I’ve found a lesser-known FTSE 250 stock that looks like it could be a promising dividend payer. Over the past 10 years, its annual dividend’s increased from 6.38p per share to 9.96p — an annual increase of 4.15%.

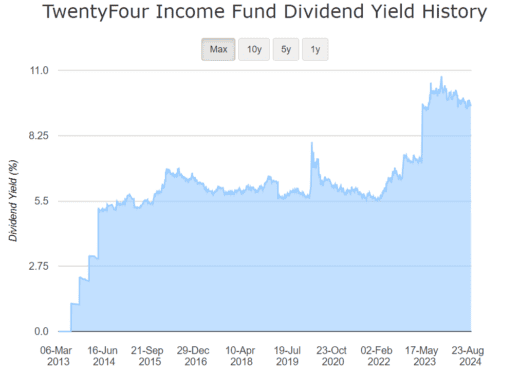

If it keeps that up, it could pay 15p per share in 10 years. That’s a pretty decent return on shares that currently cost just over £1. The yield‘s now 9.5%, having almost doubled in the past few years.

So what kind of income could I expect to earn from the stock? Well, assuming the yield and growth continue, 10,000 shares could be worth £114,330 in 21 years (with dividends reinvested). And that’s not taking into account any potential share price growth. At that point, the annual dividend could be around £12,000 a year.

Should you invest £1,000 in Lloyds Banking Group right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Lloyds Banking Group made the list?

That would be a nice bit of extra income for a relatively small initial investment. But what stock am I talking about — and will it keep performing well?

TwentyFour Income Fund

TwentyFour Income Fund‘s (LSE: TFIF) a closed-ended, fixed-income mutual fund managed by Numis Securities. The fund invests primarily in high-yield European asset-backed securities. Based in Guernsey, it’s only been operating for just over 10 years but already seems to be doing well.

A high yield means this fund is in the top 10 dividend payers of 250 UK companies. It also offers good value with a price-to-earnings (P/E) ratio of only 5.7. That’s well below the UK market average of 14.4.

Sometimes this figure’s low because the price has been crashing, but over the past year it’s up 6.48%. That suggests the fund’s not only cheap but also performing well.

In the same vein, the high yield isn’t inflated by a falling price. Rather, it’s the result of generous payouts by the company. This increases the likelihood that it could remain high for the indefinite future.

Considerations

One problem I find with close-ended funds is that they provide little or no information about their holdings. This requires a lot of trust on the investor’s part, with only the performance of the fund to go on.

TFIF is mostly investing in UK-based asset-backed securities and securitised loans. This puts it at risk of falling in price if the UK economy takes a dip. We all know from 2008 that certain investments like mortgage-backed securities can be risky.

The level of risk depends on how well the fund’s managed. And with a market-cap of only £786m, liquidity could be an issue — meaning it may be hard to find buyers at the right price when trying to sell.

There’s always a level of risk and reward involved!

Making the most of an investment

To maximise gains, I think it’s best to invest via a Stocks and Shares ISA. This type of ISA allows UK residents to invest up to £20,000 a year tax-free.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

I already hold several similar funds in my portfolio so I’m not planning to buy the stock today. But it’s on my watchlist and I think it’s worth considering for investors looking to increase their dividend income.