When a FTSE 100 company attracts investment from high-profile billionaires, it’s worth taking notice. That’s exactly what BT Group (LSE:BT.A) has done in recent months, causing the share price to skyrocket.

In June, Mexican business magnate Carlos Slim acquired a 3% stake in the British telecoms giant. This month, Indian industrialist Sunil Bharti Mittal’s conglomerate agreed to buy 24.5% of BT’s shares. These are impressive votes of confidence from veteran investors.

However, there’s a fly in the ointment. Sky — a major BT client — has just reached a deal with broadband rival CityFibre. This has sparked fresh jitters among BT shareholders and wiped £1bn off the group’s market cap.

Should I join the industry stalwarts scooping up BT shares, or steer clear? Let’s explore.

Share price

It’s worth putting the recent BT share price gains in context. Although the stock has surged in recent months, it’s delivered a negative return over five years (excluding dividends).

Past performance doesn’t guarantee future returns, but it’s fair to say the company’s been a poor investment for long-term shareholders compared to many other FTSE 100 stocks.

Cash flow

However, there are signs the group could be turning a corner. For a mature business like BT, free cash flow is an important marker of financial strength, as it underpins dividend payouts.

In this regard, BT’s guidance looks promising. The board anticipates normalised free cash flow will improve from £1.3bn to £1.5bn this year, but it’s the long-term target that catches my eye. This figure could double to £3bn by 2030.

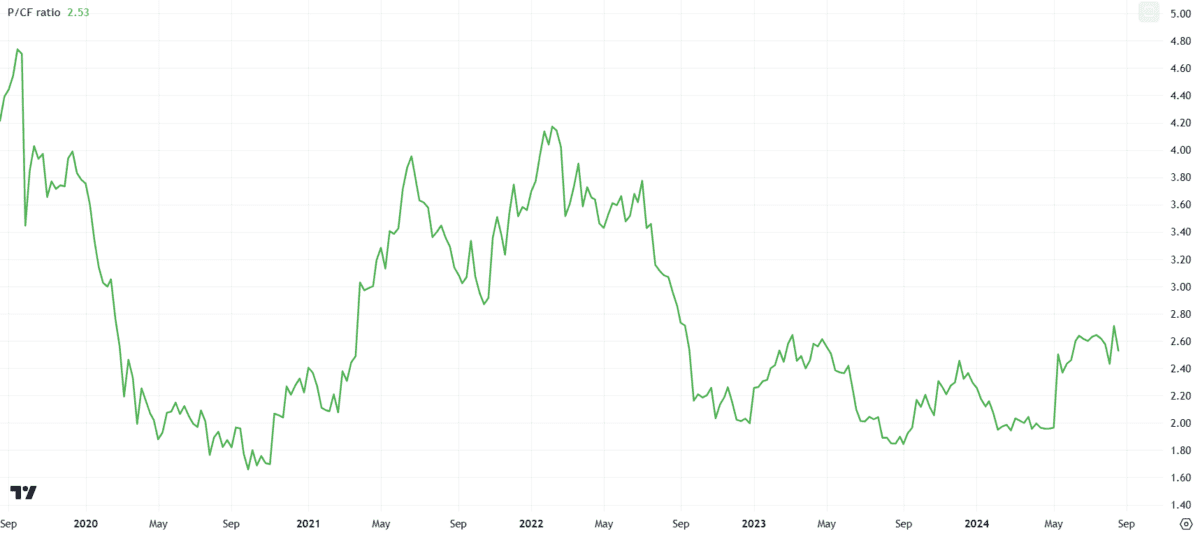

Moreover, BT shares look cheap measured against current cash flow. The price-to-cash flow (P/CF) ratio of around 2.5 is well below the five-year average.

Cost cutting

Nevertheless, BT’s balance sheet concerns me. Net debt stands at nearly £20bn, threatening dividend sustainability and potentially limiting future share price growth.

On the bright side, the group has suggested it’s past peak investment in rolling out its UK full-fibre broadband network. Lower capital costs should help BT get net debt under control.

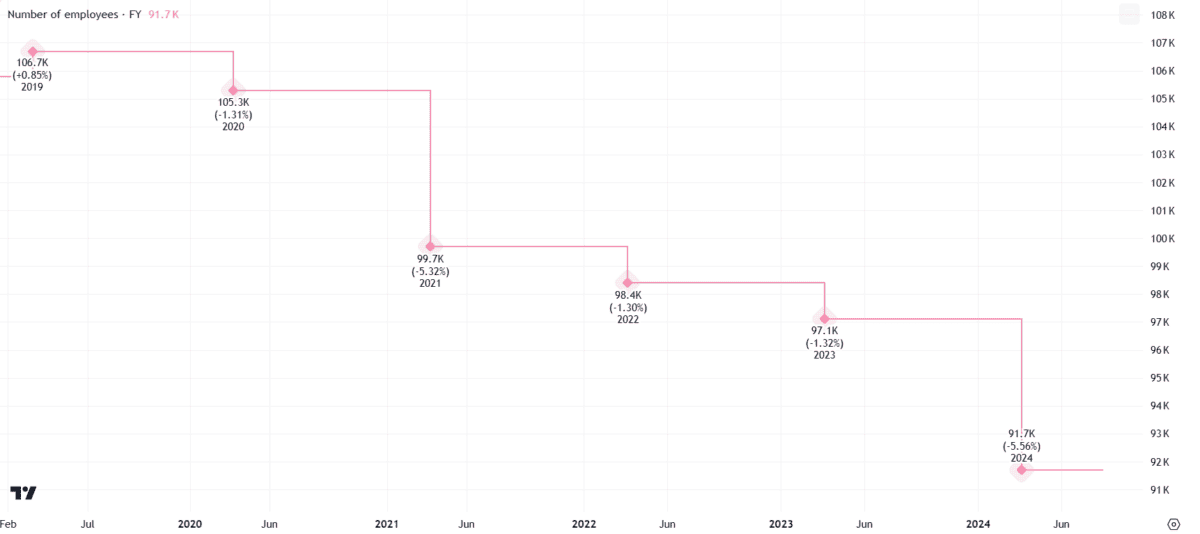

Yet, this won’t be enough on its own. The group plans to cut its global headcount by up to 42% by the end of the decade, with many jobs being replaced by artificial intelligence (AI).

Streamlining measures are often well-received by City analysts, but I’m concerned by the scale of the planned restructuring and the adverse impact it might have on service quality.

After all, BT’s number of employees has declined every year since 2019. There’s a risk AI tools may not be the silver bullet the company hopes.

Competition

Finally, the impact of Sky’s latest deal can’t be understated. Currently, the TV company uses BT’s Openreach network as the host for all of its 5.7m broadband customers.

Considering BT lost almost 200,000 Openreach customers in the latest quarter, the agreement has come at an unwelcome time.

Intensifying competition risks are a key consideration for potential investors.

Should I join the telecoms tycoons?

A 6% dividend yield and a forward price-to-earnings (P/E) ratio below nine might boost BT’s investment appeal, but they’re not enough to persuade me to invest.

The other side of the coin is a debt-heavy balance sheet and rising competition. For those reasons, I’ll be looking for other FTSE 100 shares to buy instead.