The FTSE 100 index is popular with investors seeking hot dividend stocks. It’s packed with companies whose strong balance sheets and mature operations provide a sustainable, large, and even growing dividend over time. But the FTSE 250 is also home to a wide range of great income shares.

I’ve been searching for the best dividend stocks to buy for my own portfolio. And I’ve come across the following two dividend heroes from the UK’s second-most-prestigious share index.

Here’s why I’ll carefully consider adding them to my Stocks and Shares ISA when I next have cash spare to invest.

Should you invest £1,000 in Lloyds Banking Group right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Lloyds Banking Group made the list?

Wind machine

Greencoat UK Wind (LSE:UKW) offers one of the biggest forward dividend yields on the FTSE 250 today. In fact, at 7%, its yield is twice the size of the broader index average.

Electricity generators like this can be perfect picks for a stable income over time. The power they generate remains in high demand regardless of whatever economic, political or social crises come along. So they enjoy reliable cash flows that they can then dish out to their shareholders.

These business aren’t completely without risk however. One concern to me is that the cost of building wind farms is rising sharply. In recent months, Denmark’s Ørsted has either delayed or scrapped three major projects in the US due to spiralling expenses.

That said, the long-term upside of investing in renewable energy stocks like Greencoat UK Wind remains considerable. With the climate emergency accelerating, steps to boost clean energy capacity is heading in the same direction.

This particular stock — which owns 49 assets the length and breadth of Britain — should receive a boost from the greener policies of the new UK government. Labour has vowed to revamp planning rules to make it easier to build onshore wind farms.

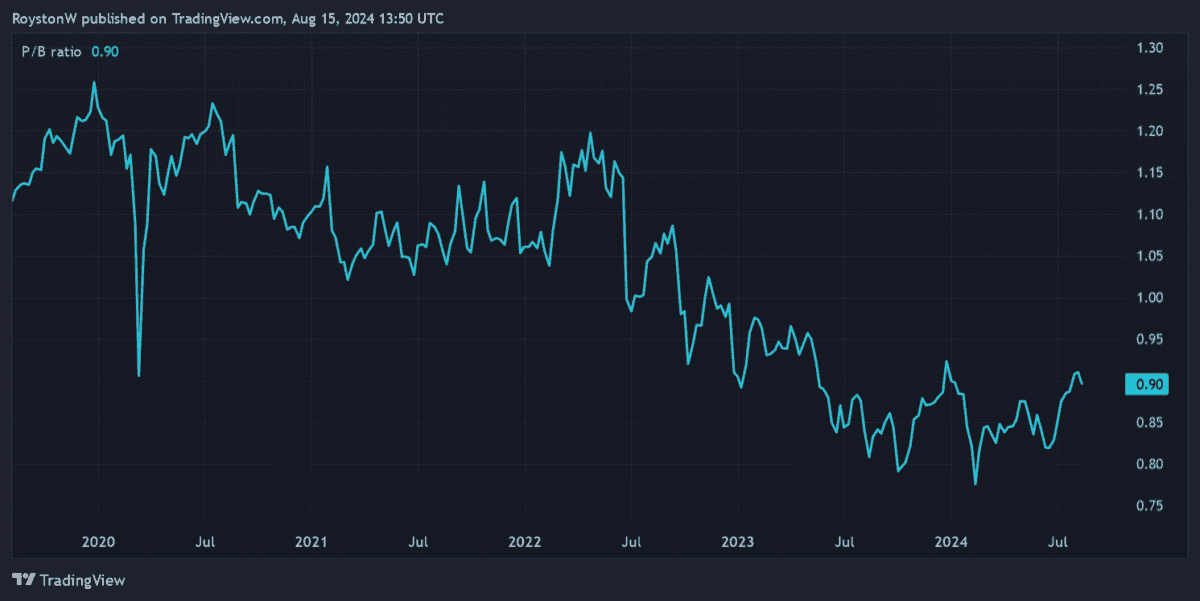

With the business also trading at a discount to the value of its assets, I think now could be a great time to invest. Its price-to-book (P/B) ratio stands inside value territory of below 1, at 0.9.

Healthcare giant

With a dividend yield of 7.9%, Assura‘s (LSE:AGR) another share that brokers expect to deliver market-beating income this year. Like Greencoat, it enjoys dependable income streams that translate into a sustainable dividend.

This particular business owns and lets out primary healthcare properties like GP surgeries across the UK and Ireland. This is a highly defensive part of the real estate market. And what’s more, the rents it receives are essentially guaranteed by local authorities, meaning it doesn’t have to worry about missed payments.

I also like Assura because of its more recent move into the private hospital sector. Its purchase of 14 properties from Northwest Healthcare Properties for £500m will allow it to capitalise on booming demand for private healthcare in Britain.

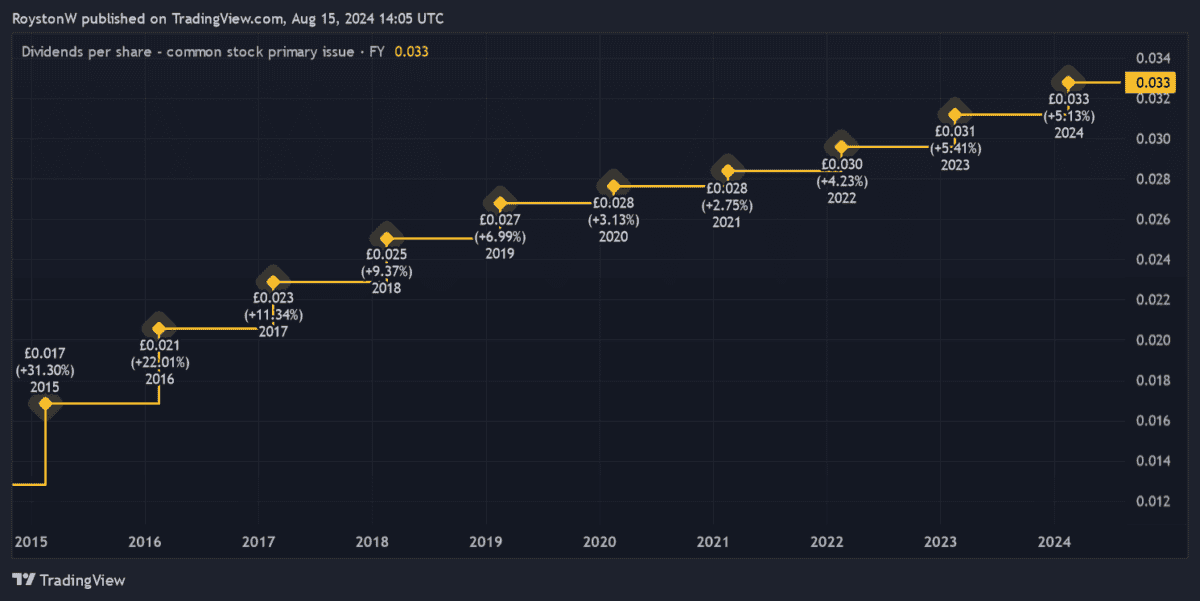

Assura has a great record of steady dividend growth, as shown in the chart above. Earnings may suffer if the Bank of England fails to significantly slash interest rates. But, on balance, I think this remains a top dividend stock to consider buying.