British investors love FTSE 100 exchange-traded funds (ETFs). And this is understandable as the Footsie’s the UK’s main stock market index.

It can pay to look at other ETFs though. Here’s a product that’s delivered far higher returns than FTSE 100 tracker funds over the last decade.

Incredible long-term returns

The product in focus today is the iShares NASDAQ 100 UCITS ETF (LSE: CNDX). This is an ETF that tracks the tech-focused Nasdaq 100 index.

Over the 10-year period to the end of July, this fund returned 424.52% (in US dollar terms). That compares to a return of 80.65% (in GBP terms) for the iShares Core FTSE 100 UCITS ETF (Acc), which tracks the FTSE 100 index and includes all dividends.

It means that, ignoring currency movements, the Nasdaq 100 ETF generated roughly 5.3 times the return from the FTSE 100 ETF.

When currency movements (the weak pound) are factored in, it delivered around seven times the return of the Footsie product (ie this is the return UK investors would have got).

Note that I’m ignoring all trading commissions and platform fees here.

The world’s best tech companies

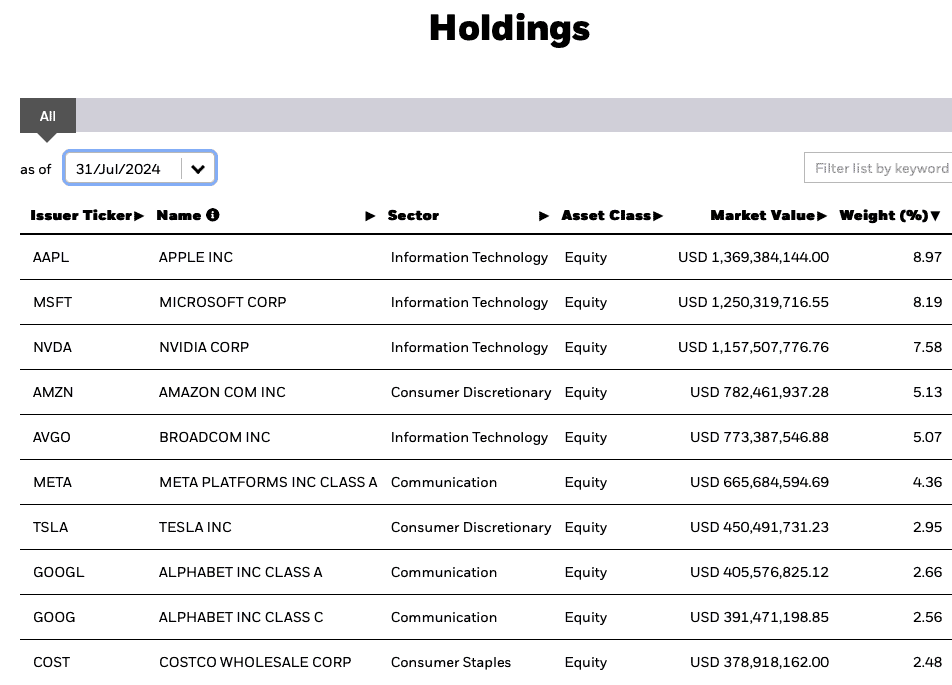

How has this index managed to generate such spectacular returns? Well, it comes down to the fact that the Nasdaq 100 is home to dominant tech companies like Apple, Microsoft, Amazon, and Nvidia, which are all growing rapidly as the world becomes more digital.

Source: iShares

The FTSE 100, by contrast, is home to a lot of lower-growth businesses such as BP, Shell, Unilever, and British American Tobacco. And some of these are facing structural challenges (ie the shift to renewable energy for the oil majors).

Expect volatility with this ETF

Now, I don’t own the iShares NASDAQ 100 UCITS ETF. That’s because I own shares in a lot of the top holdings directly (I’ve large positions in Apple, Microsoft, Nvidia, Amazon, and Alphabet).

And this has worked well for me. I’m up 502% with Nvidia, for example.

But if I was looking to build a well diversified long-term portfolio from scratch today, I’d definitely consider this ETF.

It’s not a product I’d go ‘all in’ on. This is due to the fact that the Nasdaq 100 (and the underlying technology stocks) can be very volatile at times. In 2022, for instance, this ETF fell a whopping 32.7% (in US dollar terms), versus a return of +4.6% (in GBP terms) for the FTSE 100 product. That’s a nasty fall.

But I think it could play a valuable role as part of a diversified portfolio. For example, if I had a global equity tracker fund such as the iShares Core MSCI World UCITS ETF as a core holding, this could be a nice addition for a bit of extra zip.

I’d expect this part of my portfolio to be volatile. But in the long run, I think it should do well for me. After all, the world’s only going to become more digital in the years ahead.