FTSE 100 stocks have a reputation for being steady dividend payers. Yet the UK’s premier index is also home to some exciting shares with long-term growth potential.

If I were given £5k to invest, I’d snap up this pair in August.

An oncology heavyweight

First up is AstraZeneca (LSE: AZN), the largest Footsie firm by market cap (£195bn). The shares are up 17% in 2024 and 72% over five years, which far outpaces the returns from the wider FTSE 100 (even after dividends).

Should you invest £1,000 in AstraZeneca right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if AstraZeneca made the list?

The pharma giant also pays a dividend, though the yield is modest at 1.8%.

AstraZeneca’s strengths are in oncology, biopharmaceuticals, and rare diseases. The former makes up about a third of overall sales and in H1 this segment grew 22% year on year to $10.4bn.

Of course, cancer treatments are incredibly complex and costly, meaning major clinical setbacks are an unavoidable risk. But Astra has a great hit rate and a very deep pipeline, giving it multiple shots on goal.

Meanwhile, the barriers to entry in the industry are very high. Few firms have the scale and wherewithal to compete successfully on research and development.

Recently, the firm unveiled a lofty goal of reaching $80bn in sales by 2030, up from $46bn in 2023. It’s also targeting a mid-30s core operating margin, up from 30% in 2022.

Unsurprisingly, the shares aren’t cheap, but neither are they grossly overvalued. They’re trading at around 20 times forward earnings versus a 10-year average of 18.2.

Long term, there are some powerful growth drivers working in the company’s favour. Chief among these is a rapidly ageing global population, particularly in China where the firm has a growing presence.

A superstar growth portfolio

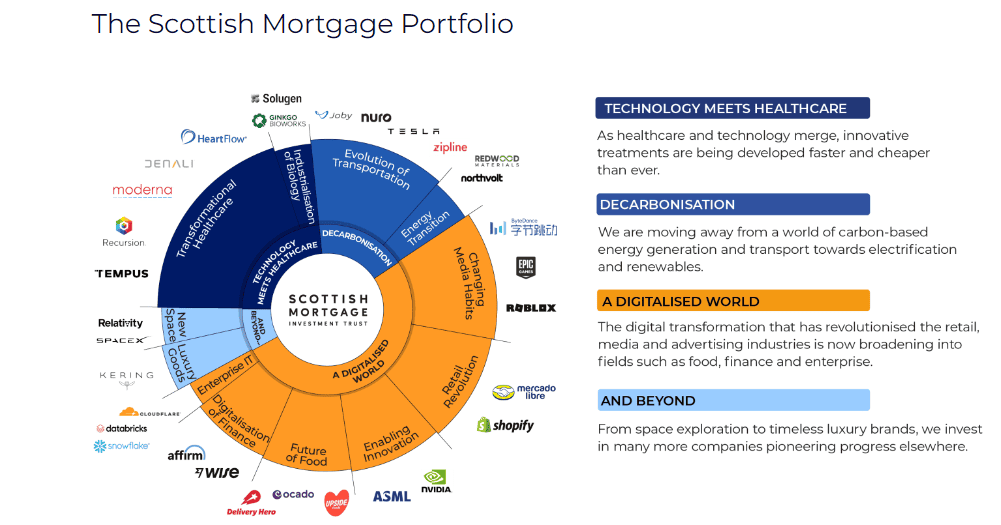

Next, we have Scottish Mortgage Investment Trust (LSE: SMT), which invests in both public and private growth companies.

The shares have been incredibly volatile in recent years, more than doubling in value in 2020 before plunging by nearly 50% in 2022.

Year to date, they’re up just 2.2%, lagging the FTSE 100’s return. That’s disappointing considering how well some of the trust’s largest holdings have done, including Nvidia (up 111%) and Ferrari (up 24%).

One reason I’m still bullish is that there’s been strong growth reported at many of the firms held in the portfolio. Amazon, Shopify and MercadoLibre are all benefitting massively from the ongoing growth of e-commerce, despite weak overall consumer spending.

Another reason to be optimistic is that the trust has been targeting dominant firms trading at attractive valuations. This bodes well for future returns.

For example, it bought back into Taiwan Semiconductor Manufacturing (TSMC) after a 10-year gap earlier this year. It said “TSMC is a key enabler of AI applications” and its scale means “few others can compete” against it.

This firm is making most of the world’s advanced AI chips on behalf of customers, including Nvidia. And the managers appear to have invested when TSMC shares were trading below 18 times forward earnings (very cheap for a world-class tech stock). They’re already up 28% in six months.

One risk here would be another big sell-off in tech stocks, particularly Nvidia, the trust’s largest position.

However, with Scottish Mortgage shares trading at a 9.3% discount to underlying net asset value, I’d embrace the risk.