Possibly the most popular measure used to compare the levels of passive income offered by different stocks is the dividend yield. It’s a simple tool that divides a company’s payout by its share price, and expresses the result as a percentage. In theory, the higher, the better.

But as American author Mark Twain said: “There are three kinds of lies: lies, damned lies, and statistics.”

Approach with caution

This quote came to mind when I recently saw a league table of dividend shares. According to Trading View, there are currently (22 August) 109 UK stocks offering a yield of 10%, or more.

I’m sure the maths is sound but such high yields require closer scrutiny. For example, the list contains Vodafone. It paid a dividend of 9 euro cents (7.68p) in respect of its 31 March (FY24) financial year. That’s why the stock’s shown to be yielding over 10%.

However, the telecoms giant recently announced it’s cutting its FY25 payout by 50%. The days of a double-digit yield are long gone and — in my view — unlikely to return.

It’s a similar story with Close Brothers. Following the announcement of an industry-wide investigation by the Financial Conduct Authority into the possible mis-selling of car finance, the merchant banking group decided to suspend its dividend. And yet, based on its payments over the past 12 months, it’s yielding over 13%.

There are other examples that illustrate that shareholder returns are never guaranteed and that it’s the expected dividend that really matters. With this in mind, I think there’s one FTSE 100 share that’s truly appealing. It’s currently yielding close to 10%.

Generous returns

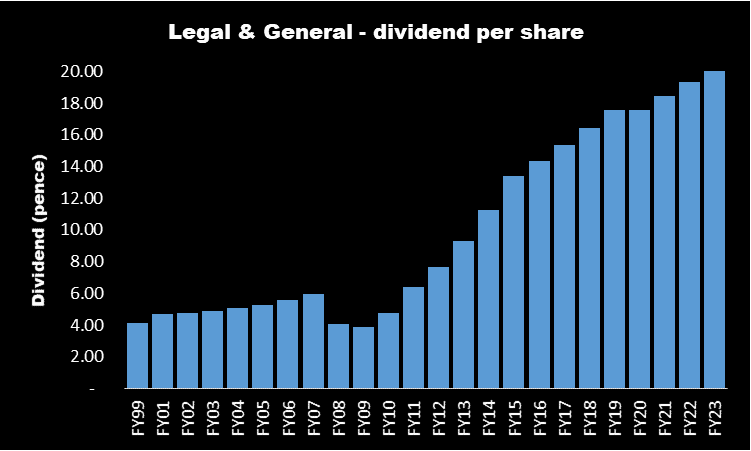

Legal & General‘s (LSE:LGEN) an impressive track record of increasing its dividend payments. Over the past 25 years, it’s only cut annual distribution twice, during the 2008-2009 global financial crisis.

And for the year ending 31 December (FY24), it’s promised to raise its dividend by 5%, to 21.36p. Based on its current (22 August) share price of 225p, this implies a yield of 9.5%. For FY25-FY27, it’s committed to an annual increase of 2%.

It’s able to do this because its annuity business is doing well as a result of the higher interest rate environment in which we find ourselves.

Legal & General’s also expecting a bumper second half to its current financial year from its pension risk transfer (PRT) division. This involves taking on the assets and liabilities of third-party pension schemes. It says it has a pipeline of deals worth £24bn, most of which are expected to complete in 2024. For context, it acquired £5bn of schemes during the first six months of the year.

But there are risks. Global interest rates have probably now reached their peak. And it’s worth keeping an eye on its assets under management which fell from £1.170trn at 30 June 2023, to £1.136trn a year later.

However, the company retains a strong balance sheet which puts it in a good position to grow over the coming years. And the prospect of achieving a near-10% return, albeit one that’s not guaranteed, appeals to me.

That’s why I’m going to put the stock on my watchlist for when I next have some spare cash.