Fears of a US recession have sent stock markets into a tailspin. It’s no surprise as severe weakness in the world’s largest economy, and eventual contagion to other regions, could hammer corporate earnings and, by extension, the passive income companies provide to their shareholders.

As a consequence, those seeking a reliable dividend income need to tread carefully when choosing which stocks to buy. Selecting companies in defensive sectors, with strong balance sheets and ‘economic moats’ (to quote markets guru Warren Buffett), are a few strategies investors can employ.

Pleasingly, the FTSE 100’s packed with companies that meet some or all of these criteria. Here are two I’d buy if I had cash to spare.

Should you invest £1,000 in Aviva right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Aviva made the list?

Bunzl

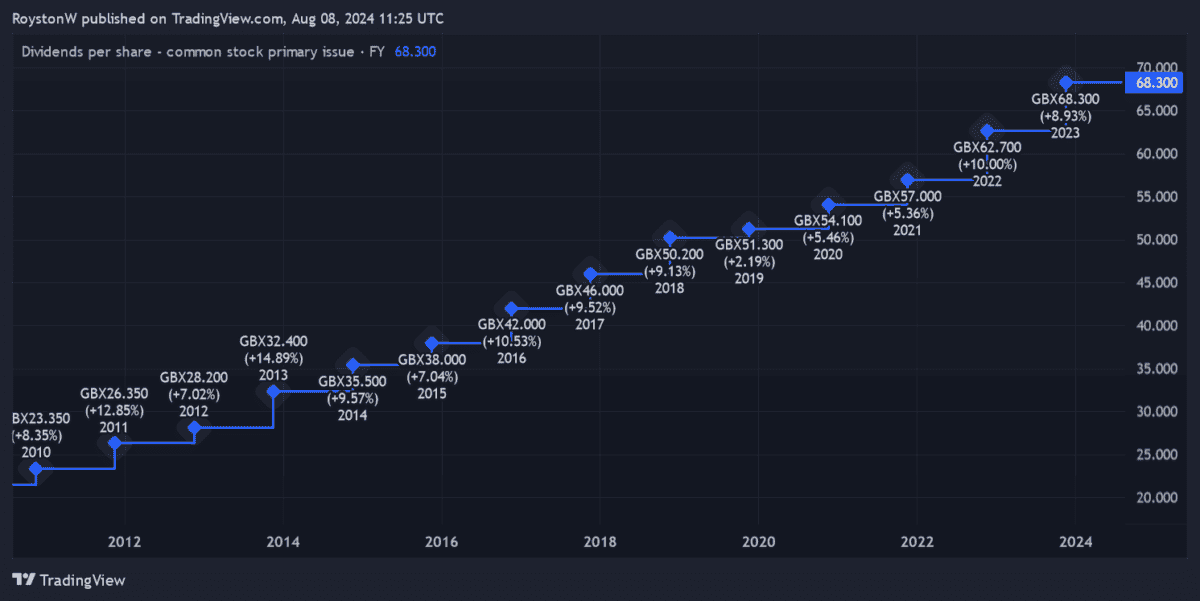

Support services provider Bunzl (LSE:BNZL) is one of the Footsie’s true dividend aristocrats. It’s raised annual payouts for a staggering 31 years in a row, and at an impressive compound annual growth rate of around 10% too.

What’s Bunzl’s secret? Firstly, it sells a wide range of essential everyday products like medical gloves, food packaging, cleaning chemicals and disposable cutlery. So sales remain stable at all stages of the economic cycle.

Cash conversion’s also highly impressive, remaining consistently above 100% (though this fell to 96% last year). Meanwhile, the firm’s net-debt-to-EBITDA ratio remains low around 1.1 times, giving it room to raise dividends while pursuing earnings-boosting acquisitions.

Bunzl’s dividends aren’t completely without risk. Weakness in certain cyclical sectors could hamper its payout potential, as may a spike in costs. But its past record’s a good omen looking ahead.

The forward dividend yield here stands at a healthy 2.3%. It’s not the biggest the FTSE 100 has to offer, yet Bunzl looks in much better shape to continue growing payouts than many other blue-chips.

BAE Systems

Defending the realm is one of the primary objectives of any government. And so BAE Systems (LSE:BA.) — which is one of the world’s largest arms contractors — also has the financial firepower to raise dividends every year.

In fact, with global defence spending rising at its most rapid pace for decades, BAE may be one of the best stocks to buy in these economically uncertain times.

Strong trading last year allowed the Footsie firm to raise the annual dividend by a whopping 11%. And demand for its hardware’s continued to pick up since then, an encouraging sign for future payout growth. Sales jumped 13% between January and June, while its order backlog stood at a record £74.1bn as of June.

Encouragingly, BAE’s also a formidable cash generator. And following the strong first half, it raised its free cash guidance by around £200m for the full year. It’s now tipped to come in at above £1.5bn.

While its end markets are strong, I’m concerned about enduring supply chain worries in the aerospace industry. But for the time being the company seems to be managing these problems well.

Today, the dividend yield on BAE Systems shares is a solid 2.5%. Again, it’s not the largest, but I believe the prospect of sustained dividend growth makes it a top stock to consider.