The UK stock market is loaded with a glittering display of high-yield dividend shares. Many have the potential to generate long-term passive income for my portfolio.

However, Legal & General (LSE: LGEN) in particular would be my top choice if I had to choose just one stock. It offers the perfect mix of high returns combined with a track record of reliability and a long history of excellent performance.

I’ve held the stock for some time in my portfolio and plan to continue contributing to it over time.

Should you invest £1,000 in Primary Health Properties right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Primary Health Properties made the list?

Here’s why.

Payment track record

On first look, Legal & General might not appear as such a hot ticket right now. The share price plunged 12% in June after it revealed plans to reduce dividend growth from next year.

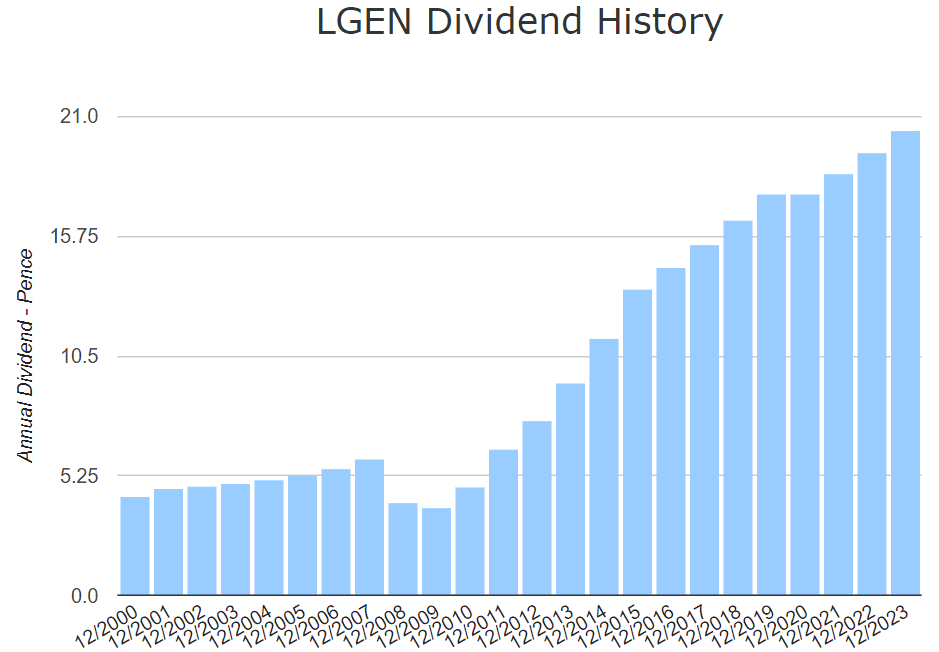

But its track record keeps me interested. Besides a minor drop after the 2008 financial crisis, dividends have been increasing consistently for over 20 years. Its 15-year dividend growth rate is 11.34% — considerably higher than most other stocks.

When investing for the long term, I try to ignore minor blips. History tells me that the reduction in dividend growth probably won’t last long.

Long-term growth

Recent performance aside, Legal & General exhibits decent growth over extended periods. For example, over the past 30 years, it’s up 457%, delivering annualised returns of 5.89%. That’s slightly below the FTSE 100’s average yearly growth but much higher when adding dividends to the mix.

Even if L&G’s average yield over that period was only 5%, the total returns would still be greater.

But working on today’s 9% yield and accounting for price growth, a £10,000 investment would net me dividends of around £930 after a year. Leave it to sit for 20 years while reinvesting the dividends and it could grow to around £145,000, paying me an annual dividend of £11,800.

Now that’s not bad!

Risks

Insurance is a competitive industry in the UK and Legal & General is not without rivals (although I’m invested in some of those too, just to be safe!). Its main competitors include Aviva, Prudential, and Admiral Group.

Despite the falling price, Legal & General’s price-to-earnings (P/E) ratio of 30 is a lot higher than most rivals. But with earnings expected to grow 178% in the coming 12 months, that number could come down to 10.8. Then it would be more in line with other UK insurance firms.

If earnings don’t increase, further price growth will be hindered. This, combined with reduced dividend growth, would significantly reduce the company’s value. With a 20p annual dividend and earnings per share (EPS) at only 7p, the payout ratio is already almost triple (hence plans to reduce dividend growth).

Big boots to fill

All things considered, my faith in Legal & General remains unshaken. The new CEO António Simões certainly has some large boots to fill. This year, he took over from Sir Nigel Wilson who received a knighthood for his exceptional work at the company.

So far, Simões seems highly motivated to fill those boots… and then some. His plans include a £200m share buyback programme, organisational restructuring, and the sale of Cala, the company’s housebuilding business.

Whether his ambitions spell success remains to be seen, but I expect they will.