4.2bn of post-tax profits on revenues of $27.9bn.

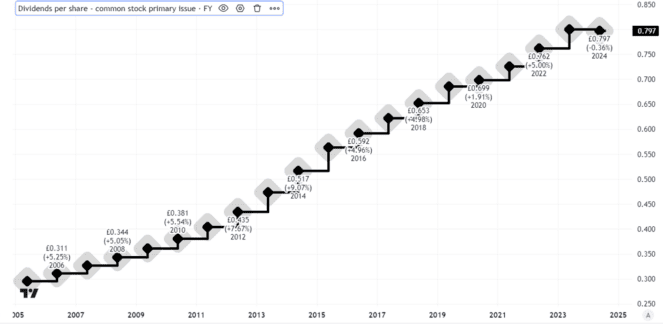

That has helped the company raise its dividend annually for over three decades, most recently by 5%.

Created using TradingView

The current yield is 3.3%, not far shy of the FTSE 100 average. On top of that, after a 29% share price decline over the past five years, I think Diageo now offers me decent value.

Yes, there are risks that help explain that slide. Weaker sales in Latin America could be an early warning of declining demand for premium products globally in a weak economy.

As a long-term investor, however, I like the outlook here as well as the ongoing dividend potential.

Spirax

While Diageo’s brands are well-known, the company itself is not a household name.

That is even truer of another FTSE 100 Dividend Aristocrat, Spirax (LSE: SPX). As a business focussed on commercial customers and operating with a number of different units, Spirax lacks widespread brand recognition, including with some investors.

But its rise has not gone unnoticed in the City and indeed, ongoing success is what propelled it into the FTSE 100 in 2018.

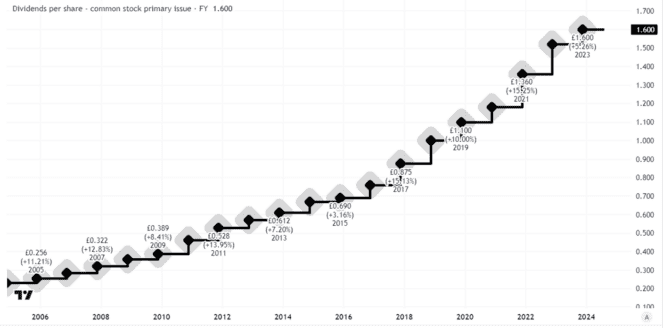

That was a long journey: the engineering specialist had been listed on the London market since the late 1950s. it has grown its dividend annually since the 1960s. That is one of the most consistent records across the London market.

Created using TradingView

With its specialised know-how, established customer base, and focus on important functions for businesses, I like the business model.

Risks include a slowdown in spending by clients in Asia. Indeed, operating profit last year fell by 11%. But my main reason for not owning the shares is valuation.

The shares have fallen 4% in five years, but still trade on a price-to-earnings ratio of 30. That is too high for me.

However, Spirax could well be on my shopping list if the share price falls considerably from here. That would also push up the yield, which at its current 2.1% does not excite me much.