High-yield shares can offer juicy passive income streams. But sometimes a high yield signifies an above-average level of perceived risk on the part of investors.

As an example, consider a stock that jumped as much as 14% in morning trading today (31 July) after releasing its results for the first half of this year: Ferrexpo (LSE: FXPO). Its dividend history has been a rollercoaster, to say the least.

That is already obvious looking at the history of its dividend per share.

Created using TradingView

But dividend yield is a function of dividend per share and share price. Ferrexpo shares have lost three quarters of their value over the past five years.

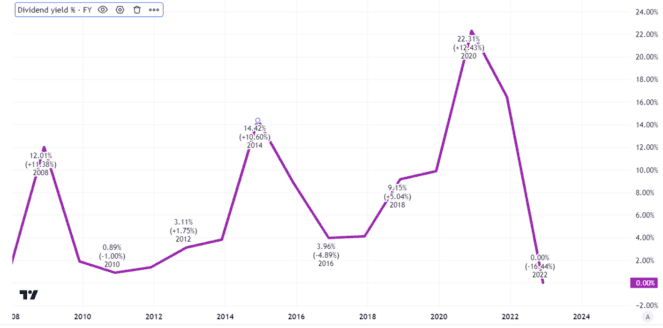

The dividend yield chart is therefore even more dramatic than the one showing dividends per share.

Created using TradingView

That is right. The stock – now with a dividend yield of zero – had a high yield of over 20% in 2020.

What is going on – and could the yield ever get close to where it used to be?

High-risk stock

The clue to all this is the nature of Ferrexpo’s business. The miner makes its money from mining in Ukraine.

Even before the war in that country, this geographic concentration was a risk to profits in my view. Before Russia invaded Ukraine in February 2022, when the share had a high yield of 12%, I wrote, “I see a big risk with Ferrexpo’s business model. Not only it is it concentrated on iron alone… it is also focussed on production from a single complex of mines.”

That remains a key risk in my view. On top of that, another risk that has materialised since I penned those words is the war. On top of even that, there is a long-running legal dispute concerning a subsidiary’s contested ownership of key assets.

All shares have risks — but clearly Ferrexpo has lots.

Business proving resilient

Despite that, the company has actually performed fairly well given the dire circumstances under which it is operating.

Today’s interim results showed total commercial production up 75% on the same period last year and total sales up 85% to almost 4m tonnes. Revenues grew 64% to over half a billion dollars and profit after tax more than doubled to $55m. Ferrexpo has $112m in net cash.

Despite this resilience, the market capitalisation of the business is currently £370m. That reflects ongoing risks, not least the ownership dispute.

Far too risky for me

The dividend remains suspended due to the legal dispute. If that is resolved favourably, the company could conceivably resume dividends even during wartime given the proven resilience of its business.

But the risks here are huge in my view.

Indeed, Ferrexpo recognises that its “ongoing legal disputes in Ukraine” could ultimately affect its ability to continue as a going concern. If that eventuality came to pass, the share price could fall even from here.

Ferrexpo is a good illustration of why a high-yield stock can end up being a costly investment, as the dividend gets axed and share price falls too.

I am glad I did not buy in when it was yielding over 20% — and have no plans to do so now.